Layer 1 Coins Bounce Back From Russia-Ukraine Dip

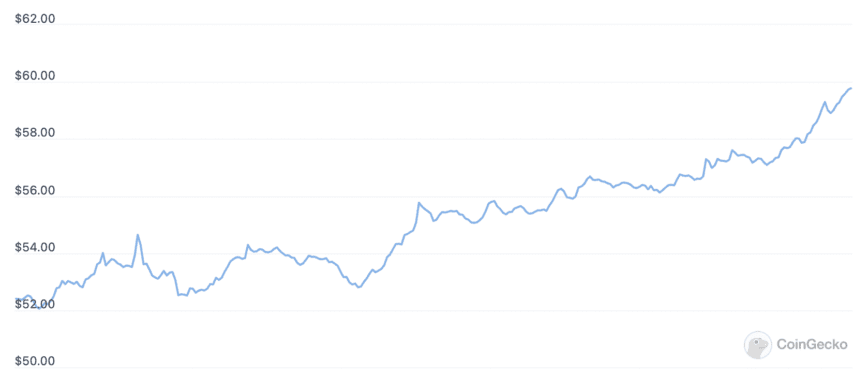

The crypto market has rallied 5.1% over the past 24 hours, shaking off Russian invasion fears.

Key Takeaways

- The crypto market has partly recouped its losses following the sell-off prompted by Russia-Ukraine tensions.

- Layer 1 coins have led the recovery, with Kadena, Avalanche, and Terra posting double-digit gains on the day.

- Russia's stock market has also recouped most of its losses, bouncing from the low 2,756 level to 3,036 on the stock market's close.

Share this article

The crypto market is up 5.1% today as investors appear to be shaking off fears of a potential Russia-Ukraine conflict. Layer 1 coins have led the recovery, with Kadena, Terra, and Avalanche posting double-digit gains.

Crypto Market Recovery, Layer 1s Lead the Way

The crypto market is showing renewed confidence after dipping in response to ongoing Russia-Ukraine tensions.

Several major coins are rallying today after the market took a beating Tuesday on the possibility of Russia invading Ukraine.

In response to Vladimir Putin’s threats, several countries, including the U.S., U.K, France, and Japan, have announced sanctions against Russia, its top political leaders, and banks. The markets appear to have interpreted the latest geopolitical developments as less worrying than previously expected, with investors worldwide temporarily moving risk-on. Like the crypto market, stock futures are up today after the S&P500 entered a correction. Meanwhile the IMOEX, a stock market index tracking the 50 largest Russian companies, has recouped most of Monday’s losses during the past 24 hours. It has bounced from the lowest 2,756 level to 3,036 on Tuesday’s close.

Layer 1 coins appear to be leading the crypto recovery. The two top crypto assets—Bitcoin and Ethereum—have both jumped today, but several newer Layer 1 coins are outperforming both assets. Terra and Avalanche, two breakout stars of the 2021 bull run, have respectively gained 13.3% and 12%. Terra’s rally comes after it announced a $1 billion private LUNA sale to establish a Bitcoin-denominated reserve for its flagship stablecoin, UST. As Terra’s entire ecosystem is based around UST, the news that it will become more stable with Bitcoin backing will likely be welcomed by Terra enthusiasts—and may act as a bullish catalyst for LUNA.

Kadena, a scalable Proof-of-Work-based smart contract-enabled Layer 1 blockchain, has fared better than most other assets in the market, posting 14.3% gains on the day. Other Layer 1 coins posted significant, albeit lesser, gains. Fantom has rallied 8.2%, Cardano 7.3%, and Solana 7%.

Disclosure: At the time of writing, the author of this piece owned ETH, UST, and several other cryptocurrencies.

Share this article