Fantom ICO Review and FTM Token Analysis

Share this article

Our Fantom ICO spree continues! We published a preview yesterday, and the team updated us today with the information we needed to complete a full ICO review. In conjunction with Andre Cronje’s initial Fantom code review, we’ve really had a chance to take a close and careful look at this high-performance blockchain play.

Fantom ICO Overview

The Fantom ICO offers a DAG-based blockchain protocol for instant transactions and infinite scalability at near zero cost. The Fantom team has set a throughput target at 300k transactions per second (TPS).

As a high-performance blockchain, their goal is to be among the first platforms to disrupt the existing payments and supply-chain management industries. With a value proposition that focuses on reducing costs, increasing transparency and executing hundreds of thousands of transactions per second, Fantom envision future use cases for their product in a multitude of sectors including food technology, telecom, banking, electricity and real estate.

Fantom ICO Value Proposition

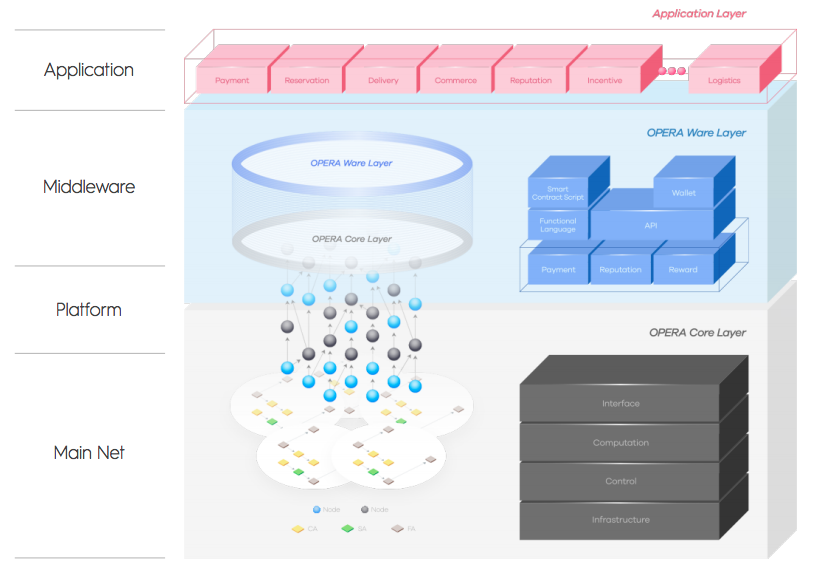

The actual architecture of Fantom is divided into three layers.

The bottom is called the OPERA Core Layer and is responsible for creating events and maintaining consensus across all nodes via the Lachesis Protocol. Transactions are confirmed by leveraging a Directed Acyclic Graph (DAG), allowing nodes to process transactions asynchronously.

Similar to a blockchain, transactions are saved on each node in the network, though data is not required to be saved across all nodes. In order to validate transactions, a second type of node is employed, called the witness node. Witness nodes check validity across all nodes on the network. These nodes rely on Delegated Proof of Stake to elect validators.

The middle layer of the protocol is called the OPERA Ware Layer. This layer acts to execute functions such as issuing payments, rewards, and writing “Story Data”.

The top layer is called the OPERA Application Layer, and will provide publicly available APIs for dApps to utilize the middle layer. One particular aspect of note is what Fantom refer to as the “Story Data”.

While Ethereum has a limited capability of tracking past transactions, Fantom solves this issue by leveraging Story Data, which allows all past transactions to be tracked. Every transaction and smart contract execution can store a piece of data this way for functions like tracking items. For utilities such as supply-chain management where indefinite records of data are essential, this type of architecture offers immense value.

Illustration of Fantom

The FTOM token is used primarily for staking and to reward witness nodes participating in validation of the network. FTOM tokens will also be used for incentivization schemes to reward users and attract contributors to the platform. FTOM will initially be issued as an ERC20 token until the launch of the mainnet, at which time participants will lock the FTOM ERC20 tokens on the Fantom Platform and the equivalent amount of native tokens will be allocated.

Fantom ICO Team

The Fantom team is large. The lead team behind Fantom Foundation is comprised of 11 members, along with 8 advisors. Beyond the core foundation members, the platform development team includes an additional 16 members in total.

Dr. Ahn Byung Ik (Founder and CEO) Dr. Ahn holds a PhD in computer science from Yonsei University and is President of the Korea Food-Tech Association. Dr. Ahn’s record of previous successes in the startup realm is noteworthy. In 1998, he founded a location based service company called Point-I which he then sold after IPO. Again, in 2010, Dr. Ahn founded food-tech platform SikSin (similar to Yelp) which according to Google Play has reached 1 million+ downloads.

Bob Tucker (COO) Bob has over 25 years of experience managing businesses for leading financial institutions and asset managers, including Barclays Capital, Bank Austria Creditanstalt, Man Investments and ANZ Bank. Most recently, Bob was the Head of Business Management for the Global Markets and Institutional Loans division of ANZ Bank. He has prior experience in the cryptospace through his role as COO at Digital Currency Holdings.

Sean Yun (CFO) Sean concurrently serves in several different positions aside from Fantom- he is an Auditor for Natural FNP and TCN Bioscience, and also CEO of Foodntable. Prior to his current roles, he served as a manager at the Industrial Bank of Korea for 3 years.

Isaac Lee (CIO) Isaac is a general partner at BlockWater Capital. As a firm that focuses on bringing blockchain projects to fruition, this is not his first foray into the cryptospace. Isaac is also former COO of KRTG, a consulting company specializing in digital assets.

Jake Choi (CMO) Jake Choi serves as Chief Investment Officer at Digital Currency Holdings. He holds a demonstrated track record in the financial services industry through past roles such as Security Analyst for the Digital Currency Group at Capital Markets CRC and as Vice President of Sales with digi.cash.

Joseph Jang (CSO) Joseph currently serves as VP of SL Blockchain Partners. He is also former CFO of Global IP, a company which offers a cryptocurrency arbitrage automated tradebot system. Other past roles include International Director of Business Development at DVInside and Director of International Investment at Sansoo Ventures.

Advisors to the Fantom ICO include:

Steve Bellotti – COO of Digital Currency Holdings and former Director of ANZ Bank

Cho Min Sik (Michael)- board member of Korean messaging app Kakao

Kim Hyeong Joo- President of the Korean Blockchain Association

For a complete list of team members and advisors please visit the Fantom website.

Fantom ICO Strengths and Opportunities

Fantom have laid out a plan for capturing their initial target market. The website lists the South Korea Food-Tech Association as a partner, which includes the top 90 leading companies in the 200 billion dollar food industry.

As mentioned above, CEO Dr. Ahn also serves as President of this association. With Dr. Ahn’s extensive background in both the food and technology sectors, Fantom plan to start building their ecosystem with dApps for food reservations, delivery services, and supply-chain management.

The team have expressed their intention to leverage partnerships via the Food-Tech Association toward this end. The sales team also plan to promote the product to retailers and street vendors as a cheaper alternative to the transaction fees incurred by regular payment systems, though this remains a more theoretical prospect at present.

DAG-based protocols provide one path to scalability that has in the past proven attractive to investors, with previous projects such as IOTA, Byteball and Nano all having seen significant returns post ICO.

While those projects hail from the first wave of DAG protocols, the next round could well induce similar sentiments within the space. A real value-add, Fantom brings to the table the incorporation of infrastructure for smart contracts and dapps, which prior DAG projects like IOTA and Nano did not offer at the time of their launch and have yet to incorporate into their product. The past performance of DAG-based protocols gives us increased confidence for the future of Fantom.

Fantom ICO Weaknesses and Threats

According to the Fantom roadmap, the testtnet launch is planned for Q4 2018. Fantom may encounter competition from other DAG protocols like Hedera Hashgraph and Constellation, which also plan to have live testnets by the end of 2018.

Hedera and Constellation both deploy similar architectures to Fantom through their incorporation of smart contract functionality. In terms of TPS, Hedera also have taken aim at a higher figure, which they purport to have already achieved.

As a project based out of Korea, Fantom could arguably maintain a hold on their domestic market via the connections Dr. Ahn and others on the team possess. Nonetheless, this is not a guarantee and the progress of Fantom in relation to direct contenders will represent a crucial element in achieving adoption with enterprises.

At this stage, Fantom has yet to establish any partnerships with enterprise clients. While there has been mention of discussions that are in the works, no official announcements have been made. As enterprise adoption is the crucial element of Fantom’s scaling strategy, it will serve to foster a greater sense of confidence if the team can produce solid agreements from enterprises to work together on piloting and incorporating the protocol. We will be looking out for developments on this front.

The Verdict on Fantom ICO

Fantom is one of several contenders that have chosen to combine DAG scalability with smart contracts for use utility. If the Fantom project is able to deliver on the promise of high TPS and leverage their industry domain toward enterprise adoption, we see the possibility for a path to actual use.

That said, at this point in the evolution of blockchain, when actual enterprise adoption of such technology will take place remains an open question. Regardless, we think the Fantom ICO has a team with the right mixture of blockchain expertise and industry domain for a fair shot.

In addition to this Fantom review, we have published Andre Cronje’s code review of the project, and you can read it here.

As a Top 10% rated ICO, we will look to make a small bet on the Fantom ICO (FTOM Token).

Learn more about the Fantom ICO (FTOM token) from our Telegram Community by clicking here.

We have rated hundreds of projects to unearth ICOs in which members of our team intend to invest.

We won’t often go into further depth on projects that we don’t consider as candidates for our investments after the initial rating process, which is why you will usually see our stamp on our detailed ICO reviews – they are the best we have found. However, on occasion, we might also rate a well-hyped project that does not meet our personal investing criteria. Please see our detailed disclaimer to the right (on desktops) or below (on other devices).

The Crypto Briefing Top 10 stamp is awarded to ICO projects that we rate in the top 10% of all projects.

FANTOM ICO REVIEW SCORES

SUMMARY

The Fantom ICO (FTOM Token) aims to create a blockchain that can be used across multiple industry sectors without the serious limitation of transactions-per-second (TPS). As we have detailed in many project reviews, scalability is a major obstacle to enterprise adoption of the blockchain, and the solution that Fantom is building would remove this for most use-cases. The race to mass adoption has many competitors and many solutions; Fantom may have as good a chance as most.

Founding Team……………………….8.8

Product…………………………………..5.2

Token Utility…………………………..9.3

Market…………………………………..7.4

Competition…………………………..7.1

Timing……………………………………6.5

Progress To Date……………………8.1

Community Support & Hype…..7.8

Price & Token Distribution……..6.2

Communication……………………..10.0

FINAL SCORE……………………….7.8

UPSIDES

- Founding team has industry domain in both blockchain and target market

- Project combines best of smart contract utility with scalability of DAG

- Promising roadmap for capturing target market on home soil

DOWNSIDES

- No official partnerships with enterprises announced yet

- Product development is still at an early stage

- Competition is present from similar projects

Today’s Date: 5/8/18

Project Name: Fantom

Token Symbol: FTM

Website: https://fantom.foundation/

White Paper: Fantom White Paper

Crowdsale Hard Cap: $39,400,000 USD

Total Supply: 3,175,000,000

Token Distribution: 40% Token Sale, 30% Market Development, 15% Advisors and Contributors, 15% Fantom Team and Founders

Price per Token: 1 FTM = $0.04

Initial Market Cap (at crowdsale price): $50,800,000 USD

Two Year Market Cap (at crowdsale price): $101,600,000 USD (5% inflation rate)

Accepted Payments: ETH

Countries Excluded: China, USA

Bonus Structure: N/A

Presale Terms: 30% bonus with 3 month lock up for private sale

Whitelist: TBA

Important Dates: TBA

Expected Token Release: Following token sale

Additional Information: Whitelist will open around the second week of May. See https://t.me/fantom_english for more information.

ICO Review Disclaimer

The team at Crypto Briefing analyzes an initial coin offering (ICO) against ten criteria, as shown above. These criteria are not, however, weighted evenly – our proprietary rating system attributes different degrees of importance to each of the criteria, based on our experience of how directly they can lead to the success of the ICO in question, and its investors.

Crypto Briefing provides general information about cryptocurrency news, ICOs, and blockchain technology. The information on this website (including any websites or files that may be linked or otherwise accessed through this website) is provided solely as general information to the public. We do not give personalized investment advice or other financial advice.

Decentral Media LLC, the publisher of Crypto Briefing, is not an investment advisor and does not offer or provide investment advice or other financial advice. Accordingly, nothing on this website constitutes, or should be relied on as, investment advice or financial advice of any kind. Specifically, none of the information on this website constitutes, or should be relied on as, a suggestion, offer, or other solicitation to engage in, or refrain from engaging in, any purchase, sale, or any other any investment-related activity with respect to any ICO or other transaction.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media LLC makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media LLC expressly disclaims any and all responsibility from any loss or damage of any kind whatsoever arising directly or indirectly from reliance on any information on or accessed through this website, any error, omission, or inaccuracy in any such information, or any action or inaction resulting therefrom.

Cryptocurrencies and blockchain are emerging technologies that carry inherent risks of high volatility, and ICOs can be highly speculative and offer few – if any – guarantees. You should never make an investment decision on an ICO or other investment based solely on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional of your choosing if you are seeking investment advice on an ICO or other investment.

See full terms and conditions for more.

Founding Team

This category accounts for the leaders, developers, and advisors.

Poor quality, weak, or inexperienced leadership can doom a project from the outset. Advisors who serve only to pad their own resumes and who have ill-defined roles can be concerning. But great leadership, with relevant industry experience and contacts, can make the difference between a successful and profitable ICO, and a flub.

If you don’t have a team willing and able to build the thing, it won’t matter who is at the helm. Good talent is hard to find. Developer profiles should be scrutinized to ensure that they have a proven history of working in a field where they should be able to succeed.

Product

What is the technology behind this ICO, what product are they creating, and is it new, innovative, different – and needed?

The IOTA project is a spectacular example of engineers run amok. The technology described or in use must be maintainable, achievable, and realistic, otherwise the risk of it never coming into existence is incredibly high.

Token Utility

Tokens which have no actual use case are probably the worst off, although speculation can still make them have some form of value.

The best tokens we review are the ones that have a forced use case – you must have this token to play in some game that you will probably desire to play in. The very best utility tokens are the ones which put the token holder in the position of supplying tokens to businesses who would be able to effectively make use of the platforms in question.

Market

There doesn’t have to be a market in order for an ICO to score well in this category – but if it intends to create one, the argument has to be extremely compelling.

If there is an existing market, questions here involve whether it is ripe for disruption, whether the technology enables something better, cheaper, or faster (for example) than existing solutions, and whether the market is historically amenable to new ideas.

Competition

Most ideas have several implementations. If there are others in the same field, the analyst needs to ensure that the others don’t have obvious advantages over the company in question.

Moreover, this is the place where the analyst should identify any potential weaknesses in the company’s position moving forward. For instance, a fundamental weakness in the STORJ system is that the token is not required for purchasing storage.

Timing

With many ICO ideas, the timing may be too late or too early. It’s important for the analyst to consider how much demand there is for the product in question. While the IPO boom funded a lot of great ideas that eventually did come to fruition, a good analyst would recognize when an idea is too early, too late, or just right.

Progress To Date

Some of the least compelling ICO propositions are those that claim their founders will achieve some far-off goal, sometime in the future, just so long as they have your cash with which to do it.

More interesting (usually) is the ICO that seeks to further some progress along the path to success, and which has a clearly-identified roadmap with achievable and reasonable milestones along the way. Founders who are already partially-invested in their products are generally more invested in their futures.

Community Support & Hype

Having a strong community is one of the fundamental building blocks of any strong blockchain project. It is important that the project demonstrates early on that it is able to generate and build a strong and empowered support base.

The ICO marketplace is becoming more crowded and more competitive. While in the past it was enough to merely announce an offering, today’s successful ICO’s work hard to build awareness and excitement around their offering.

Price & Token Distribution

One of the biggest factors weighing any analysis is price. The lower the price the more there is to gain. But too low of a price may result in an under capitalized project. It is therefore important to evaluate price relative to the individual project, its maturity and the market it is going after.

The total supply of tokens should also be justified by the needs of the project. Issuing a billion tokens for no reason will do nobody any good.

Communication

Communication is key. The success of a project is strongly tied to the project leaders’ ability to communicate their goals and achievements.

Things don’t always go as planned but addressing issues and keeping the community and investors in the loop can make or break a project.

Share this article