How Realistic Is $1 Million Bitcoin?

Proponents have long talked about how Bitcoin could hit the $1 million mark. Previously, this was just speculation. Now, some reputable names have thrown their name behind the possibility.

Key Takeaways

- Predictions of $1 million Bitcoin prices by 2025 have been prompted by the massive global quantitative easing programs underway in light of the coronavirus pandemic.

- Experts see Bitcoin's approaching a stock-to-flow ratio similar to that of gold, suggesting that a surge in market capitalization is possible.

- Inflows into Grayscale's Bitcoin and Ethereum trusts continue to indicate bullishness among institutional investors.

Share this article

Massive global quantitative easing has reignited price predictions for $1 million Bitcoin. Even in light of the coronavirus pandemic, are these prices realistic?

Calls for $1 Million BTC by 2025

Global Macro Investor just released a report outlining what the future holds for markets around the world.

“Gold can go up 3x to 5x in the next three to five years. Bitcoin, well that’s a different story. I think it can get to $1m in the same period,” said the report.

The argument is that Bitcoin’s market cap would grow from being a $200 billion asset class to a $10 trillion asset class, similar to how gold (including paper gold) grew from $15 trillion to $60 trillion over the same period.

At a current circulating supply of just over 18 million Bitcoin, the $10 trillion figure would actually have each Bitcoin worth just over $550,000. Still Raoul Pal’s outlook is remarkably bullish.

One Billionaire Sees the Potential

Social Capital CEO and former Facebook executive Chamath Palihapitiya also sees the potential for Bitcoin to hit seven figures. As reported early April by Forbes, Palihapitiya told Morgan Creek Digital’s Anthony Pompliano that he saw Bitcoin’s path after coronavirus stimulus as binary: it will either go to zero or millions.

Palihapitiya argues that the global economy is possibly headed for a period of extreme fiat currency debasement, in which case “the path dependence for Bitcoin is if it looks like [debasement] is likely, it will really emerge as a flight to safety.”

The former Facebook executive did paint a longer timeline for that to happen, saying that the process could take ten years. As the billionaire explained:

“If the probability was 1% that [Bitcoin] would be valuable, unfortunately, the probability is now probably like 5% or 10%. And there’s a real chance that by 2030 we don’t find a way to inflate our way out of this. The only way to break the back of inflation is essentially to create some quasi form of a gold standard, but it’ll be almost impossible to do that between governments and central banks. They’ll never agree on an instrument and they’ll never agree on an exchange [rate]. But then, bottoms up, people could decide to do it [with Bitcoin].”

How do Bitcoin Fundamentals Hold Up?

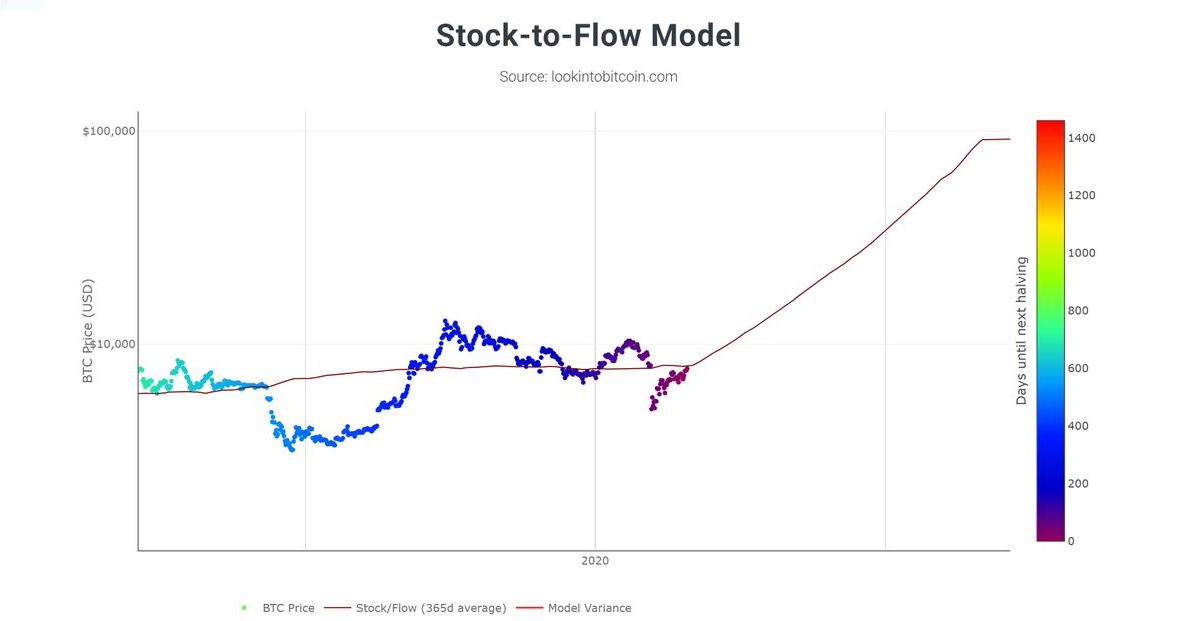

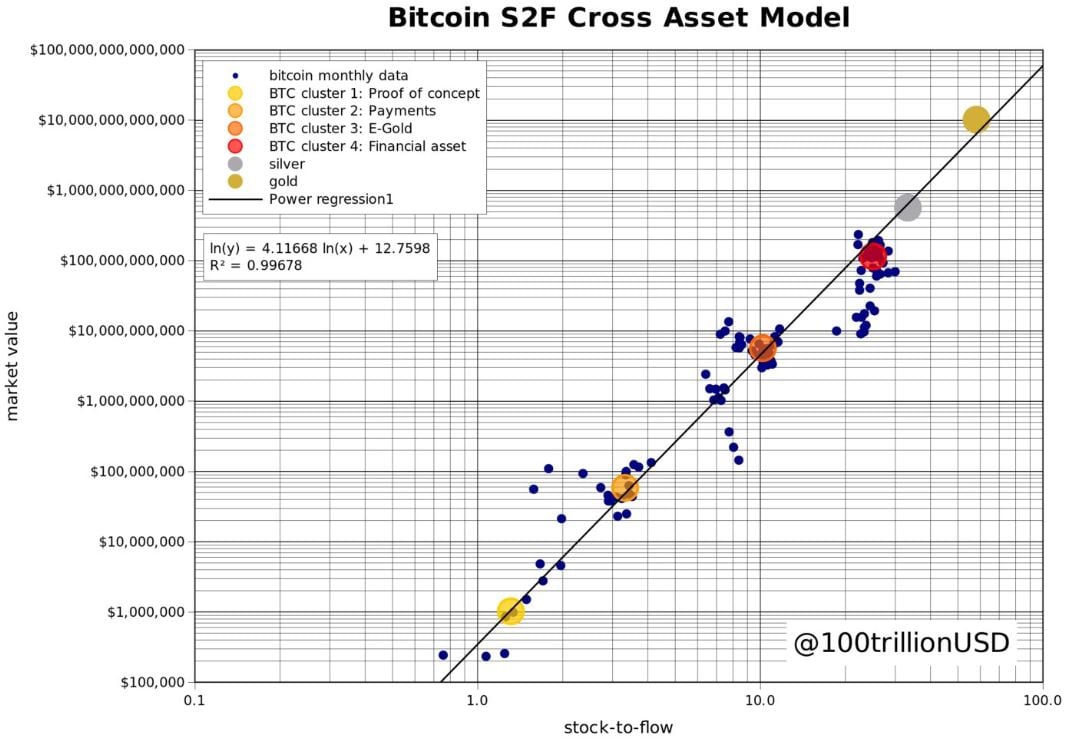

The stock-to-flow (S2F) model, albeit controversial, has Bitcoin approaching the scarcity of gold after the forthcoming halving event, which is about two weeks away at press time.

The S2F model is a valuation metric used to measure scarcity. It is simply the ratio of the current supply of an asset divided by the annual rate of production of new supply. Silver’s stock-to-flow ratio, for example, is 22.

The measure’s application to Bitcoin was first proposed by investor PlanB as a way to estimate the long-term value of Bitcoin, which currently has a stock-to-flow ratio of 27—already greater than that of silver’s. Meanwhile, gold’s ratio is 62.

What this number means, using gold as an example, is that at current rates of extraction it would take 62 years to double the gold supply, making it extremely scarce. Using this scarcity model it is possible to try and predict future prices.

However, after the May 2020 halving, Bitcoin’s ratio will double to around 52, placing it much closer to gold in terms of scarcity. Based on the model, this would place Bitcoin’s projected price at around $55,000 as a result of the forthcoming halving.

Taking this one step further, if gold and Bitcoin are valued similarly as hedge assets, something a similar stock-to-flow ratio could give them, then theoretically, the two assets could have similar market caps. So if Bitcoin’s market cap were to soar to gold’s, it would be worth over half-a-million dollars. Including paper gold, that rises as high as $800,000.

Alternatively, one view put forth by analyst Philip Swift shows Bitcoin approaching $100,000 values as a result of the price and stock-to-flow ratios converging.

However, courtesy of new analysis by PlanB, a new S2F model has emerged, predicting Bitcoin prices hovering around the $288,000 levels from 2020 until its 4th halving.

Does Current Demand Support $1 Million Bitcoin?

Demand for Bitcoin, given its current supply, has it priced just under $8,000. Supply growth will be halved after mid-May, but total supply will continue growing. So the narrative really is demand-driven until the full impact of the issuance reduction sets in.

Grayscale’s seminal 2019 Investor Study found that around 36% of American investors were interested in Bitcoin as an investment. Almost all (83%) cited Bitcoin’s “potential for growth” as a reason it interested them as an investment. Its scarcity also resonated strongly.

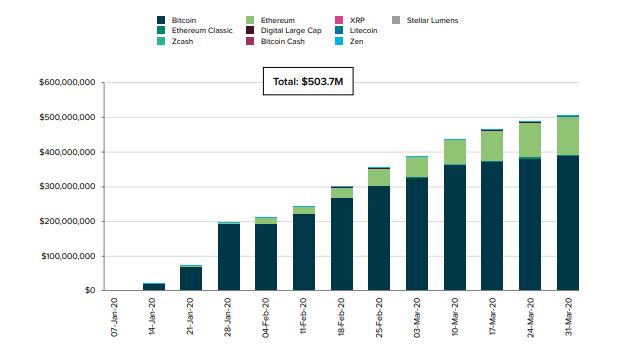

Grayscale is interesting for another reason, as their quarterly reports paint a picture of the growing levels of institutional investor interest in Bitcoin. Their Q1 2020 quarterly report showed the strongest demand levels ever, with over $500 million in inflows into the fund.

Most of those inflows (79%) were from hedge funds and other institutional investors. Most of which, around $400 million, went into the company’s Bitcoin Trust fund. The remaining $100 million was poured into Grayscale’s Ethereum Trust product.

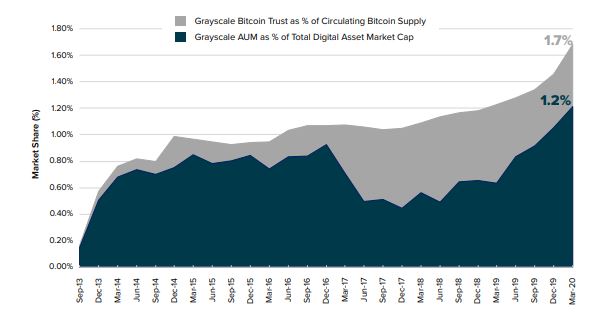

Grayscale’s quarterly reports are indicative of broader demand because the fund is a significant holder of digital assets. As of the end of the first quarter of this year, it held 1.7% of the circulating supply of Bitcoin. This means that 1.2% of the total digital asset market cap is entrusted with the company.

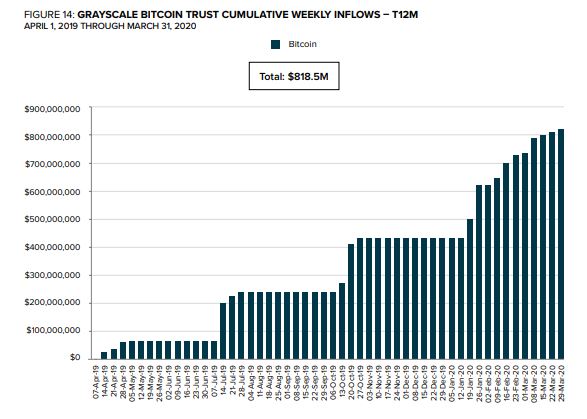

The company has seen a doubling of inflows into its Bitcoin product every quarter over the last year. While the graph below shows growth plateauing from the beginning of Q2, Q3, and Q4 of 2019 to the end of those periods, this is actually the result of caps from Grayscale.

The asset manager periodically ceases accepting new inflows when its funds are oversubscribed. So those flat periods do not represent a cessation of demand for its products, but an artificially imposed cap of its assets under management.

Over the past 12 months, cumulative inflows into Bitcoin via Grayscale doubled every quarter from around $100 million in Q2 2019, $200 million in Q3 2019, $400 million in Q4 2019, to $800 million by the end of March, 2020. The trend for institutional Bitcoin demand is clear.

Grayscale figures show a strong upward demand pressure among institutional investors. As infographics from Visual Capitalist suggest, globally derivatives have between $630 trillion to $1.2 quadrillion in notional value. If only a fraction of those funds were shifted from derivatives to digital assets, Bitcoin could enjoy a dramatic price surge. Institutional flight from other asset classes to digital assets will be required to push prices up toward the million dollar mark.

By the time Bitcoin reaches its fourth halving event, and assuming that will be four years from now, there will be 19,687,500 in circulation. Its S2F will have doubled again, surging beyond that of gold. If, by that time, Bitcoin cements itself as a haven asset then all bets are off.

While $1 million Bitcoin may seem far-fetched in 2020, current prices would have seemed equally as far-fetched as recently as 2016.

Nevertheless, all price predictions and projections should be taken with caution. The smallest error in the underlying assumptions at the beginning of these time frames can alter the final number dramatically.

Will we see $1 million Bitcoin by 2025? Nobody really knows. Some of the calculations above, however, suggest that it is entirely possible.

Share this article