IOST / USD Technical Analysis: Higher Highs

Share this article

- IOST has a bullish short-term trading bias, with the cryptocurrency rising to its highest trading level since May 2018

- The IOST / BTC pair has a strong bullish medium-term outlook

- The daily time frame shows the formation of a bullish inverted head and shoulders pattern

IOST / USD Short-term price analysis

IOST has a bullish short-term trading outlook, with the IOST / USD pair surging to its highest trading level since early May 2018. Bulls continue to create bullish higher highs on the four-hour time frame with strong dip-buying demand seen on any technical corrections.

Indicators remain bullish across the four-hour time horizon and continue to signal further gains ahead, although bearish MACD price divergence has built up on the four-hour time frame.

IOST / USD H4 Chart (Source: TradingView)

Pattern Watch

Traders should continue to monitor the dynamic of price creating bullish higher highs and lower lows.

Relative Strength Index

The RSI indicator on the four-hour time frame remains bullish and is showing that buying interest remains strong.

MACD Indicator

The MACD indicator on the four-hour time frame is bullish and is generating a strong buy signal.

Fundamental Analysis

IOST price surge is supported by several positive announcements that have been made recently. Earlier this week, the company announced that it received funding from a Chinese blockchain fund, with $200M under management. In addition to that, today, IOST reported that it will be launching its own stable coin iUSD, which has generated excitement in the community.

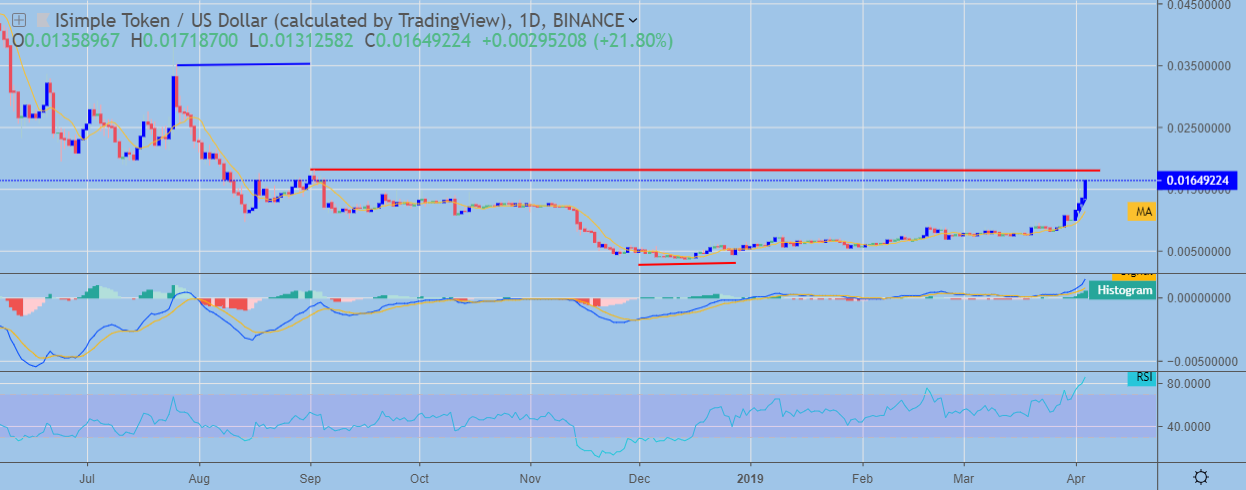

IOST / USD Medium-term price analysis

IOST has a bullish medium-term outlook, with the IOST / USD pair enjoying four straight days of strong gains in the cryptocurrency market.

The daily time frame is showing the formation of a bullish inverted head and shoulders pattern, with the IOST / USD pair now approaching the neckline of the pattern.

Technical indicators on the daily time frame remain bullish and continue to generate a strong buy signal.

Pattern Watch

Traders should note that the bullish target of the inverted head and shoulders pattern would take the IOST / USD pair towards the July 2018 trading high.

Relative Strength Index

The RSI indicator on the daily time frame remains bullish, although it is worth noting that the indicator has now reached its most overbought level on record.

MACD Indicator

The MACD indicator on the daily time frame is bullish and continues to generate a strong buy signal.

Fundamental Analysis

The medium-term outlook for IOST looks promising. Although the project has just launched its mainnet, the team appears to have a clear strategy on how to grow its ecosystem. In addition to quality partnerships, the team is working on increasing the number of dApps on its network.

There are already 30+ dApps that will be launched on IOST, while the number of wallets is growing at a rate of about 10,000 per day. All of these factors should support the value of the project in the medium-term.

Conclusion

IOST has an improving bullish outlook over both time horizons, with the cryptocurrency on course to post its strongest weekly gain since May 2018.

The presence of the inverted head and shoulders pattern on the daily time frame suggests that the IOST / USD pair could trade significantly higher over the medium-term.

The oversold RSI indicator on the daily time frame and the bearish MACD divergence on the four-hour time frame are offering warning signs that a strong technical correction may occur once the cryptocurrency reaches its near-term target.

For a brief introduction to the IOST project, check out our coin guide here.

Decentral Media, Inc., the publisher of Crypto Briefing, is not an investment advisor and does not offer or provide investment advice or other financial advice. Nothing on this website constitutes, or should be relied on as, investment advice or financial advice of any kind. Specifically, none of the information on this website constitutes, or should be relied on as, a suggestion, offer, or other solicitation to engage in, or refrain from engaging in, any purchase, sale, or any other any investment-related activity with respect to any transaction. You should never make an investment decision on an investment based solely on the information on our website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an investment.

Share this article