How To Profit From Crypto Without Owning Coins

Investing in cryptocurrencies may or may not be your thing, but there’s no denying that it’s one of the hottest conversations in finance today. But how can you profit from crypto without actually owning Bitcoin or altcoins? These six companies are riding the Bitcoin wave right now.

Investing in cryptocurrencies may or may not be your thing, but there’s no denying that it’s one of the hottest conversations in finance today. But how can you profit from crypto without owning any?

Putting money into real cryptocurrencies is easier said than done. Depending on where you are in the world (and what time of day it is), jumping on top of the cryptocurrency bandwagon ranges from being somewhat convoluted to completely twisted.

With government regulations coming and going, as well as new challenges cropping up every other day, it can be pretty daunting and a formidable challenge to invest in them.

Now, if you’re a cryptocurrency enthusiast who truly wants to hold this asset class, your choices are limited. You’ll have to find a way to purchase the coin(s) of your choice.

But if that’s not going to work, what other options do you have? Are there other elements in the cryptocurrency ecosystem that you can invest in, and still participate in the growth of this industry?

In this article, we’ll look at six companies, understand what they do, and compare their investment returns over the last few months against Bitcoin (BTC/USD). Of course, there are hundreds of cryptocurrencies out there, but Bitcoin serves as an excellent proxy for the overall cryptocurrency market.

And before we proceed, we have to drop our obligatory disclaimer into the mix. Please keep in mind, past performance is no predictor of future performance, and this is merely a fun exercise to understand how the volatility of cryptocurrencies impacts other parts of the ecosystem – not financial advice.

Our Methodology

With each of the companies below, we compared their stock price action over the past eight months against the BTC/USD exchange rate.

BTC/USD is represented by the green and red candles, while the individual tickers are represented with blue and yellow candles.

Nvidia (NASDAQ: NVDA)

Nvidia designs and manufactures high-end graphics processing units. For a very long time, their core market was limited to graphic-intensive applications, such as visual effects, animation, and gaming.

However, the raw computing power built into these graphics processing units (GPU) makes them excellent for processing cryptocurrency transactions.

Let’s take a look at NVDA’s chart.

NVDA

NVDA’s chart did seem to follow the same trajectory as bitcoin during the third and fourth quarters of 2017, but after December, they stepped out of sync. Keep in mind, 2017 was a fantastic year for Nvidia overall, as they made tremendous strides in AI.

But for an investor looking to harvest some of the cryptocurrency volatility trends, NVDA doesn’t look too promising.

AMD (NASDAQ: AMD)

AMD is one of the top semiconductor companies in the world, but they’re second best two of their biggest product groups. Intel gives them a run for their money on the microprocessor market, and Nvidia has the lion’s share of the GPU world.

That hasn’t stopped them from cranking out powerful CPUs and GPUs either, and their ‘Radeon’ line of GPUs is a favorite among cryptocurrency miners for their excellent affordability, low power consumption, and powerful processors.

But enough about that. Let’s look at the chart.

AMD

AMD has had a rough ride on the back of their microprocessor segment, but their recent strong performance has been on account of their GPU sales and their foray into blockchain and AI.

Just like NVDA, AMD is betting big on blockchain and AI. And both companies have actively downplayed their involvement in cryptocurrency, preferring to focus the story on their investments in AI & blockchain.

While AMD’s price action towards the most recent couple of months does seem to mimic that of bitcoin, it’s not a compelling enough chart.

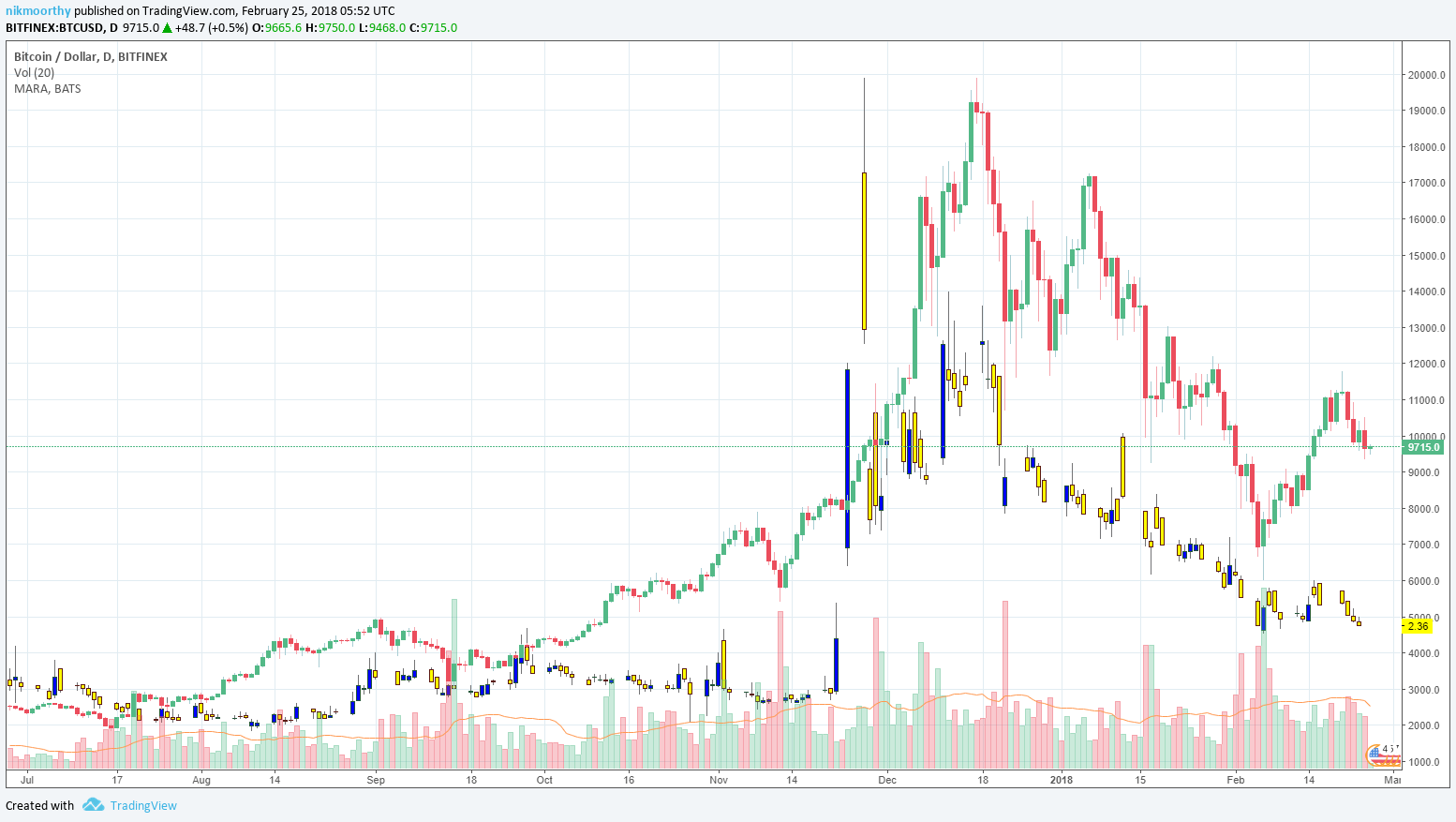

Marathon Patent Group (NASDAQ: MARA)

Marathon Patent Group is a company that licenses and commercializes IP. The company sources IP from corporations, universities, and individuals. However, their ‘side-hustle’ is mining cryptocurrency. They do this through a subsidiary arm called Marathon Crypto Mining Inc. In short, they ‘mine cryptocurrencies.

MARA

Now we’re getting somewhere. MARA’s price action appears to trace BTC/USD quite well. It makes intuitive sense given their direct involvement in mining cryptocurrency. MARA shows a big jump in November 2017. That’s when they bought GBV, a small cryptocurrency mining company. Notice the price-pop in their stock once the news came out.

I went over to MARA’s website to get a better understanding of how their business works. Interestingly, the large part of their site focuses on their patent licensing business, with their cryptocurrency mining operations only showing up on their news blurbs.

However, their price action makes it evident that the stock market looks at them as a good proxy for BTC/USD.

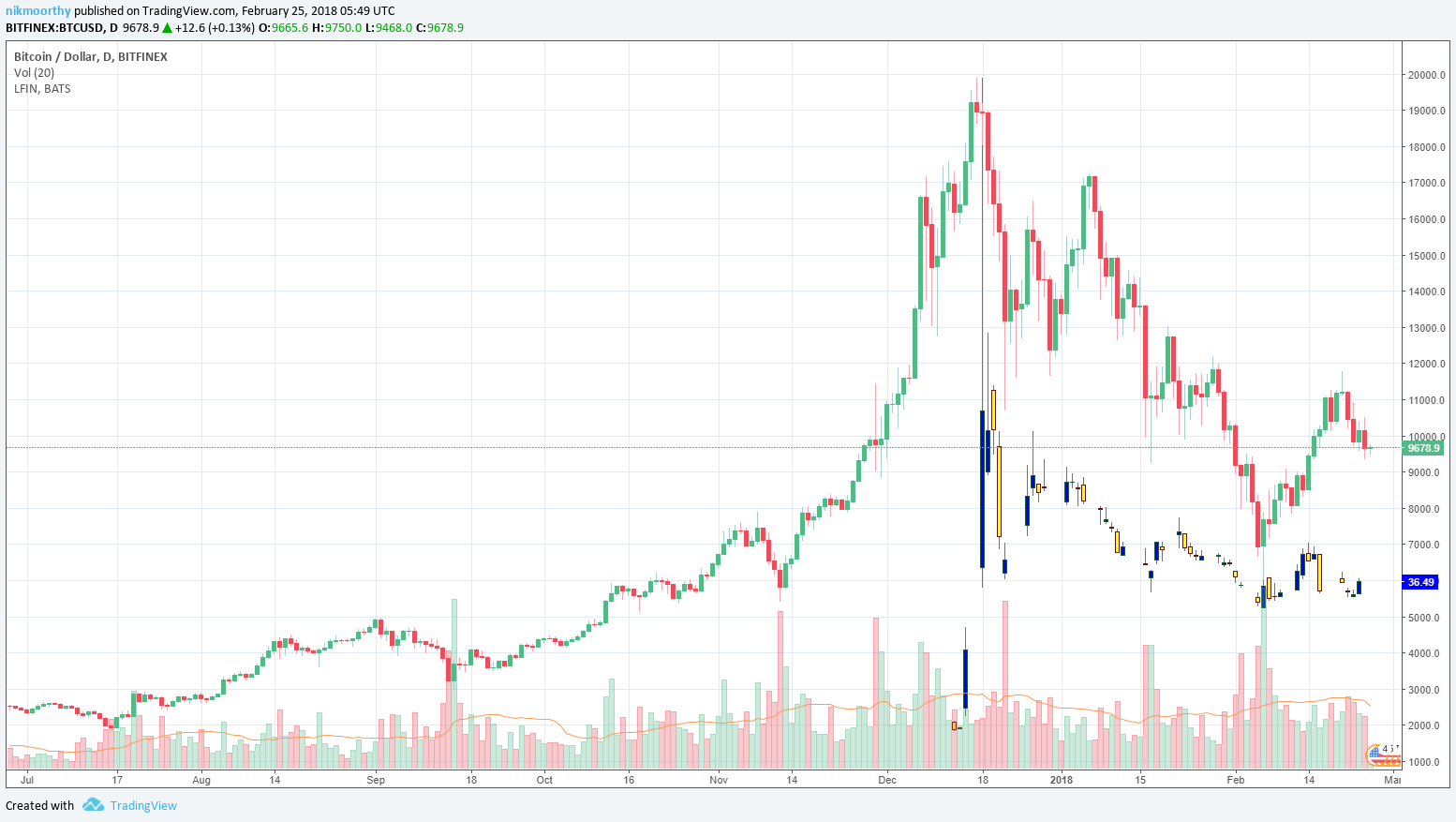

Longfin Financial Corp (NASDAQ: LFIN)

Longfin Financial Corp is a relatively new fin-tech company, based in NY. They specialize in blockchain technology and use it to offer various alternative finance/shadow banking solutions. They went public in December 2017.

LFIN

LFIN hasn’t been around for very long, but one look at their chart and you can see the trend.

It’s hard to call their IPO a roaring success, but it wasn’t a complete flop either.

However, shortly after their IPO, they purchased a small company that specialized in cryptocurrency contracts (Ziddu.com) and saw their stock price rocket upwards by almost 2600%. Check out that spike in price in December.

I was amused by how their CEO downplayed the surge in the stock’s price, calling it “crazy, frenzied speculation.”

In summary, LFIN, even with its brief history, seems to show a strong correlation to BTC/USD price action and could be a potential candidate for those looking to play the trends.

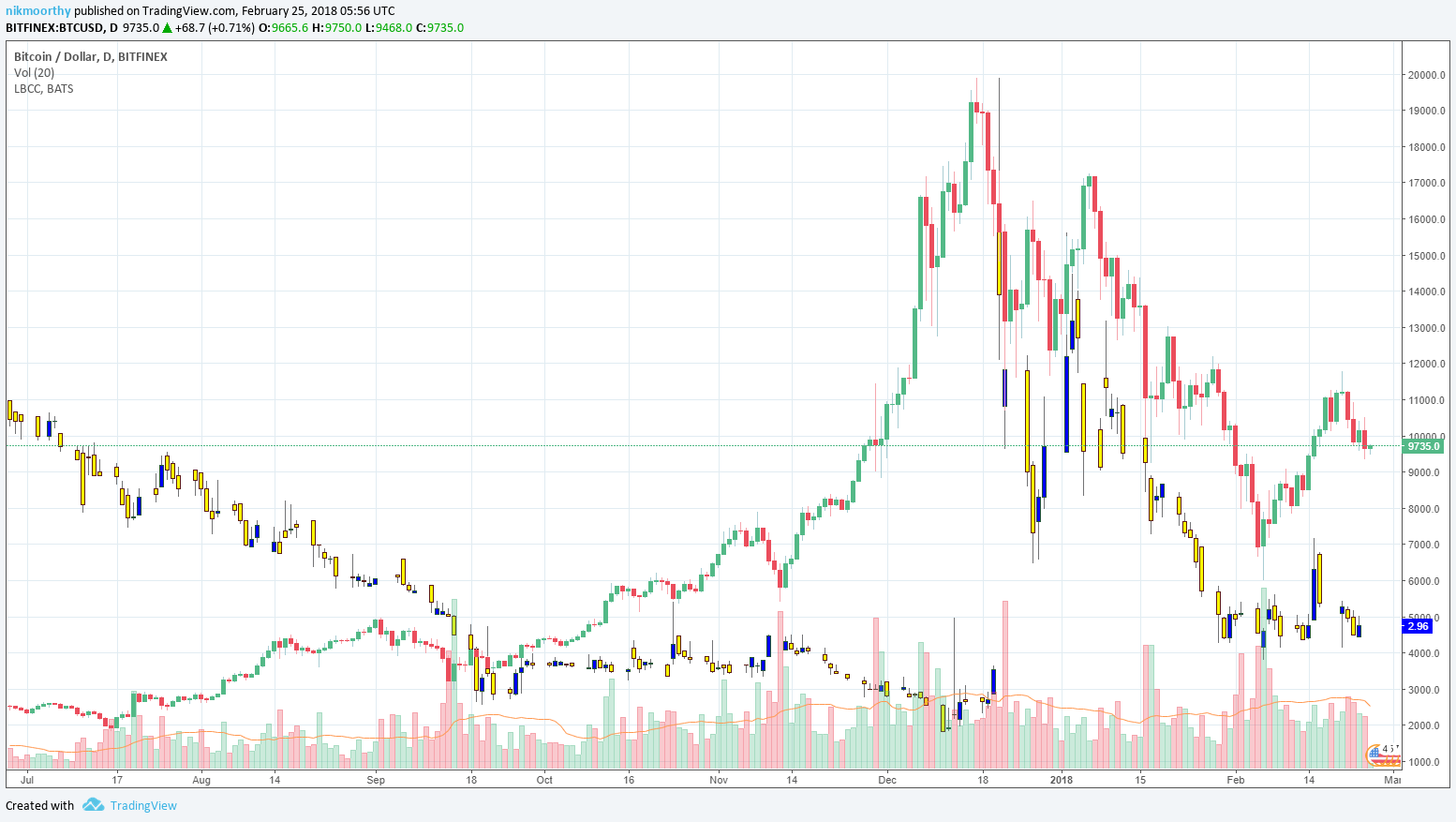

Riot Blockchain (NASDAQ: RIOT) & Long Blockchain Corp. (NASDAQ: LBCC)

So, here’s a joke. Don’t stop me if you’ve heard this one.

Two companies, Bioptix and Long Island Iced Tea Corp, walk into a bar. Bioptix has a royalty-bearing license to sell and distribute hormones for cattle. Long Island Iced Tea Corp makes iced tea.

Bioptix: “Man, this cryptocurrency stuff is on fire! I’m going to change my name to include the word ‘blockchain,’ even though I have nothing to do with it, and see what happens!”

*changes name to ‘RIOT BLOCKCHAIN’*

Bioptix: “Wait! WHAT?? Did you see that? I found suckers! They bought into it! How lucky did I get? I didn’t think I’d be able to get away with that.”

Long Island Ice Tea Corp.: “Hold my drink.”

*changes name to ‘LONG BLOCKCHAIN’*

Boom!

Wait. What exactly is happening here?

RIOT

LBCC

Two companies, from completely unrelated fields, announced they were ‘blockchain’ companies, and their shares took off? So, RIOT now develops blockchain cattle hormones? And LBCC will have distributed ledger technology in their beverages? Or is someone just trying to cash in and profit from crypto?

Now that I’ve gotten my little rant out of the way let’s read what their charts tell us. Both tickers mirror BTC/USD very closely. If you were looking for stocks that could give you access to the wild swings in cryptocurrency values, you’ve found a couple of them.

But does this mean the trend will continue? Hard to say. People may wise up, and pull their money out from these stocks. Or the SEC, which has just announced a wave of subpoenas, might take some kind of action. Or they might be delisted by the NASDAQ. Worse still, they could face a class action lawsuit.

However, they say there’s a sucker born every minute. And some of them have money to spend. So keep an eye on these stocks.

Conclusion

There are plenty of ways in which an investor can gain exposure to the cryptocurrency market, without ever holding a single coin.

Some companies track the Bitcoin exchange rate better than others.

If you want to participate in the future of blockchain technology and artificial intelligence, you could stick with companies like NVDA and AMD.

Solid fundamentals? Check. Cryptocurrency-like volatility? Not so much.

If, on the other hand, you’re looking to ride the waves, consider companies like LFIN, MARA, and even RIOT/LBCC (yuck).

Ultimately, it comes down to your risk tolerance and trading goals.

No matter which way you go, one thing is for sure. There’s plenty of excitement to come.