Lightning Nodes: How Risk-Averse Investors Will Finally Enter Crypto

Share this article

Lightning nodes may be able to create a safe return similar to holding bonds in traditional finance, creating an opportunity for risk-averse investors to enter the cryptocurrency market.

At least that’s the view taken by BitMEX who suggest that able node operators, who provide liquidity and ensure transactions run smoothly through the network, may be able to make consistent yields from their Bitcoin (BTC) holdings – at little risk.

In their latest research paper, BitMEX highlighted the “major challenge” of ensuring channels have sufficient market makers for the secondary layer. While it is important to keep fees low enough to maintain high levels of usage, BitMEX said, nodes had to be readily incentivised to provide liquidity.

Liquidity describes the relative ease in which a market participant can buy or sell a particular asset. It’s crucial for most markets. Without sufficient liquidity, Lightning transactions take longer to complete and have a greater than expected impact on the Bitcoin price.

Lightning node operators are required to hold BTC on the network. This enables the node to make payments through the channel. Although there is an associated “opportunity cost“, as BTC locked-up can’t readily be exchanged on the open market, it also provides liquidity. Channels with a ready amount of BTC have increased capacity, making transactions easier to send.

As BitMEX researchers point out, the challenge of providing liquidity only increases as the network expands and additional channels are created. “Liquidity needs to be allocated specifically to the channels where there is demand and identifying these channels may be challenging,” said the report, “especially when new merchants enter the network.”

How is liquidity provided?

The Lightning Network is a web of interconnected payment channels that are run by nodes. Instead of recording transactions on the blockchain, nodes maintain balances between all the parties. These are only settled when the channel closes and the final difference is recorded on-chain.

Many node operators are hobbyists and enthusiasts, according to the BitMEX report, unmotivated by returns and possibly even running at a loss. Although it may be sufficient at its current scale, the vast majority of current nodes are unlikely to provide adequate liquidity as the network expands.

What’s needed are node operators who, with the proper incentive, are willing to become market makers in a much larger payments protocol.

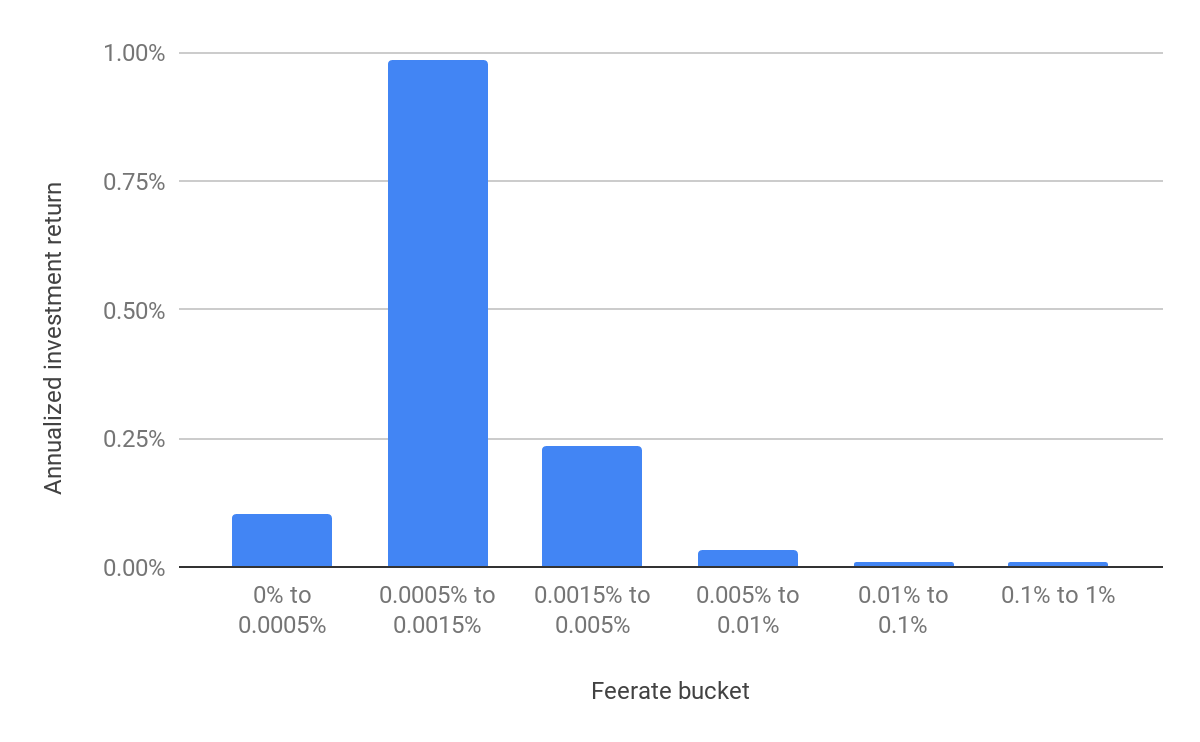

As the graph below shows, most nodes could expect to make an annual yield of roughly 1% if they set fees at the right level. That’s around about the same level of return most bond-holders expect.

While that may be unlikely to attract retail investors already in the space (most reports show that what continues to attract people to invest in crypto is the high-risk-high-gain opportunity) it may be tempting to investors with a longer-term thesis.

Lightning will therefore likely have to become more appealing to traditional investors, the sort who buy low-risk treasury bonds; content with a couple of per cent return each year. Considering the enduring popularity of Bitcoin and, more recently, Lightning, the investment would be at a relatively low level of risk. For larger players, hedge funds and institutions, it could become part of a diversified portfolio

A year old, Lightning is still very much in its nascent stage. But it is growing. As Crypto Briefing reported, there were more than 4,000 active nodes last week, double what there were in December.

As the network matures, it may become possible to attract more node operators willing to lock-up their BTC to provide liquidity. It may provide one of the first opportunities for investors to make a return with a level of risk that challenges the most conservative traditional financial instruments.

The author is invested in digital assets including BTC which is mentioned in this article.

Share this article