New DeFi DAO Offers Greater Liquidity for Crypto Ecosystem

Share this article

The CEO of Ren protocol, Taiyang Zhang, recently announced the launch of yet another DeFi liquidity solution for the crypto ecosystem. Keeper DAO looks to offer many of the same services of traditional underwriting services but will instead focus on non-custodial crypto markets.

Binding the DeFi Community Together

The rise of decentralized financial products like Compound, Maker, and dYdX have opened a world of opportunities for budding financiers. The primary issue facing many applications, however, remains liquidity and access to capital.

Compound is built around a relatively straightforward financial concept — that of lending and borrowing. Like a bank, Compound allows users to earn interest on the loans that borrowers claim. As Compound is a smart contract, these return rates are typically much higher than a bank due to the lack of intermediaries.

For 10,000 DAI, a user could reasonably expect a return of 3.97%, according to statistics found on DeFi Pulse.

In exchange for the DAI a user has deposited, they receive cDAI tokens. This interest rate fluctuates based on how many borrowers and how many depositors are active on Compound.

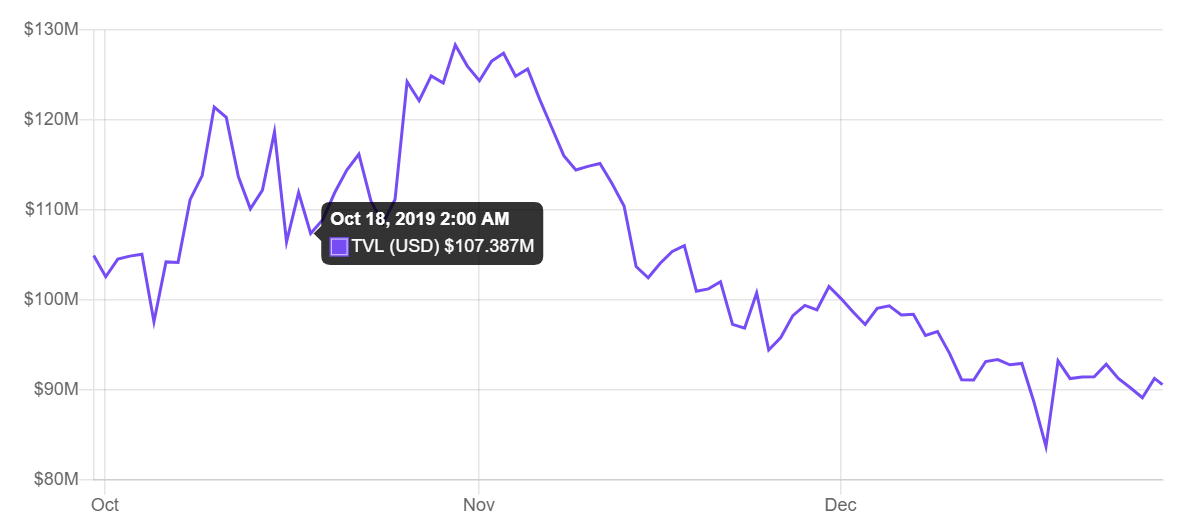

(Source: DeFi Pulse)

Currently, there is $90.6 million locked up in the Compound protocol. For its part, Maker has a reported $324.3 million locked up, making it the number one DeFi application on the market.

Loans on Compound are secured via collateralization. In traditional financial terms, this refers to when a borrower offers an asset as collateral in case they default on the loan. On Compound, the asset used as collateral is the tokens that borrowers deposit to increase their “borrowing power.” If this borrowing power falls below zero, their assets are sold to cover the debt.

An immediate barrier to this system is, of course, liquidity.

Users are only able to loan or borrow funds that they have. Going beyond this amount (for purposes of margin lending, for example) is not possible for low-cap borrowers. The same is true for broader margin trading on other DeFi platforms like dYdX.

In the Keeper DAO primer, Zhang writes, “as with any leveraged financial application, there needs to exist a mechanism to liquidate under-collateralized positions to ensure solvency.”

Flash Boys 2.0

Keeper DAO is proposed as this mechanism by pooling capital within Ethereum-based smart contracts. As this capital is typically much more significant than any one individual, it allows users of DeFi products to enjoy steeper profits from on-chain liquidation or arbitrage opportunities.

Zhang told Crypto Briefing in an interview that:

“When positions on approach a mark where they’re close to being undercollateralized, systems like dYdX will auction them off, enabling a participant such as KeeperDAO to bid and win the liquidation for a margin. This is to keep the system solvent. Arbitrage opportunities exist between dexes such as KyberNetwork / Uniswap etc.”

Instead of various individual liquidators competing to arbitrage for profit, these siloed liquidators are brought together under a single entity. This also has advantages when working in the context of Ethereum and paying gas fees to execute trades.

Individual liquidators must estimate the best transaction fee to have their orders placed ahead of their competitors within a specific block. These competitions are referred to as Priority Gas Auctions (PGAs).

Often is the case that individuals end up spending much more than necessary to “win” these competitions, according to a document called “Flash Boys 2.0: Frontrunning, Transaction Reordering, and Consensus Instability in Decentralized Exchanges.” These costs naturally cut into whatever profits are eventually earned.

In joining Keeper DAO, users instead pay a flat fee to fund the pool and give transaction front-running to bots. These bots “constantly watch the Etheruem mempool for opportunities and, if found, will initiate an Etheruem transaction to participate in [PGA].” Once the bot wins the PGA, the profits are distributed through “an on-chain rebalancer network,” according to the primer.

Albeit esoteric in its financial jargon, services like Keeper DAO continue to sustain the democratic DeFi narrative. Instead of large firms and trading platforms, Keeper DAO allows anyone with a bit of know-how to profit from the emerging digital economy.

Share this article