Small Cap Coins Stuck In Vicious Cycle Of Low Liquidity, High Slippage

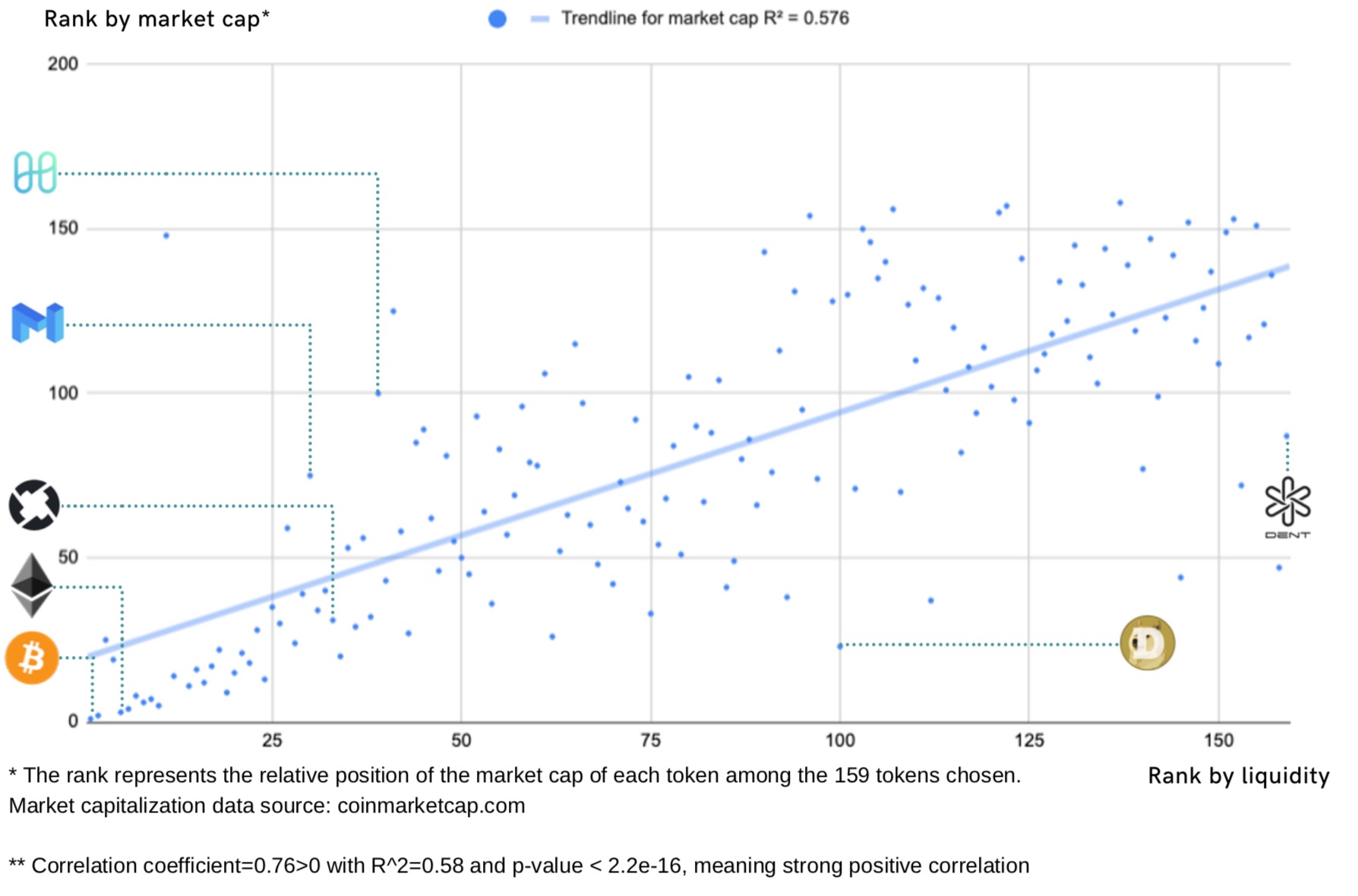

There's a strong correlation between slippage and market cap.

Smaller-cap cryptocurrency coins are struggling with low liquidity, destined to suffer in a vicious cycle with their ecosystems struggling to maintain deep order books – making transactions harder to execute.

That’s the conclusion of a report released exclusively to Crypto Briefing, in which the automated market maker provider Hummingbot discovered a developing trend that might ultimately determine which coins have a long-term future.

Based on their findings, researchers found that the cryptocurrency market is moving into two distinct camps: coins with liquidity, and those without.

“The most liquid asset is 600x more liquid than the least liquid asset” according to the report, and large-cap cryptocurrencies and stablecoins generally have the strongest liquidity.

Slippage, Not Volume

The report uses slippage as a metric, which represents the difference between the price expected and price executed. Coins with high liquidity have lower slippage, as they have deeper order books so asks can be filled at different price points.

Researchers at Hummingbot argue it’s a stronger metric than trading volumes, which can be easily manipulated by exchanges or the coin projects themselves.

Based on Binance order book data from April, the report found Bitcoin (BTC) – which has a market cap of $150bn – was the most liquid asset, with Ether (ETH) – $20bn market cap – also faring well with an average bid slippage 2.4x more than BTC.

The most illiquid coin was Dent Wireless (DENT) – at $19M total value – with slippage of nearly 600x that of Bitcoin, followed by the cryptocurrency and phone project Pundi X (NPXS) – which has a $48M market cap.

Furthermore, liquidity had consolidated further within a small group of assets. Hummingbot noted that there was a strong positive correlation between liquidity and market capitalization.

August price-performance appeared to have little to no effect on the liquidity of an asset, perhaps because cryptocurrencies tend to remain highly correlated and move as one. There was a very weak correlation of -0.17 with volatility, suggesting coins with higher slippage experienced somewhat greater price fluctuations.

The correlation between volatility and slippage is generally much more prominent among other asset-classes, particularly Forex. That might highlight crypto traders have become accustomed to a volatile market and therefore place orders at more price points than they would, say, in fiat currencies where prices tend to move in a smaller range.

Part of Hummingbot’s role is to make liquidity more accessible across the cryptocurrency market, which they do in part by hosting a marketplace for individual liquidity providers.

As well as having a smaller market-cap, coins with high-slippage also tended to have a “dearth of affordable and effective” market makers. Coins with smaller market caps failed to attract professional liquidity providers, who had “little incentive to perform the technical integration and maintain the requisite inventory for illiquid long-tail assets.”

Unless market makers can be coaxed onto smaller-cap cryptocurrencies, liquidity will concentrate increasingly in the top-ten. That might make other coins less viable and harder to trade, pushing more people off their ecosystem.