Exchange Coins Poised to Surge: Binance Coin, UNUS SED LEO, OKB

While many market participants remain fearful, Binance Coin, UNUS SED LEO and OKB are presenting sizable opportunities.

Key Takeaways

- Multiple technical indexes indicate that Binance Coin is preparing for a significant price movement.

- Along the same lines, UNUS SED LEO is forming one of the most reliable trend reversal patterns that could result in a 20% upswing.

- OKB, however, is consolidating within two strong barriers of support and resistance.

Share this article

Like most cryptocurrencies, the top crypto exchange tokens—Binance Coin, UNUS SED LEO, and OKB—also suffered from the sell-off seen across the global financial markets. However, the bullish momentum behind these altcoins seems ready to resume.

Binance Coin Prepares for High Volatility

Over the last two weeks, Binance Coin has been contained within a parallel channel. Each time BNB rises to the top of the channel, it drops down to hit the bottom of the channel, and from this point, it bounces back again. These are the primary characteristics of a channel.

Although this type of technical pattern makes the price action of an asset extremely predictable, it does not provide a clear outlook about when or where the breakout will take place. For this reason, trading within parallel channels poses high levels of risk.

As a result, the range between the $11 support level and the $13 resistance level can be considered a no-trade zone. A candlestick close above or below this area will be the catalyst for the next major price movement.

A similar outlook is given by the Bollinger bands on BNB’s 12-hour chart, which appear to be squeezing. Squeezes are indicative of periods of low volatility that are typically followed by periods of high volatility. The longer the squeeze, the higher the probability of a strong breakout.

A sudden spike in demand for Binance Coin could allow it to close above the upper boundary of the channel and its 50-twelve-hour moving average. Such a bullish impulse could push its price further up to test the next level of resistance around $17. This is where the 200-twelve-hour moving average sits.

Meanwhile, closing below the lower boundary of the channel at $11 would likely allow the bears to profit.

If this support level fails to hold the price of BNB, then it would likely continue to drop to try to find support around the 61.8% and 78.6% Fibonacci retracement levels. These demand barriers sit at $10.4, and $9.5, respectively.

UNUS SED LEO Shows an Ambiguous Outlook

During the recent meltdown seen across the global financial markets, including the cryptocurrency industry, UNUS SED LEO was one of the assets that was barely affected by the downturn. As a matter of fact, this crypto has regained over 90% of the losses it incurred.

Now, the TD sequential indicator is presenting a sell signal in the form of a green nine candlestick on LEO’s 3-day chart. The bearish formation estimates a one to four candlestick correction before the continuation of the uptrend.

If validated, UNUS SED LEO could lose some of the gains it made.

Nevertheless, in a lower time frame such as the 1-day chart a head-and-shoulders pattern appears to be developing. This technical formation is considered to be one of the most reliable trend reversal patterns by many traders.

An increase in the buying pressure behind LEO around the current price levels could confirm this bullish pattern. Thus, breaking above the neckline could send this crypto up over 20% to around $1.26. This target is determined by measuring the distance between the head and the neckline and adding it to the breakout point.

Due to the ambiguous outlook that UNUS SED LEO presents, investors must be cautious.

A break above the $1.04 resistance level could signal that the head-and-shoulders pattern will be validated. Conversely, failing to close above this price hurdle could add credibility to the bearish outlook presented by the TD sequential indicator.

OKB Could Bounce Back to Resistance

Following a 73.5% price drop, OKB managed to rebound quickly and turn its 200-twelve-hour moving average into support. Although the bullish momentum was significant, it was not strong enough to allow it to break above the resistance provided by its 100-twelve-hour moving average.

The low levels of volatility seen over the last two weeks suggest that OKB could continue consolidating within these two moving averages for a longer period of time.

Adding credence to this idea, a falling wedge appears to be developing in the 4-hour chart. This technical formation is signaling that an 18% upswing is on the works. If validated, OKB could soon climb to test its 100-twelve-hour moving average once again.

Even though support and resistance levels weaken the more they are tested, it remains unclear whether the 100 or 200-twelve-hour moving average will break first. Therefore, market participants must wait for OKB to move above or below this trading range before entering any trade.

Closing above resistance will set the stage for a further advance to $5.4 or even $6.3 while losing the 200-twelve-hour moving average as support could trigger a sell-off that sends OKB back to $2.

Moving Forward

Most cryptos in the industry, including BNB, LEO and OKB, have been able to make significant gains over the last few weeks after the massive correction they suffered between the beginning of February and mid-March. Regardless, the upturn seen recently has not been able to bring back most of the capital that was wiped out of the market.

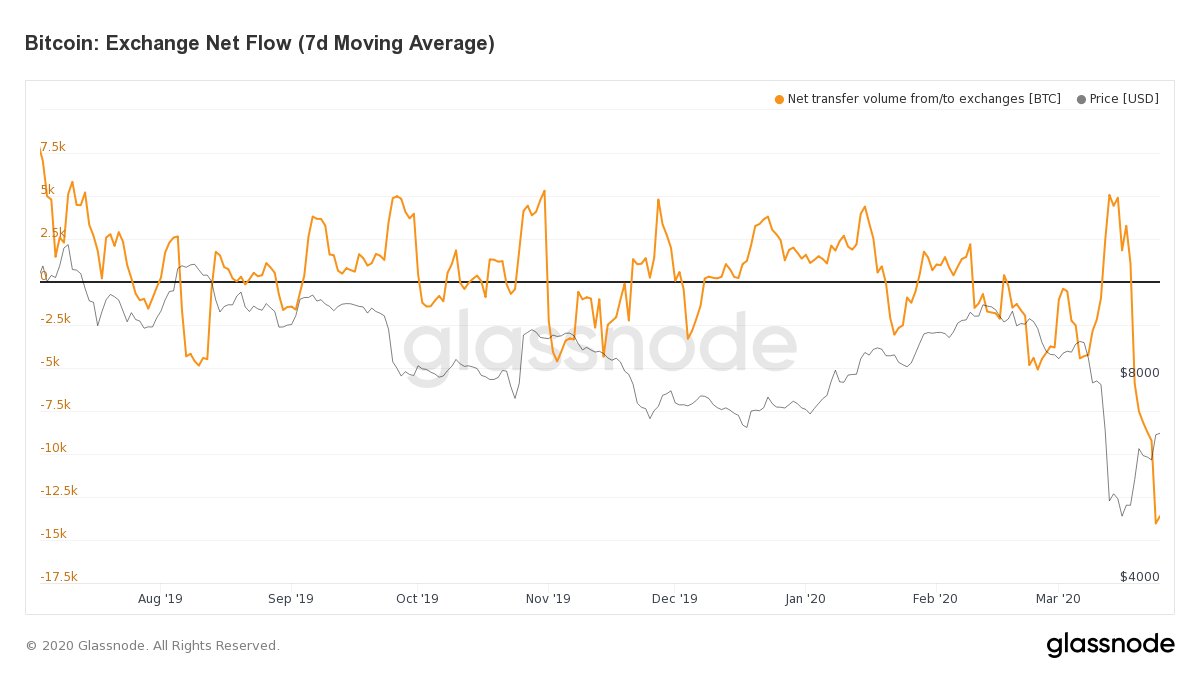

Data from Galssnode reveals Bitcoin holders are actually withdrawing their funds from exchanges. The outflow has been increasing on a daily basis since March 18. Currently, BTC exchange balances are the lowest they have been in approximately eight months, according to the on-chain data and intelligence firm.

As market participants continue to shiver in “extreme fear,” the Bloomberg Galaxy Crypto Index flashed its first buy signal in over three months leaving many wondering whether it is time to “be greedy when others are fearful.”

Share this article