Kyber Network Launches Katalyst, Investors Prepare to Take Profits

On-chain liquidity protocol Kyber Network underwent a system upgrade that is set to incetivize and give voting rights to KNC holders.

Key Takeaways

- Kyber Network has successfully launched the Katalyst upgrade and KyberDAO on mainnet.

- Despite the hype around this hardfork, data reveals that KNC holders have moved a significant number of tokens to different cryptocurrency exchanges.

- In the event of a sell-off, the $1.23 support level may hold as investors within this price range will likely try to remain profitable.

Share this article

Kyber Network just launched its highly-anticipated Katalyst upgrade. Still, after a nearly 900% bull run, it seems like the project’s native token KNC could be poised to correct before advancing further.

Kyber’s Katalyst Upgrade Is Here

Kyber Network is back in the spotlight after a hardfork that expected to improve the DeFi project’s liquidity. Dubbed Katalyst, the network upgrade, incentivizes KNC holders to take part in the new decentralized governance protocol, KyberDAO.

Katalyst kicked off with a network fee parameter where 65% of all the fees collected go to staking rewards, 30% are destined to Fed Price Reserves (FPRs), and the rest is used for buying and burning KNC tokens.

Though the community can adjust these percentages via a new proposal, the upgrade has launched following this initial framework. Now that Katalyst is live, KNC holders can stake their tokens on the KyberDAO.

Users can also participate in the governance of the protocol or delegate their votes to earn rewards in Ether (ETH). On the other hand, developers can set their custom platform fee on each trade and route them across more simplified reserves.

These new features will help Kyber provide better liquidity across a range of sources and enable decentralized token swaps in any application.

“Katalyst will harmonize our efforts towards providing a single on-chain liquidity endpoint for all takers and makers, and establish a long term virtuous loop where the success of the DeFi space, growth of the Kyber ecosystem, and value creation for KNC holders go hand in hand,” reads the announcement.

Since Katalyst was announced in mid-December 2019, the buying pressure behind KNC has done nothing but shoot up. Such a significant spike in demand pushed Kyber’s price up by nearly 900% to recently hit a high of $2.

But now that the network upgrade was successfully launched, different metrics suggest that the DeFi token is poised to retrace.

Kyber Investors Prepare to Off-Load Their Bags

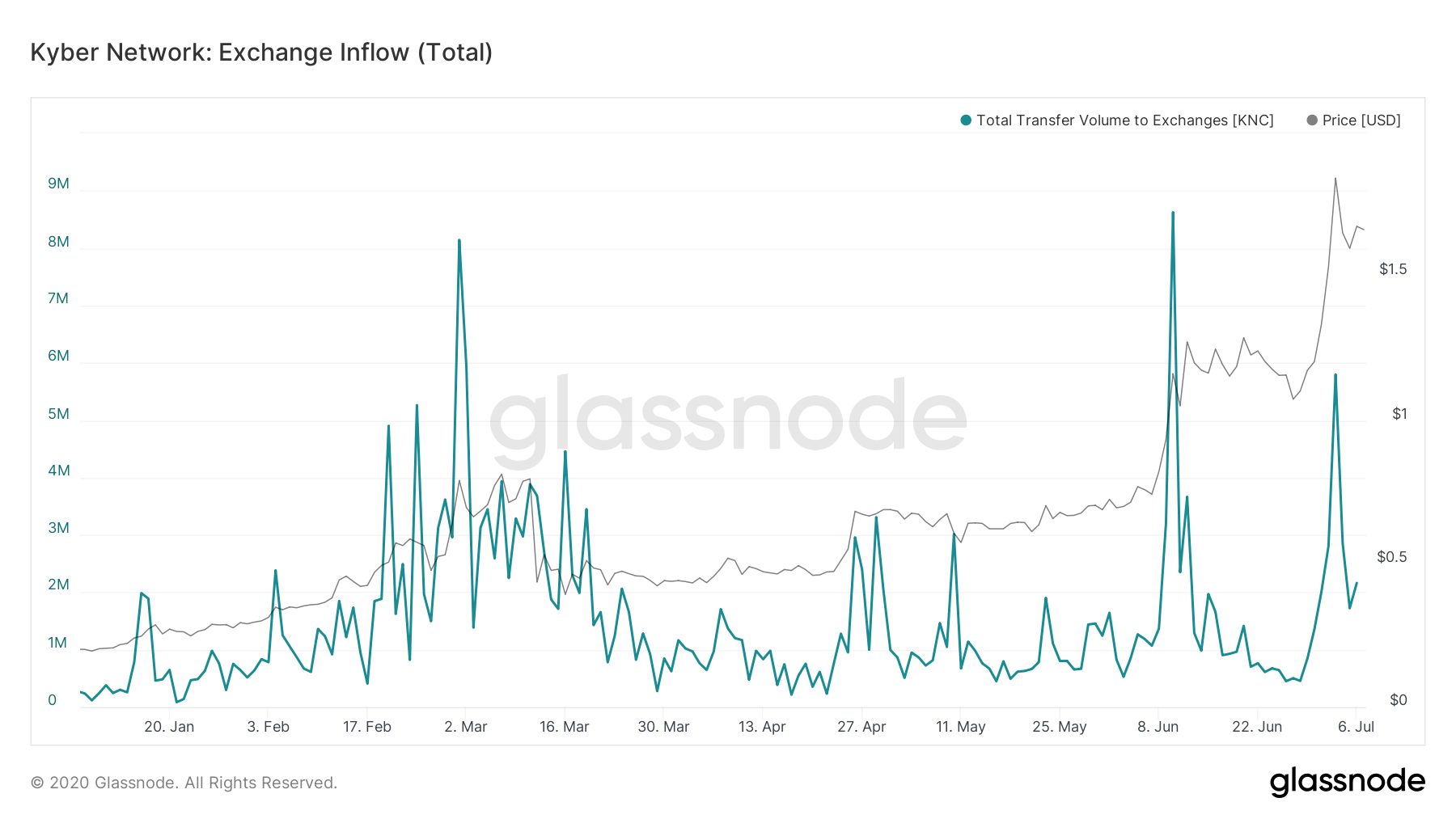

Data from Glassnode reveals that some investors could be preparing to exercise a “buy the rumor, sell the news” scheme. Indeed, the on-chain data and intelligence platform registered a considerable spike in the number of KNC tokens transferred to exchanges.

On July 3 alone, roughly 734 transfers were made to different cryptocurrency exchanges, amounting to nearly 5.8 million KNC.

The short-term MVRV ratio adds credence to the bearish outlook since it recently moved back in the “danger zone,” according to Dino Ibisbegovic, Head of Content and SEO at Santiment.

This fundamental index measures the average profit or loss of addresses that acquired KNC in the past month. Each time the 30-day MVRV moves above 1.25, a correction tends to follow.

“The 30-day MVRV ratio is now hovering at 1.44, indicating that short-term KNC holders are currently – on average – up 44% on their initial investment. As a rule of thumb, the higher the MVRV ratio becomes, the more likely it is that short-term holders will start to offload some of their bags and take profit,” said Ibisbegovic.

Key Support Levels Ahead of KNC

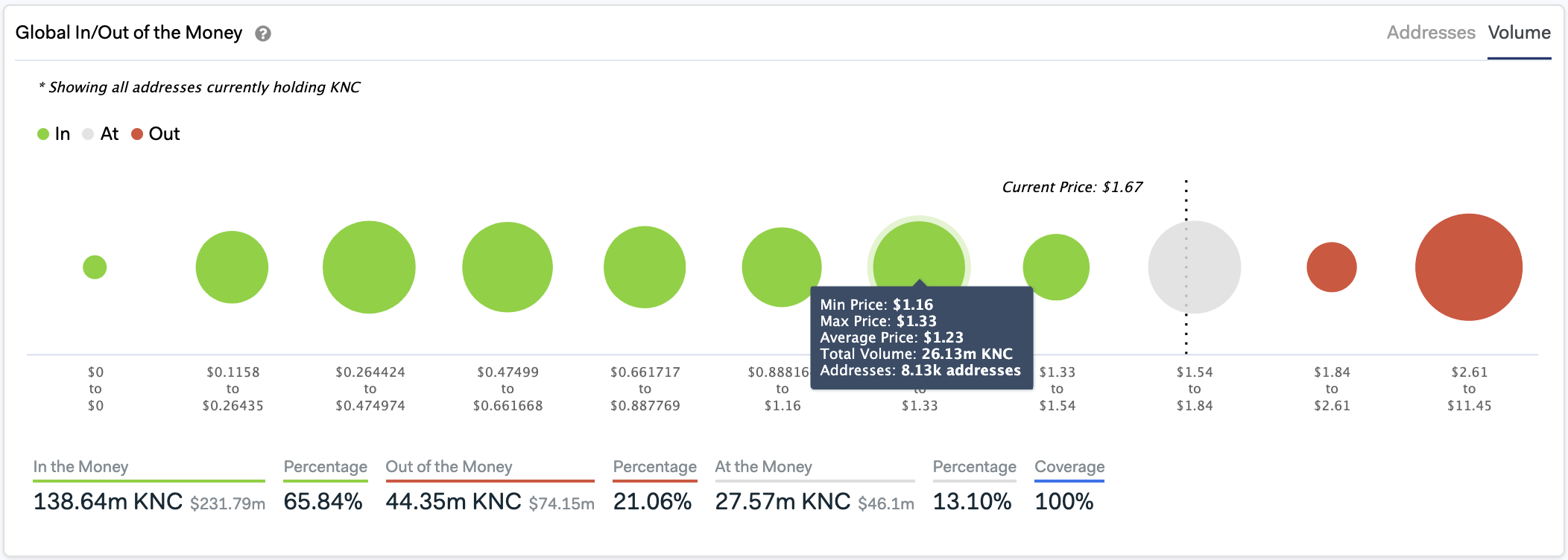

In the event of a correction, IntoTheBlock’s “Global In/Out of the Money” (GIOM) reveals that the $1.23 support level may hold. Around this price level, approximately 8,130 addresses had previously purchased over 26 million KNC.

Holders within this price range will likely try to remain profitable. They may even buy more KNC to avoid seeing their investments drop into the red.

It is worth noting that large holders continue joining the network despite the high probability of a pullback. The number of addresses holding 1 million to 10 million KNC increased by over 11% in the past few days.

If these large bag holders continue accumulating in the days to come, the bearish outlook might be jeopardized.

For this reason, investors must pay close attention to the $1.84 resistance level.

Moving past this price hurdle could propel Kyber Network towards $2.61 since there aren’t any considerable supply barriers in-between these price points based on the GIOM.

Share this article