Is bZx's New DeFi Token Enough to Win Back Wary Users?

bZx is back with a plan. But is it enough?

Key Takeaways

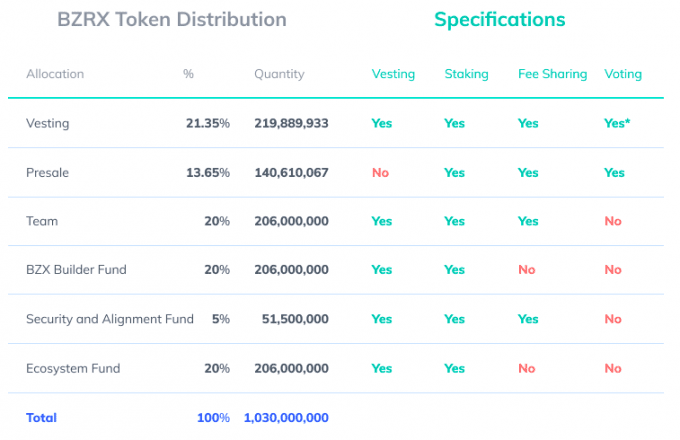

- bZx is launching a governance token, BZRX, which will dictate protocol governance and act as a value-earning instrument.

- BZRX will have four layers of compensation: two portions of fees, BAL rewards, and a claim on bZx insurance fund assets.

- The plan to rescue traders and lenders stuck in the iETH pool isn't necessarily the best plan.

- bZx must convince the market it is now a reliable place to do business.

Share this article

bZx is on the road to recovery and is implementing a plan to breathe new life into the protocol. By tweaking its native token, BZRX, with strong economics and introducing a rescue plan for illiquid lenders, bZx is launching its second attempt to capture DeFi market share.

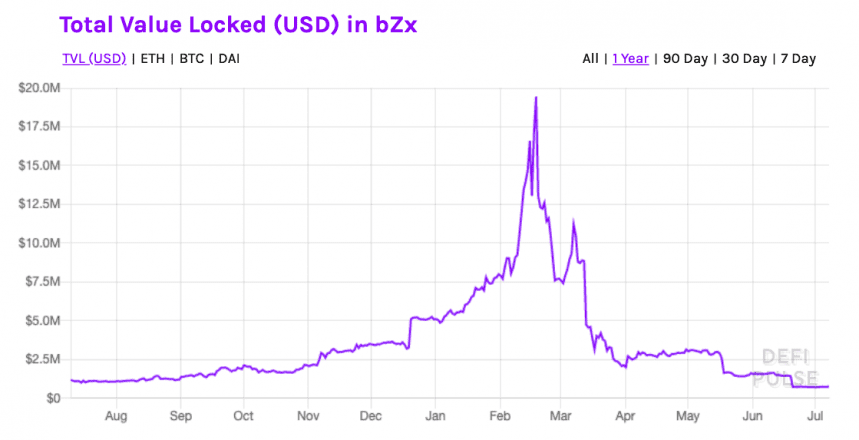

The Fall of bZx

In February 2020, bZx was struck by two consecutive vulnerabilities stemming from an oracle deficiency. These exploits crippled the network, forcing the team to head back to the drawing board.

Lenders from almost every bZx pool ran for the exits, but there wasn’t enough available liquidity for all lenders to get out of their positions. This is always a risk with money markets, as a “bank run” on the supply side would still put some lenders at risk since some of the pool is issued to borrowers.

Up until this moment, DeFi hadn’t witnessed such a rush for exit liquidity.

bZx laid out a plan to improve it’s price feeds, roping in ChainLink with plans to diversify oracle risk by also integrating Band Protocol. However, these improvements weren’t enough for bZx to bounce back.

The protocol has been leaking liquidity ever since February 2020.

Five months on, bZx has its eyes on redemption.

BZRX Token Economics

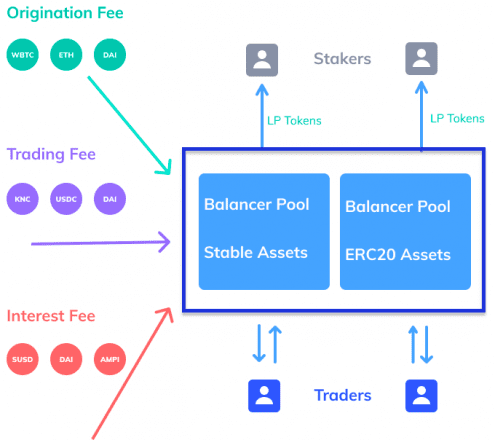

Most tokens are shifting to a model of staking and cash flows. Stakers would lock their tokens in a contract and receive fees from protocol usage as compensation. BZRX is borrowing this model.

BZRX is a governance token used to participate in the bZxDAO. Holders are entitled to four layers of compensation:

- Fees accrued through loan/borrowing origination, trading, and interest payment from borrowers will make up the cash flow that is directed to stakers.

- Each token can be used to redeem a proportional amount of the bZx insurance fund. Half of the fees from loan origination, interest payments, and trading are sent to the insurance fund.

- These fees are sent to Balancer pools. Fees generated from trading in that Balancer pool will be directed at BZRX stakers, creating another layer of income.

- BAL rewards earned by the Balancer pools will also be disbursed to BZRX stakers.

In effect, the BZRX token is backed by a mix of future cash flows (fee income via staking) and cryptoassets on bZx’s balance sheet (insurance fund, made up of various assets). This dynamic means the value of each BZRX token can be determined using traditional valuation models such as book value and discounted cash flows.

The layered incentives come in two flavors: BAL rewards and a claim on insurance fund assets. However, some concerns need to be alleviated before this can be deemed a success.

Making Traders and Lenders Whole

Several traders on Fulcrum, bZx’s trading product, lost money due to the two-day million-dollar exploit.

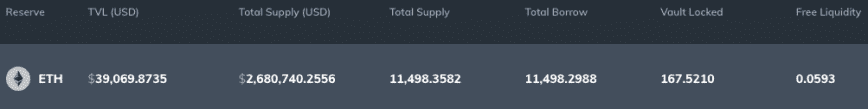

Several lenders have also been stuck in bZx’s Fulcrum liquidity pools for nearly five months now. The ETH pool, for instance, has 11,498.3582 ETH of supply and 11,498.2988 of borrowing – a utilization rate of 99.999% with just 0.0594 ETH ($14) of liquidity.

As soon as fresh liquidity flows into bZx’s ETH pool, chances are that it will be used up by old lenders to exit, trapping the new lenders immediately.

To fix this situation, bZx announced compensation for aggrieved parties.

More than 2 million BZRX is being allocated to any traders that were impacted by the events of Feb.18, 2020. Lenders have two options: buy BZRX at a discount using iETH (bZx’s ETH liquidity pool token), but these tokens will be vested for four years, or bZx will convert half of all fees collected to ETH and send it to the ETH liquidity pool so lenders can exit.

New lenders will be shielded from the risk of the current iETH pool, as bZx will create a fresh pool from which borrowers can draw liquidity.

In terms of the broader picture, bZx still has to convince the market that it’s a safe place to play around with DeFi. Attractive rates and incentives mean nothing if everybody is too scared to use the protocol.

July 7, 2020, 12:46 EST: The article has been updated to reflect the creation of a new iETH liquidity pool to shield new lenders from the risks of the current iETH pool.

Share this article