IOTA / USD Technical Analysis: A Bleak Picture

Share this article

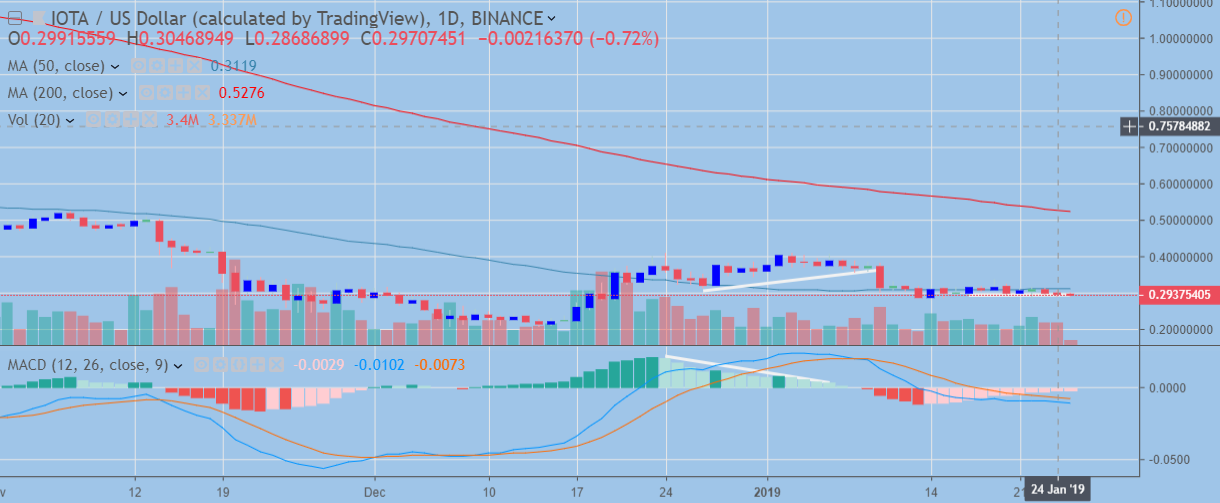

- IOTA is bearish in the short-term and risks imminent losses

- IOTA/USD has been a one-way trade lower since May 2018

- Medium-term picture is bleak despite December rally

IOTA / USD Short-term price analysis

In the short-term, IOTA is bearish with price trading close to the neckline of a bearish head and shoulders pattern. A failed inverted head and shoulders pattern is also putting downside pressure on the pair.

A bearish crossover is currently underway with the 50-period moving average crossing over the 200-day moving average.

One more rally towards the IOTA / USD pairs 50-period moving average on the four-hour time frame may occur before another higher volume decline.

Pattern Watch

Given the scale of the large decline seen in the IOTA / USD pair since May 2018, traders would need clear confirmation that the price floor has been established if the bullish counter move were to occur.

Short-term sellers are likely to stick with the prevailing theme until IOTA starts creating higher highs and lower lows.

IOTA / USD H4 Chart (Source: Tradingview.com)

Key Moving Averages

Price trades below its 50 and 200-period moving average on the four-hour time frame; further weakness should be expected towards the current 2019 trading low.

IOTA / USD Medium-term price analysis

IOTA is overwhelmingly bearish in the medium-term, traders looking for a longer-term counter-move higher in the IOTA / USD pair may be better suited looking at other cryptocurrency pairs.

If sellers did in fact create a major technical low during mid-December 2018, buyers may want to test as close as possible to the all-time low for further confirmation that a long-term price floor has been established.

A bearish head and shoulders pattern is also visible, which is consistent with the lower time frames, a pending bearish drop.

IOTA / USD Daily Chart (Source: TradingView)

MACD INDICATOR

The bearish price divergence seen on the MAC indicator has largely played out across the daily time frame. The histogram appears to be correcting to neutral levels ahead of the next large directional move.

Decentral Media, Inc., the publisher of Crypto Briefing, is not an investment advisor and does not offer or provide investment advice or other financial advice. Nothing on this website constitutes, or should be relied on as, investment advice or financial advice of any kind. Specifically, none of the information on this website constitutes, or should be relied on as, a suggestion, offer, or other solicitation to engage in, or refrain from engaging in, any purchase, sale, or any other any investment-related activity with respect to any transaction. You should never make an investment decision on an investment based solely on the information on our website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional if you are seeking investment advice on an investment.

Share this article