Ethereum Whales Enter Buying Frenzy as ETH 2.0 Mainnet Approaches

Ethereum whales grow optimistic following the recent launch of the Medalla testnet, the last testnet before the launch of ETH 2.0.

Key Takeaways

- Ethereum's Medalla testnet went live on Aug. 4.

- Following the launch, data reveals that seven new whales joined the Ether network.

- If the buying spree by these large investors continues, ETH may rise towards $500.

Share this article

The Ethereum Foundation has put forth a plan to finally launch ETH 2.0. Investors welcomed the news, and have responded by accumulating a massive number of tokens over the past few hours. The increasing buying pressure may lead to new yearly highs despite the stiff resistance that lies ahead.

Ethereum Whales Accumulate Ahead of ETH 2.0

The smart contracts giant is back on the crypto spotlight after its team of developers launched the Medalla testnet. Ethereum core developer Danny Ryan affirmed that this is the last testnet prior to ETH 2.0’s mainnet launch in November.

This testnet allows critical features to be tested in the wild, allowing users and builders the ability to examine its scalability and efficiency.

“The launch of Medalla is a huge milestone in the development of eth2 – if Medalla proves stable, mainnet launch is next – and represents years of hard work by countless engineers, researchers, and community members. We hope you are as excited as we are,” said Ryan.

As speculation mounts around the success of the Medalla testnet, large investors rushed to add more Ether to their portfolios.

Santiment’s holder distribution chart shows that over the past 24 hours, the buying pressure behind Ethereum rose dramatically. The behavioral analytics firm recorded a significant spike in the number of addresses with millions of dollars in ETH, colloquially known as “whales.”

Since Ethereum 2.0’s testnet launched, the number of addresses holding 10,000 to 100,000 ETH shot up. Roughly seven new whales have joined the network, representing a 0.7% increase in such a short period.

At first glance, the recent increase in the number of large investors behind Ether may seem insignificant.

However, when taking into consideration that these whales hold between $3.9 million and $39 million in Ether, the sudden spike in buying pressure can translate into millions of dollars.

If the buying spree continues, ETH may have the ability to advance further and reach new yearly highs.

ETH’s Bumpy Road Ahead

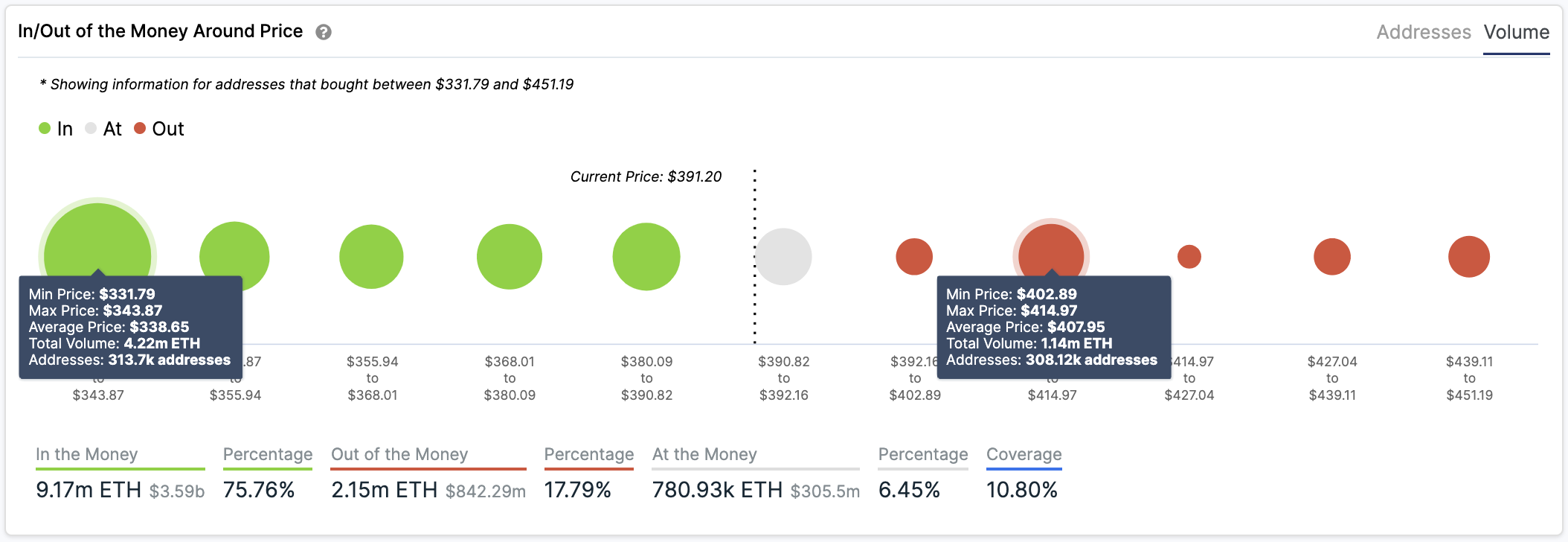

On its way up, IntoTheBlock’s “In/Out of the Money Around Price” (IOMAP) model suggests that Ethereum could face stiff resistance between $403 and $415. Based on this on-chain metric, approximately 310,000 addresses bought over 1.14 million ETH around this price level.

Such a massive supply wall could absorb some of the buying pressure. Holders within this price range will likely try to break even in their long positions in the event of an upswing.

But if demand for the second-largest cryptocurrency by market cap is significant enough, it may slice through this resistance barrier and aim for $500.

It is worth mentioning that the TD sequential indicator is currently presenting a sell signal on ETH’s 1-day chart. The bearish formation developed as a green nine candlestick, suggesting a one to four daily candlesticks correction before the uptrend resumes.

Based on historical data, the TD index has been incredibly accurate at predicting Ether’s local tops and bottoms. It even presented a buy signal on July 18, just before prices surged over 76%.

For this reason, the current forecast must be taken seriously despite the high levels of interest around this altcoin.

In the event of a correction, the IOMAP cohorts show that the most significant support level underneath Ethereum lies around $340. Here, roughly 314,000 addresses are holding 4.22 million ETH. This supply barrier may have the ability to prevent a further fall in the event of a downswing.

Given the ambiguous outlook, traders must watch out for the $385 support and the $408 resistance level. Breaking below or above these critical hurdles will determine where Ethereum is headed next.

Share this article