ETH Moons on News of Ethereum 2.0 Mainnet Launch This December

Crypto enthusiasts are going wild as the highly-anticipated Ethereum mainnet deposit address has been deployed.

Key Takeaways

- Ether's price surged over 7% after developers deployed one of the most challenging aspects of ETH 2.0.

- As the Ethereum Foundation seems to be on track for the network upgrade, investors rushed to exchanges to get a piece of this altcoin.

- A further spike in buy orders could see prices rises towards $480.

Share this article

Buying pressure behind Ethereum is rapidly increasing as the network moves closer to its long-awaited 2.0 upgrade.

Ethereum Ready to Resume Historic Uptrend

Fears over the U.S. presidential election have dissipated at least within the Ethereum community.

After the Ethereum Foundation released a tool to create ETH 2.0’s deposit contracts, market participants rushed to exchanges to get a piece of this altcoin.

The massive spike in buy orders resulted in a 7% upswing over the last few hours, which could be the very beginning of a new uptrend.

Spencer Noon, head of investments at dtc.capital, believes that the launch of Phase 0 was by far one of the most challenging accomplishments towards the full deployment of ETH 2.0. But after this milestone, the Foundation has paved the way for the genesis block.

“For the people downplaying ETH 2.0 Phase 0 launch: YOU ARE BUGGING. This isn’t the same as launching a new network no one uses. This is a $45 billion network securing billions of dollars in assets. It’s like launching a rocket. Every milestone is enormously hard. The first one is the hardest,” said Noon.

Given the significance of the news, Ether’s price quickly reacted.

The smart contracts token jumped from hovering at a low of $380 to hit a high of $409. The bullish impulse led to the breakout of an ascending triangle where prices have been contained since late September.

If buy orders continue to pile up, Ethereum would likely advance towards $480. This target is determined by measuring the triangle’s highest points and adding that distance to the triangle’s x-axis.

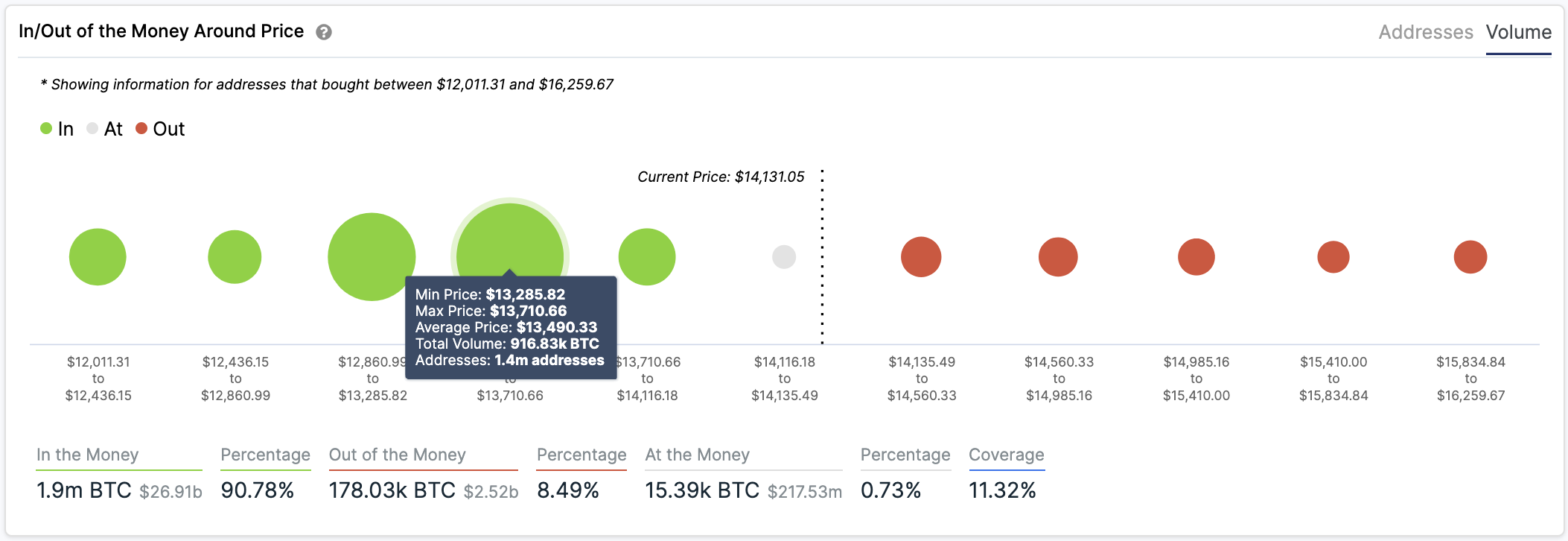

IntoTheBlock’s “In/Out of the Money Around Price” (IOMAP) model adds credence to the optimistic outlook.

Based on this on-chain metric, there aren’t any significant supply barriers ahead of Ethereum that would obstruct its rise to $480 or higher.

On the flip side, the IOMAP cohorts also show strong buy-in for Ether around $393, which coincides with the x-axis of the ascending triangle previously mentioned. Roughly 1.5 million addresses bought over 12 million ETH around this price level.

The convergence of these two support barriers should sustain prices above the $400 mark.

Share this article