Ethereum Climbs to Yearly High, Technicals Show New Peaks Ahead

Ethereum is mooning as investors shift their focus from low-cap coins towards the smart contracts giant.

Key Takeaways

- Ethereum broke out of a bullish pennant that estimates its price could rise towards $250 or higher.

- Data reveals that there isn't any significant barrier ahead of Ether that will prevent it from achieving higher highs.

- On the flip side, the most important support level beneath ETH sits around $300.

Share this article

Since the Ethereum Foundation has accelerated the development of ETH 2.0, the buying pressure behind this cryptocurrency has skyrocketed to new yearly highs. Now, several technical indicators have pointed out further bullish action.

Ethereum Aims for Higher Highs

Ethereum made headlines after its price surged to a new yearly high of $343.9.

When looking at the price action of the top five cryptocurrencies by market cap, it seems that the smart contracts giant is leading the ongoing run-up. And, data reveals that it may have more room to grow.

Based on its hourly chart, Ether appears to have broken out of a bullish pennant on July 30, invalidating all the sell signals that suggested it was bound for a correction.

This technical formation was created as a direct result of ETH’s price movement between July 26 and July 30. Two trendlines that converge can be drawn along with the swing highs and lows. By measuring the distance between the pennant’s highest points and adding it to the breakout point, this pattern estimates a potential upside target of 8.5%.

After breaking out of this bullish formation, the second-largest cryptocurrency by market cap has gone up by 6.4%. If the buying pressure behind it continues to increase, it may advance further towards $350.

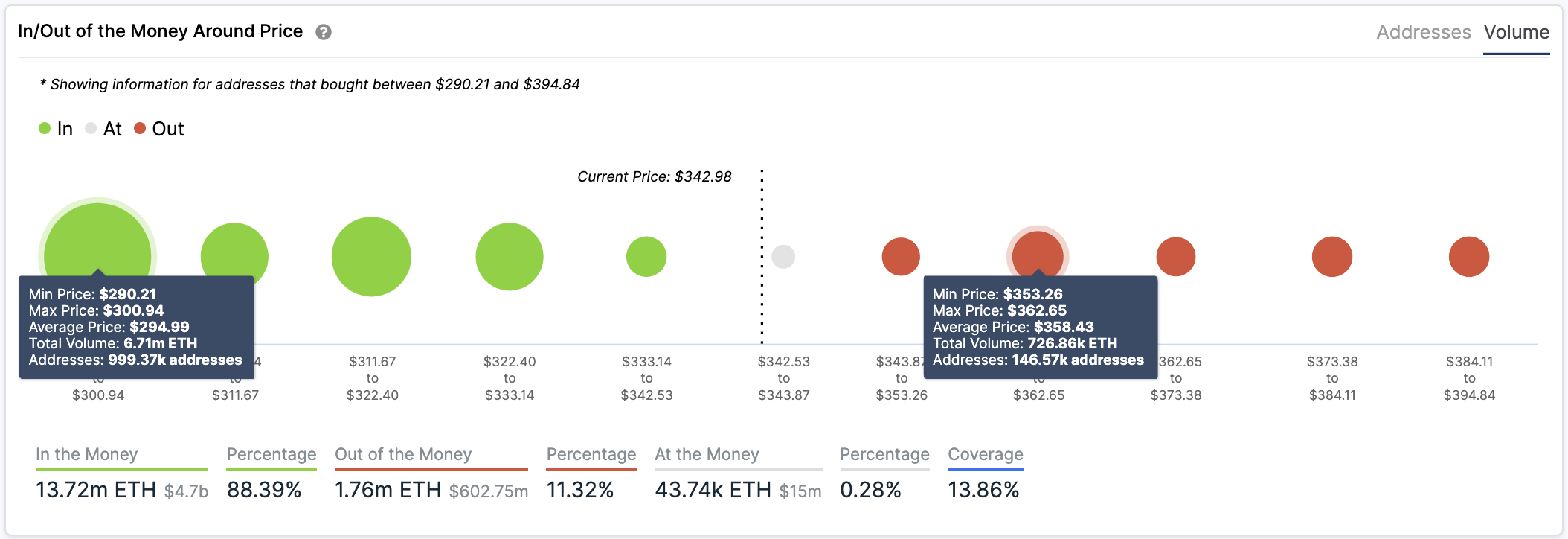

IntoTheBlock’s “In/Out of the Money Around Price” (IOMAP) model adds credence to the bullish outlook. Based on this on-chain metric, there are no significant supply barriers ahead of Ethereum that will prevent it from rising to new yearly highs.

Still, the $353 to $363 range may present a certain level resistance because over 146,500 addresses had previously purchased nearly 730,000 ETH within this price range.

Breaking through this weak hurdle could even propel Ether towards $400.

On the flip side, there are several areas of support that might absorb some of the selling pressure in the event of a correction. The most important one sits between $290 and $300, where roughly 1 million addresses bought over 6.7 million ETH.

Holders within this price range will likely try to remain profitable in their long positions. They may even buy more Ether to avoid seeing their investments go into the red.

Traders Beware of Hidden Forces

The ongoing craze in the DeFi market sector and the upcoming launch of the ETH 2.0 testnet, has brought a lot of interest to Ethereum. The rising demand for the smart contract giant may allow it to shoot for higher highs.

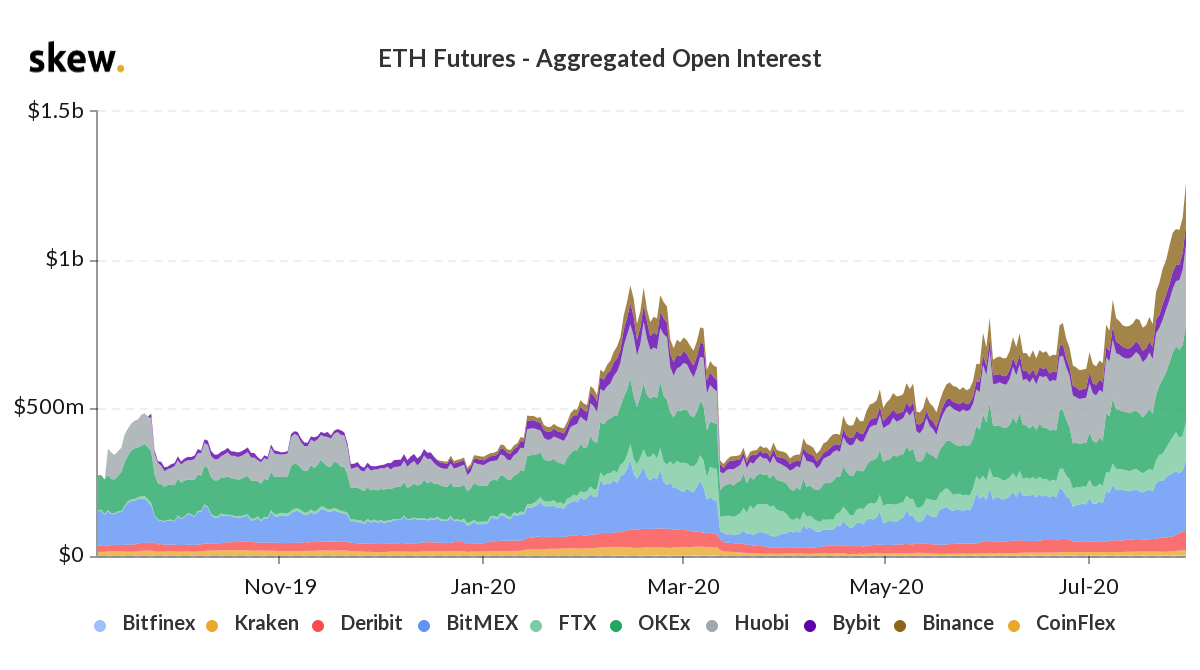

However, different metrics show that market emotions are heating up as Ether’s futures open interest has also hit new all-time highs.

While there is potential for a further advance, it is imperative to remain cautious and implement a robust risk management strategy.

At a certain point, investors will start to realize profits, and that may lead to a correction. For now, however, everything points to new yearly highs.

Share this article