Grayscale Follows Tesla by Splitting Ethereum Shares

Share splitting is usually seen as a bullish decision in traditional markets.

Key Takeaways

- Grayscale has announced plans to split its Ethereum shares (ETHE) later in the month.

- This will create eight shares for each currently held share.

- In traditional equities, this sort of split is often seen as bullish.

Share this article

Crypto investment firm Grayscale has announced a share split of its Ethereum Trust Fund (ETHE), offering eight additional shares for each share currently held by shareholders.

Split Will Occur in Mid-December

Beginning Dec. 17, the outstanding number of shares for Grayscale’s Ethereum Trust will increase from 29.5 million to 265.5 million. Grayscale’s decision should enhance the marketability of its’ Ethereum shares by making those shares cheaper.

Currently, one ETHE share represents 0.09284789 Ethereum tokens (ETH). After the split, the share will be worth 0.01031643 ETH, but the shareholders will retain their total value in the exercise. A 9-for-1 split would effectively reduce a $100 share price to $11.12, and a shareholder with ten shares will now hold 90 units.

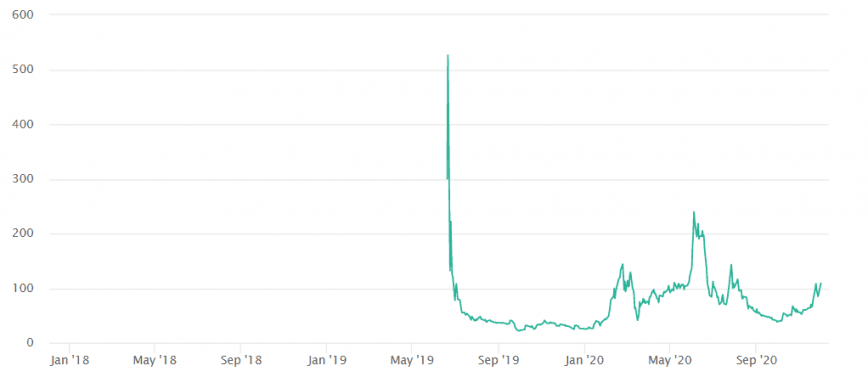

Grayscale’s ETHE shares are currently changing hands at $108.8 with a year-to-date increase of 350%, with plenty of interest from retail investors.

Why It Matters

In the equities world, a company can issue a scrip issue or bonus issue to existing shareholders for free.

This does not add or take away value from the total asset under management. Instead it means that the shareholders hold a greater number of units, while the cost of each share decreases according to the supply ratio. Investors’ total portfolio value and percentage holdings in the trust remain the same.

While a scrip issue may seem like a redundant exercise, it is taken as a sign of bullishness in traditional markets, and the reduction in share prices makes it more affordable.

The practice has been carried out by high-profile companies recently. For instance, when Tesla announced a stock split on Aug. 11, the news caused stock prices to appreciate by 70% before the split took effect on Aug. 31. Given that Grayscale has chosen to imitate the model, that could be a good sign for its future value.

Share this article