The Ethereum Token Ecosystem Is Thriving

ERC-20 tokens are worth almost as much as Ethereum itself.

Share this article

The so-called Ethereum killers never arrived. The network thrives as ERC-20 tokens approach Ethereum’s capitalization. Other smart contract platforms are not even close to Ethereum in terms of relative activity.

Coin Metrics employed an analysis developed by Chris Burniske of Placeholder, a New York-based venture capital partnership, to measure the health of the Ethereum network. The metric compares the market capitalization of Ether to that of all the tokens launched on the network. This network value to token value ratio evaluates the health of Ethereum’s token ecosystem.

A value of one indicates that Ether’s market cap and the aggregated market capitalization of the tokens it hosts are equivalent. That implies a healthy, possibly undervalued smart contract platform. Coin Metrics found that the ratio has declined significantly since Q2 2017 from just under 35 to 1.9.

What Caused the Fall?

ERC-20 tokens blossomed during the ICO frenzy of 2017. Most of those were utility tokens that enjoyed explosive initial price growth before rapidly descending — though Ether followed a similar trajectory. ICOs generally accepted ETH or BTC in return for their tokens, placing demand pressure on the platform’s native token.

Ether went through the same crypto winter endured by the whole market — perhaps exacerbated by ICO projects selling out of Ether into fiat to fund their activities.

According to Coin Metrics, stablecoins were responsible for the majority of the growth in non-native token value since mid-2018. Their capitalization rose from $109 million to more than $2.8 billion in that year-and-a-half period — going from one to 28 percent of the entire ERC-20 ecosystem.

In contrast, utility tokens fell by almost $2 billion, from 70 to less than 50 percent of the ERC-20 market capitalization. Exchange tokens remained fairly steady, representing about a quarter of the value of ERC-20 tokens.

(The sudden plunge in exchange tokens in 2019 is explained by Binance switching BNB to its own mainnet.)

Meanwhile, ETH Hasn’t Fared so Well

The growing health of Ethereum-hosted tokens only paints half the picture. Since mid-2018, stablecoin growth and a dwindling ETH price have combined to lower the relative value ratio to where it currently stands. On Jul. 1, 2018, Ether’s capitalization was just under $50 billion. Now it is around $20 billion.

The ERC-20 market essentially remained stable. Its makeup swayed with the growing relative importance of stablecoins, but its total value of approximately $10 billion increased only slightly over the period.

According to Coinmarketcap, Tether remains the dominant stablecoin at a market capitalization of over $4 billion. That is ten times the market cap of the second-largest ERC-20 stablecoin, USDC.

Tether could propel an even lower network value to token value ratio. Tether is built on a number of protocols. The most important are Omni and Ethereum. As Coin Metrics noted, “Over the last several months, usage has been shifting from the Omni-based version to the Ethereum-based version of Tether.” If that trend continues, Tether will play an increasingly significant role in the aggregate value of the tokens hosted by the Ethereum platform.

How Are the Ethereum Killers Faring?

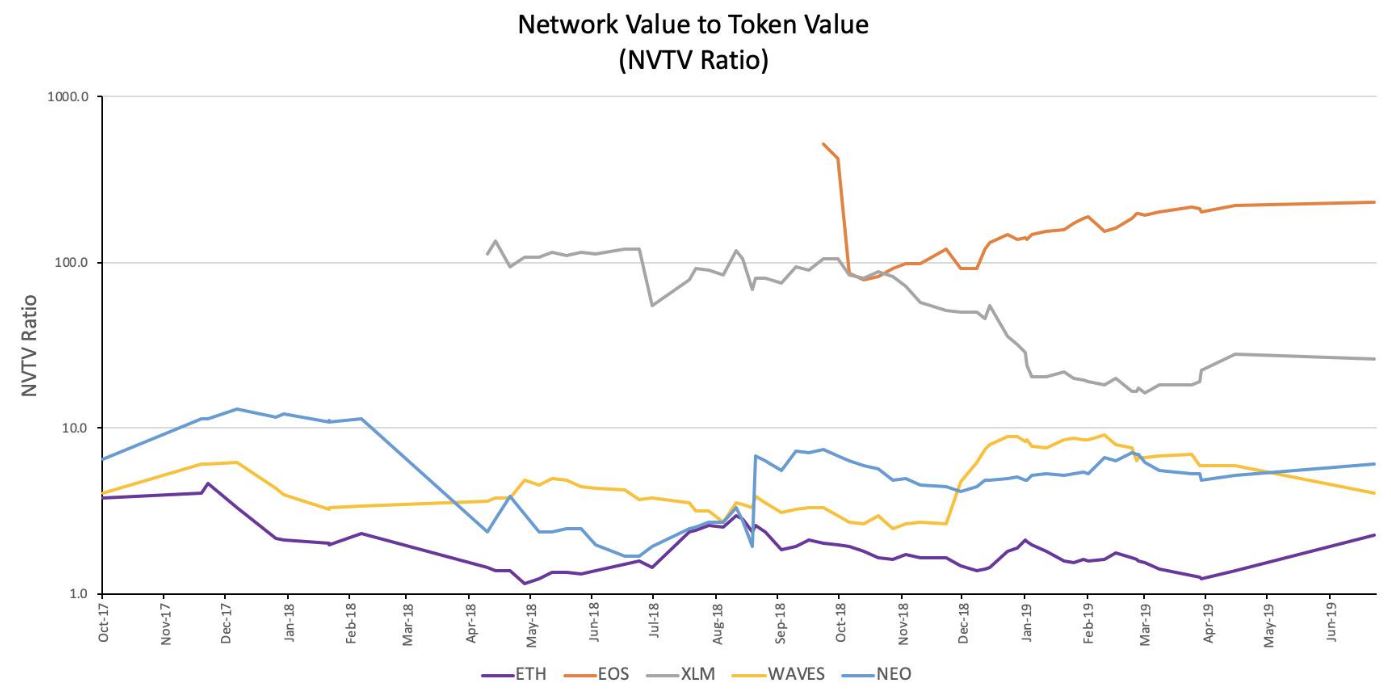

Burniske compared the network-to-token value ratios of ETH, EOS, XLM, WAVES, and NEO.

He found that activity on the Ethereum, WAVES, and NEO platforms was quite healthy with ratios under 10. On the other hand, EOS has a ratio of more than 200 — far higher than Ethereum. Burniske suggested that at least one of the assets is priced inadequately compared to its token hosting utility:

5/ As with PE or PS ratios in stocks, the higher the value of the #NVTVratio, the more richly (speculatively) the market is pricing the asset.

With $EOS at > 200x and $ETH at 2x, #Ethereum is looking massively undervalued on this basis.

Or, $EOS+friends = massively overvalued

— Chris Burniske (@cburniske) July 24, 2019

The graph illustrates that despite its own ups and downs, the Ethereum network remains a healthy platform for token activity. Crypto investors would be wise to stay alert to this metric. At current prices, Ether could be significantly undervalued.

Share this article