Polygon Could Soon Surge to $2

Polygon’s MATIC token appears to be preparing for a bullish impulse, but it must first overcome stiff resistance.

Key Takeaways

- Polygon's MATIC token has risen by more than 11% in the past five days.

- Now, the token appears to be forming a double bottom pattern.

- It must slice through $1.70 to advance to $2.10.

Share this article

Polygon’s MATIC token appears to be bottoming out after declining by more than 58% from its all-time high. Still, on-chain data shows a significant supply barrier ahead that may prove challenging to overcome.

Polygon Encounters Supply Wall

Polygon is approaching a critical area of resistance that could determine where it heads next.

The Ethereum scaling solution’s MATIC token has risen by more than 11% over the past five days as it appears to be developing an Adam & Eve double bottom pattern on its four-hour chart. This technical formation is considered a bullish reversal pattern. It developed after Polygon dropped to $1.24 on Feb. 24 to form a V-shaped valley, surged to $1.70 on Mar. 2, and pulled back again to form a rounded valley near the $1.32 level.

A spike in buying pressure that pushes MATIC above the middle peak of the Adam & Eve at $1.70 could signal the beginning of a new uptrend. If the asset did see a spike in demand, it could surge by nearly 26% to surpass $2.

Still, transaction history shows that the $1.70 resistance zone could prove challenging to break.

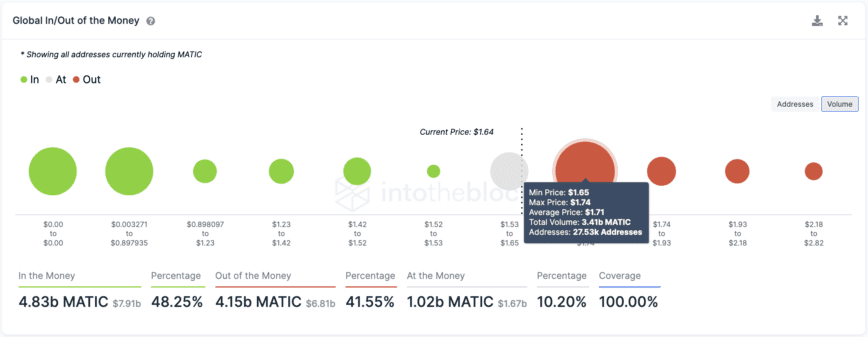

IntoTheBlock’s In/Out of the Money Around Price model reveals that more than 27,500 addresses have previously purchased over 3.41 billion MATIC at an average price of $1.72. In other words, MATIC has a large supply wall that may absorb some of the recent buying pressure and prevent it from advancing further.

Given the number of underwater holders at $1.71, MATIC needs a decisive four-hour candlestick close above resistance level to validate the bullish outlook.

Failing to overcome the $1.71 hurdle could result in investors selling their holdings to avoid significant losses. A potential increase in downward pressure could push prices to $1.50 or lower.

Disclosure: At the time of writing, the authors of this piece owned BTC and ETH.

Share this article