DREP ICO Review and Token Analysis

Share this article

DREP ICO Overview

The DREP ICO is offering the DREP token to raise funds for a decentralized reputation network comprising a public chain, reputation-based protocol and tools for integrated online platforms (DRApps).

DREP (it stands for Decentralized Reputation System) aims to quantify and tokenize the value of user reputation for online commerce, investment and data sharing. Through tokenized restructuring of online value systems, DREP aim to leverage blockchain technology and create a new paradigm for the exchange of data, goods and assets, where reputation sits firmly at the center.

*NOTE – if you intend to participate, the whitelist closes on June 30th*

DREP ICO Value Proposition

DREP Foundation proposes a pathway to the creation of a decentralized reputation ecosystem through their layered solution. DREP rests on the proposition that internet reputation is an untapped source of value that, when properly quantified, can provide a higher-quality, interconnected digital community, from which both online services and users stand to benefit.

The long-term vision of the DREP is to establish a cross-chain network of DRApps, which all operate via an the interwoven reputation system. DREP Foundation have chosen to build their own their platform, including the base protocol layer, the DREP Chain, from the bottom up.

User online reputation is based on their behavior, which is quantified and algorithmically assigned a value in tokens. Reputation becomes a means to buy and sell services, trade digital assets and prove identity across an ecosystem of online platforms. The solution proposed by DREP includes the following components:

- An infrastructure network to support the reputation system

- The Reputation Connector, comprised of a data sharing pool and cross-chain protocol

- The Reputation Accelerator, comprised of the User Growth Engine and Traffic Realization Engine for small and medium-sized DRApps

- A reputation-backed digital asset and reputation-backed currency

- The Hub for Reputation Data

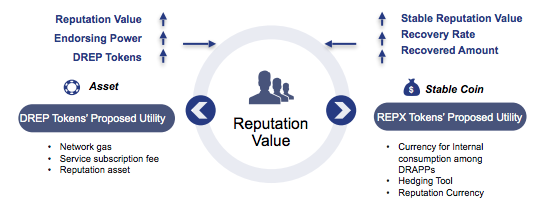

The DREP ecosystem includes both a reputation-backed asset (DREP) and reputation-backed currency (REPX). Initially the DREP token economy will only utilize DREP tokens, which reflect the reputation value of a user. DREP will later introduce the stable coin currency, REPX, when an unspecified amount of reputation data is accumulated and accounts are verified through a third-party KYC process.

Each DRApp can also issue its own token via the native smart contract template called RepToken, which will be ERC20 compatible. According to the whitepaper, for DRApps where the demand of tokenization is greater than that of decentralization, DREP will be the only form of payment and means of value transaction.

The core attribute of DREP token is tied to user reputation value. User reputation value is determined through active participation and contribution to the DREP network, for which tokens are rewarded in return. Subsequently, the tokens can be used to execute transactions on the network as gas or used to pay value-added service fees on user information pools or the integrated commerce platform. The REPX token, when deployed, will act as a stable currency to support the DREP token. REPX will then provide the underlying currency for value, payments and transactions within the ecosystem. DREP will initially be issued as ERC20 token.

Illustration of Asset and Stable Coin Utilities (from public whitepaper)

DREP ICO Team

Xiaolong Stephen Xu has spent nearly 2 years as a lead developer with Qtum Foundation. Prior to joining Qtum, he spent 3 years as a Software Engineer at Tenecent. He holds an MSc in Computer Science from the University of Chinese Academy of Sciences.

Matt Bennice has 4 years of experience at Google as a Software Engineer. He has an additional 8 years of management experience with Accenture. He currently works as a Software Engineer with X – The Moonshot Factory, a semi-secret research company founded by Google.

Momo Zhang spent 10 months as a Securities Analyst for Orient Securities before co-founding DREP. She’s also had various stints with investment companies in Hong Kong and Mainland China. She holds an MA in Finance from Nanyang Technological University.

Among the list of advisors to the DREP ICO is Siaou-sze Lien. Siaou-sze spent 28 years of her business career with Hewlett Packard, rising to the position of Senior VP. During her time with Hewlett Packard, she was ranked 3 years in a row on Fortune’s top 50 women in business.

The full list of team members and advisors can be found here.

DREP ICO Strengths and Opportunities

The DREP Foundation has announced two partnerships with online platform startups and are also incubating the network’s first DRApp. The first online platform is Comebey, a discount lifestyle website in the UAE. The site displays no traffic data on Similarweb, and Google Play indicates the app has received 500+ downloads.

The second partnership with Ziggurat, a decentralized intellectual property certification startup based in China. The DREP Foundation is also incubating Blockbate, a platform for hosting online discussion and debate, which will be one of the first DRApps on the network. Participants on the platform can gain economic incentives through engaging in discussions and sharing opinions.

DREP ICO Weaknesses and Threats

Reputation-based ICO projects have not performed well in previous instances. Ink Protocol, one of the better known tokenized reputation ICO projects, is down 85% from listing price at the time of publishing. The use utility of a reputation token will rely entirely on either integration with an existing ecosystem of large online businesses or an extensive ecosystem of dApps.

As of yet, no reputation-based token project has found adoption with existing networks of online services, and mass proliferation of dApps has yet to take off. To incentivize adoption, the team have reserved 40% of their tokens for onboarding existing platforms and spreading awareness of the project.

This distribution scheme leaves open the possibility that almost half of the total supply of DREP tokens can enter the market at anytime through incentivization schemes, with no guarantee enterprises will actually enter the ecosystem.

The core economic attribute of the DREP token begins with assigning users a reputation value. Users will then receive tokens, in the form of contribution rewards, through “social mining”; i.e. active participation and contribution on the DREP network. Subsequently, the tokens can be used to execute transactions on the network as gas or used to pay value-added service fees on the user information sharing pool and integrated commerce platform.

However, some DRApps will use DREP as the underlying token and some will not. With the RepToken smart contract template, DRApps can alternatively choose to issue native ERC20 tokens on their own. When REPX tokens are released into the ecosystem, they will become the underlying stable currency for transacting value. As REPX won’t enter the ecosystem until later in its maturation, this could in theory remove a major function of the DREP token utility as a means to transact value.

Through the issuance and circulation of DREP, REPX, and an unknown number of native DRApp tokens, the network valuation of the DREP ecosystem will not be exclusively tied to the DREP token.

As the DREP Foundation plans to target major websites for integration, the prospect of user base transition to a tokenized model, let alone one that involves multiple tokens at different junctures in the ecosystem, is highly improbable at this early stage in the development of the crypto-economy. Adoption by mainstream enterprises will unquestionably require users not only understand, but willingly support incorporation of a rather complex tokenization system.

For online platforms that already have profitable, efficient revenue models, transitioning to a new system makes little sense.

The Verdict on the DREP ICO

The DREP ICO aims to build an entirely new, layered blockchain architecture from the bottom up, based on a multi-token system. Once this architecture is ready, the focus will turn to building a network of integrated online platforms into an ecosystem where reputation is the core commodity.

For a project of such scope, there isn’t much evidence in the way of product development, interest from enterprise partners, or even a clear outline as to how project milestones will be accomplished to support the value proposition. Underlying all these factors, the concept of a reputation-based token system remains unsubstantiated.

We are not going to participate in the DREP ICO.

What Would Change our Minds?

- A successful example of a reputation-based ecosystem predicated on a similar tokenization model. The poor performance of similar projects detracts from the product concept.

- Any evidence of technical development, including a token economy model accessible to prospective users, which demonstrates DREP is capable of maintaining long-term value. As of right now, the tokenomics model is a theoretical concept.

- A detailed roadmap for onboarding online enterprises beyond simply handing them tokens. At this stage, it’s unrealistic to expect any large-scale enterprise to upend a successful business model through a tokenization scheme based on reputation value.

Learn more about the DREP ICO (DREP Token) from our Telegram Community by clicking here.

DREP ICO REVIEW SCORES

SUMMARY

The DREP team seeks to create a reputation system that will assign scores to individuals based on their behavior, awarding tokens to users who build a strong reputation and focusing on providing value to social platforms, content managers, e-commerce platforms and so on. Their central premise is that sharing this reputation score will increase authenticity on the web, driving consumer monetization through a more engaged base of constituents. However, since their two-sided market model requires the participation of both users and platforms; since we see little evidence of a well-developed product or the kind of mass platform adoption required; and since reputation-based blockchain projects have yet to capture the public imagination, we have decided to pass on the DREP ICO.

Founding Team……………………….7.8

Product…………………………………..4.4

Token Utility…………………………..3.2

Market…………………………………..6.3

Competition…………………………..7.5

Timing……………………………………4.8

Progress To Date……………………6.8

Community Support & Hype…..9.3

Price & Token Distribution……..6.1

Communication……………………..6.7

FINAL SCORE……………………….6.3

UPSIDES

- Team has developer experience with large tech companies

- Significant community support for project

DOWNSIDES

- Little visible progress on tech or business development fronts

- Poor performance record of similar reputation-based tokens

- Unproven tokenomics model

Today’s Date: 5/27/18

Project Name: DREP

Token Symbol: DREP

Website: https://www.drep.org/

White Paper: DREP Whitepaper

Crowdsale Hard Cap: $19,800,000 USD

Total Supply: 10,000,000,000

Token Distribution: 40% to user acquisition and strategic partnerships, 30% to the token sale, 15% to community development, branding, and treasury, 15% to team and advisors

Price per Token: 1 DREP = $0.0077 USD

Fully-diluted Market Cap (at crowdsale price): $77,000,000 USD

Accepted Payments: ETH

Countries Excluded: US, China

Bonus Structure: N/A

Presale Terms: N/A

Whitelist: Closed

Important Dates: Crowdsale August 1st

Expected Token Release: Tokens released after crowdsale but locked until exchange listing

Additional Information: https://t.me/drep_foundation

ICO Review Disclaimer

The team at Crypto Briefing analyzes an initial coin offering (ICO) against ten criteria, as shown above. These criteria are not, however, weighted evenly – our proprietary rating system attributes different degrees of importance to each of the criteria, based on our experience of how directly they can lead to the success of the ICO in question, and its investors.

Crypto Briefing provides general information about cryptocurrency news, ICOs, and blockchain technology. The information on this website (including any websites or files that may be linked or otherwise accessed through this website) is provided solely as general information to the public. We do not give personalized investment advice or other financial advice.

Decentral Media LLC, the publisher of Crypto Briefing, is not an investment advisor and does not offer or provide investment advice or other financial advice. Accordingly, nothing on this website constitutes, or should be relied on as, investment advice or financial advice of any kind. Specifically, none of the information on this website constitutes, or should be relied on as, a suggestion, offer, or other solicitation to engage in, or refrain from engaging in, any purchase, sale, or any other any investment-related activity with respect to any ICO or other transaction.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media LLC makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media LLC expressly disclaims any and all responsibility from any loss or damage of any kind whatsoever arising directly or indirectly from reliance on any information on or accessed through this website, any error, omission, or inaccuracy in any such information, or any action or inaction resulting therefrom.

Cryptocurrencies and blockchain are emerging technologies that carry inherent risks of high volatility, and ICOs can be highly speculative and offer few – if any – guarantees. You should never make an investment decision on an ICO or other investment based solely on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional of your choosing if you are seeking investment advice on an ICO or other investment.

See full terms and conditions for more.

Founding Team

This category accounts for the leaders, developers, and advisors.

Poor quality, weak, or inexperienced leadership can doom a project from the outset. Advisors who serve only to pad their own resumes and who have ill-defined roles can be concerning. But great leadership, with relevant industry experience and contacts, can make the difference between a successful and profitable ICO, and a flub.

If you don’t have a team willing and able to build the thing, it won’t matter who is at the helm. Good talent is hard to find. Developer profiles should be scrutinized to ensure that they have a proven history of working in a field where they should be able to succeed.

Product

What is the technology behind this ICO, what product are they creating, and is it new, innovative, different – and needed?

The IOTA project is a spectacular example of engineers run amok. The technology described or in use must be maintainable, achievable, and realistic, otherwise the risk of it never coming into existence is incredibly high.

Token Utility

Tokens which have no actual use case are probably the worst off, although speculation can still make them have some form of value.

The best tokens we review are the ones that have a forced use case – you must have this token to play in some game that you will probably desire to play in. The very best utility tokens are the ones which put the token holder in the position of supplying tokens to businesses who would be able to effectively make use of the platforms in question.

Market

There doesn’t have to be a market in order for an ICO to score well in this category – but if it intends to create one, the argument has to be extremely compelling.

If there is an existing market, questions here involve whether it is ripe for disruption, whether the technology enables something better, cheaper, or faster (for example) than existing solutions, and whether the market is historically amenable to new ideas.

Competition

Most ideas have several implementations. If there are others in the same field, the analyst needs to ensure that the others don’t have obvious advantages over the company in question.

Moreover, this is the place where the analyst should identify any potential weaknesses in the company’s position moving forward. For instance, a fundamental weakness in the STORJ system is that the token is not required for purchasing storage.

Timing

With many ICO ideas, the timing may be too late or too early. It’s important for the analyst to consider how much demand there is for the product in question. While the IPO boom funded a lot of great ideas that eventually did come to fruition, a good analyst would recognize when an idea is too early, too late, or just right.

Progress To Date

Some of the least compelling ICO propositions are those that claim their founders will achieve some far-off goal, sometime in the future, just so long as they have your cash with which to do it.

More interesting (usually) is the ICO that seeks to further some progress along the path to success, and which has a clearly-identified roadmap with achievable and reasonable milestones along the way. Founders who are already partially-invested in their products are generally more invested in their futures.

Community Support & Hype

Having a strong community is one of the fundamental building blocks of any strong blockchain project. It is important that the project demonstrates early on that it is able to generate and build a strong and empowered support base.

The ICO marketplace is becoming more crowded and more competitive. While in the past it was enough to merely announce an offering, today’s successful ICO’s work hard to build awareness and excitement around their offering.

Price & Token Distribution

One of the biggest factors weighing any analysis is price. The lower the price the more there is to gain. But too low of a price may result in an under capitalized project. It is therefore important to evaluate price relative to the individual project, its maturity and the market it is going after.

The total supply of tokens should also be justified by the needs of the project. Issuing a billion tokens for no reason will do nobody any good.

Communication

Communication is key. The success of a project is strongly tied to the project leaders’ ability to communicate their goals and achievements.

Things don’t always go as planned but addressing issues and keeping the community and investors in the loop can make or break a project.

Share this article