Ethereum DeFi Tokens Aave, Maker, Synthetix Lead Market Surge

Several so-called DeFi blue chips appear poised to make a comeback.

Key Takeaways

- DeFi blue chips are surging as the market picks up.

- Aave, Maker, and Synthetix have all rallied following positive protocol updates.

- Despite many blue chip protocols falling in value over recent months, they still play a vital role in the DeFi ecosystem.

Share this article

Ethereum DeFi protocols Aave, Maker, and Synthetix have seen their tokens rally on the back of new protocol upgrades and proposed growth strategies.

DeFi Blue Chips Bounce Back

After a long period of suppressed price action, DeFi tokens appear to be waking up.

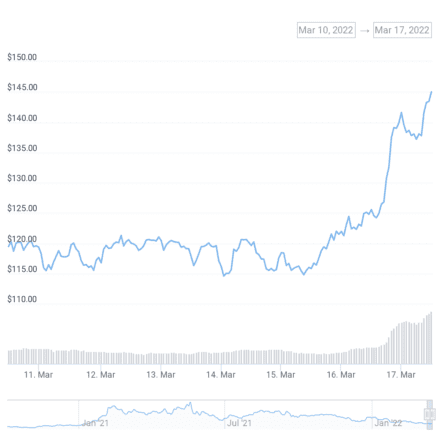

Several early DeFi blue chips have registered double-digit gains today amid growing market momentum, likely due to a slew of positive updates regarding their protocols.

Aave, the largest borrowing and lending platform on Ethereum, has broken its multi-month downtrend, rising over 17% in the last 24 hours. Yesterday’s Aave V3 launch is likely the biggest catalyst for the AAVE token’s positive price action. Aave V3 introduces cross-chain transactions through a new feature called Portals. The update also reduces the gas costs for interacting with the Aave protocol by as much as 25% and provides additional tools to help users manage the risk of their borrowing positions.

Maker, the decentralized credit platform that supports the DAI stablecoin, has also seen its MKR token gain 10.5% on the day. MakerDAO developers recently proposed a new growth strategy on the MakerDAO governance forum with the aim of bootstrapping the protocol’s Real World Asset market and diversifying its DAI collateral pool. The strategy involves raising capital by selling MKR tokens from the treasury and issuing debt. Raised funds will then be used to increase the size of Maker’s System Surplus, allowing the protocol to take on higher-risk loans involving real-world assets. While the proposal is still in the early stages of discussion, it appears to have been well received by the MakerDAO community.

Another DeFi blue chip, Synthetix, is also enjoying positive price action. The protocol’s SNX token is up 10.9%, likely in anticipation of the perpetual futures contracts launch on the Ethereum Layer 2 solution Optimism later this week. Perpetual futures will let users enter positions with up to 10x leverage across a wide range of assets, helping to build out Synthetix’s derivatives ecosystem. For SNX token stakers, the launch will also provide an additional revenue stream.

In recent months, tokens of prominent DeFi protocols have slowly declined in value after following Ethereum’s parabolic run at the start of 2021. However, while key protocols such as Aave and Maker have seen their valuations fall, they still play a vital role in the wider DeFi ecosystem, holding billions of dollars in their smart contracts. According to data from DeFi Pulse, the total value locked in DeFi on Ethereum is about $76 billion, and about a third of that is in Aave and Maker. But that sum doesn’t account for all of the value locked on Layer 2 solutions like Optimism and Arbitrum or competitor networks like Solana, Terra, and Fantom. Overall, the total value locked in DeFi is over $200 billion today. As the ecosystem grows, the generous yields offered by newer protocols like the Terra-based Anchor are increasingly providing hot competition to Ethereum’s blue chips.

Disclosure: At the time of writing this piece, the author owned ETH and several other cryptocurrencies.

Share this article