Fintech Companies Tackle Financial Inclusion: Banks Fall Further Behind

Rethink the term 'unbanked'.

Share this article

Financial inclusion has always been one of the benefits of cryptocurrencies, promising to serve the unbanked and underbanked, those ignored by legacy institutions in both the west and in the developing world.

Cryptocurrency wallets have developed highly sophisticated KYC procedures that, aided by advanced software, are fast outpacing banks in terms of their ability to identify customers and onboard people quickly.

They have been able to do this in the developed world; and in the developing world, some projects like BABB are working on innovative procedures such as social onboarding, where an onboarded user vouches for the identity of a potential customer.

With Anti-Financial Crime and Anti-Money Laundering seemingly one of the most pressing concerns among regulators when it comes to crypto, they may be overlooking the benefits new fintechs can offer, both to the unbanked and also to the fight against financial crime.

There Are Unbanked in the Developed World, Too

New migrants, temporary migrant workers, international students, and the economically marginalized are all at risk of being unbanked or underbanked even in advanced societies. For example, the U.K. parliament’s Select Committee on Financial Exclusion reported that nearly two million people in England are financially excluded.

The U.S. has 33 million underbanked households, in addition to a six percent unbanked population. Cryptocurrency wallets, on the forefront of the fintech revolution, present a golden opportunity to address this problem, using mobile, nimble solutions and a solid dose of technological prowess. According to Business Insider Intelligence:

Legacy banking systems are a country mile behind.

Newer fintech companies deploy the use of electronic address verification, selfie + ID matching, video selfies, and electronic photographs of paper documentation. These are the products of both limitations and innovations.

Without a boots-on-the-ground retail footprint and a more dispersed customer base, mobile wallets and non-traditional fintech banking companies have made complying with KYC regulations, that cynics would say have been boosted (given the almost laughable suggested nexus between crypto and financial crime) to limit crypto’s growth actually easier, cheaper, and faster.

Cryptocurrency accounts and wallets, digital by nature, have combined their tech advantages and human-interface disadvantages to create an improved KYC experience for their users. There are fintechs, such as BlockFi, who can KYC new users within minutes.

Cryptocurrency Traceable by Nature

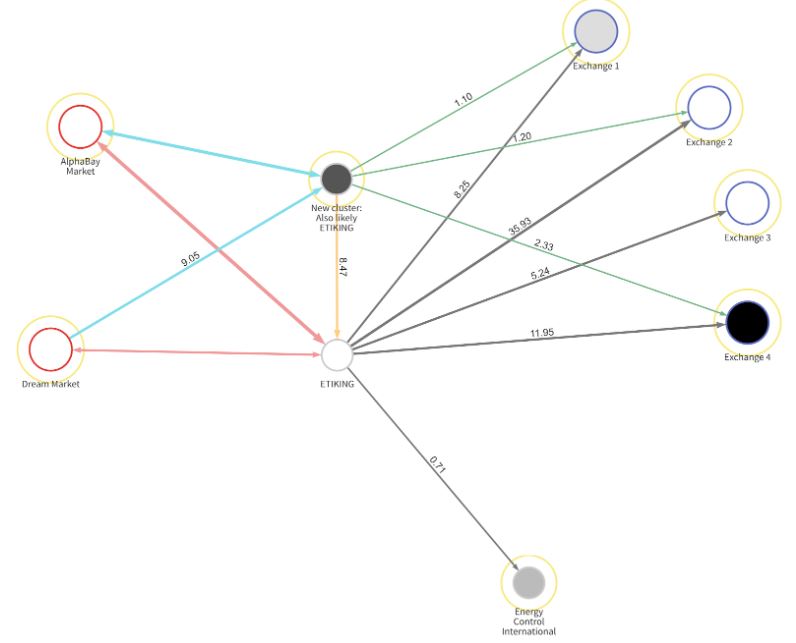

Privacy coins aside, cryptocurrency transactions are traceable by nature. More traceable than briefcases of cash. Chanalysis wrote an early October blog post about how they traced transactions linked to darknet fentanyl dealer ETIKING using only the bitcoin address he used to receive payments.

Tracking transactions into and out of the account, the blockchain analysis company produced a detailed graph of the fentanyl dealer’s transactions, ultimately helping law enforcement identify and arrest ETIKING as Jeremy Achey and make an arrest.

Beyond the traceability of cryptocurrency, however, the new fintech revolution that digital currencies have helped usher in is demonstrating to established banks that tech-driven solutions to KYC and AML are not as onerous as they used to be.

By using technology to onboard the unbanked or underbanked, crypto-based fintech companies will ultimately do more good for society than any purported harm they could cause in terms of AML efforts.

After all, fiat-based banks’ AML records are even less impressive than their underwhelming efforts at financial inclusion.

Share this article