Polygon Transactions Explode After DeFi Expansion

On-chain data shows that Polygon is catching up to competitors like Binance Smart Chain.

Key Takeaways

- Polygon is catching up to its main competitor, Binance Smart Chain, as the leading Ethereum bridge platform.

- Polygon's growth took off when the popular crypto lending platform Aave moved to the sidechain network.

- Other apps like Curve Finance and mStable have also expanded to Polygon and driven adoption of the network.

Share this article

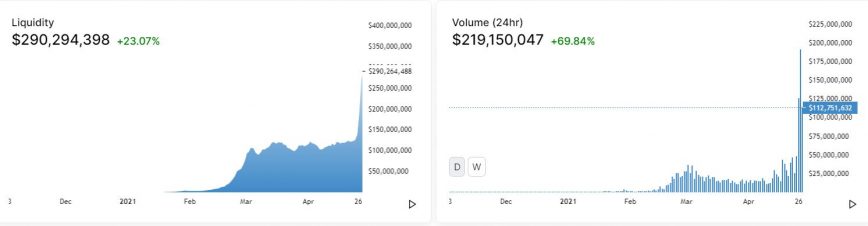

Polygon’s on-chain activity suggests exponential growth over the last month, largely driven by DeFi projects expanding to the platform.

Polygon Experiences DeFi Growth

As Ethereum faces scaling issues and high transaction fees, many DeFi users and developers are searching for a complementary network that can support greater transaction loads.

While Binance Smart Chain (BSC) remains the leading Ethereum bridge network, Polygon is quickly catching up. According to data from The Block, Polygon’s total value locked (TVL) is nearing $2 billion, about one-third of BSC’s TVL of $6.6 billion.

In fact, Polygon is experiencing a growth pattern that is similar to the one that BSC experienced in Q1 of 2021. On-chain data shows the network’s daily transactions have doubled in the last week alone, beginning at 500,000 and growing to 1 million transactions per day.

Aave and Others Catalyzed Growth

The growth began when the popular crypto lending platform Aave expanded to Polygon. The Polygon version of Aave reached more than 1.6 billion in liquidity within a few weeks of launch.

Apart from Aave, mStable has also expanded to Polygon. It reported that within 24 hours of launch, its Polygon version saw deposits grow by over $18 million—more than half of the $32 million in deposits that the project has attracted on Ethereum.

Curve, another DeFi trading platform, also expanded to Polygon recently. It reported $100 million in total deposits within a week.

Additionally, its native DEX Quickswap is also growing fast. It says it has benefited from rising participation from Aave users, who have brought on board hundreds of millions of dollars.

Thanks to this growth, Polygon’s native token (MATIC) has more than doubled in value in a single day. On Apr. 26, it began with a price of $0.36. On Apr. 27, it briefly touched an all-time high of $0.87.

At the time of publishing, MATIC is trading at $0.81 and has a market cap of $4.9 billion, according to CoinGecko.

Disclosure: The author did not hold crypto mentioned in this article at the time of press.

Share this article