HTX turns off proof-of-reserves as TUSD struggles to hold its peg

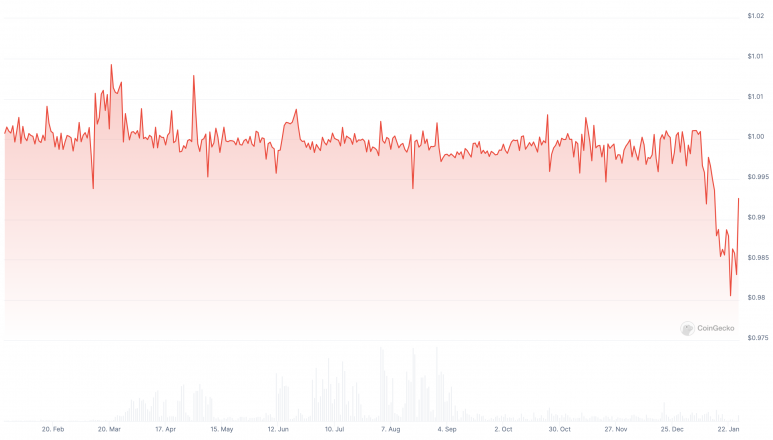

TUSD has traded below $1 for over two weeks.

Share this article

Crypto exchange HTX, previously known as Huobi, has suddenly turned off its proof-of-reserves system today, according to Adam Cochran, Managing Partner at Cinneamhain Ventures. This concerning development comes at the same time as TrueUSD (TUSD), which is believed to be owned by HTX stakeholder Justin Sun, has failed to maintain its $1 peg for over two weeks.

1/8

So Justin Sun's HTX/Huobi has suddenly turned off their proof-of-reserves system, at the same time as a few other concerning things are happening. pic.twitter.com/eCjE9YAvwA

— Adam Cochran (adamscochran.eth) (@adamscochran) January 26, 2024

Earlier today, visiting HTX’s proof-of-reserves page showed no data on the exchange’s crypto reserves. The reserve rates, wallet balances, and user asset figures were all missing temporarily. The page is now back online, but the timing of this temporary outage still raises questions given the ongoing issues with stablecoin TUSD.

This change follows recent scrutiny around TUSD and its apparent lack of adequate collateralization. TUSD has traded below $1 since January 7th according to CoinGecko.

Earlier this month, TrueUSD failed to provide real-time attestations showing it had sufficient dollar reserves backing the stablecoin. This transparency failure led to speculation that TrueUSD may be under-collateralized.

The realtime attests of TUSD stopped working since yesterday, which potentialy means that it was reported as undercollatelised. (see status description in the pic)@tusdio @The_NetworkFirm any comments? pic.twitter.com/s4vsa7Gz4o

— Symbio (@NoCryptFish) January 10, 2024

Multiple reports exist of users unable to redeem TUSD. Meanwhile, one Tron address linked to Justin Sun seems to be the sole address minting and burning over $3 billion worth of TUSD tokens.

Has anyone been part of the lucky 40 million $TUSD who's been able to redeem from @tusdio in the past three days?

I think before I've seen a major Tron wallet only be able to move this (ultimately to a burn address). pic.twitter.com/6O0dw1RiD8

— TheSkyhopper (@TheSkyhopper) January 26, 2024

Last July, Archblock’s co-founder Daniel Jaiyong filed a lawsuit claiming Justin Sun was secretly acquiring the company TrueUSD. Court documents allege Sun was buying the struggling stablecoin issuer amid negotiations with Archblock.

Archblock Founder Claims Justin Sun Was Secret TUSD Acquirer in Lawsuit (Not exactly a shocker) pic.twitter.com/ybTPmSOmtk

— db (@tier10k) July 17, 2023

Following the publication of this article, an HTX spokesperson confirmed to Crypto Briefing on Thursday that:

“User assets are 100% reserved, and user assets are also secure. There is a specific issue with the POR interface, which is expected to be fixed within a few hours.”

Share this article