Quantitative Easing Could Be Catnip For Crypto

Do high interest rates kill the tech sector?

Share this article

The world has been drunk on cheap money since the Global Financial Crisis, with low interest rates and other quantitative easing measures put in place by then-Fed Reserve Chair Alan Greenspan… and only very cautiously and slowly tightened by Ben Bernanke and Janet Yellen.

The GFC happened over ten years ago. Growth in the U.S. since then has been more Billy Joel and less Mick Jagger: sober and steady rather than raunchy and throbbing. But the economy has grown, despite a slowing Chinese economy and sluggishness on the European continent and in emerging markets.

So why ten years of historically low interest rates? It could be that Greenspan and his successors have been hesitant to be the cause of an unwanted meltdown in growth markets, where a lot of economic activity in the U.S. has been strong.

Back in 2000, Greenspan began raising interest rates aggressively. The “Greenspan put“, as they called it, was over. Some say those actions contributed to the bursting of the dot com bubble.

Does Silicon Valley hold that much sway over the Federal Reserve? And is cryptocurrency an unwitting – but grateful – beneficiary?

The Fed Won’t Be The Beast of Burden

To be fair to the Fed, persistent inflation levels tinkering around its target rate of two percent since the GFC has given the central bank little reason to tighten money supply or ease the quantitative easing cycle.

But much of the deflation is actually imported, courtesy of globalization and the emergence of China as a manufacturing hub. Core consumer price growth, which excludes volatile items such as energy and food, remains extremely weak.

An accusation may fairly be leveled at the Fed that they are attributing low inflation to a struggling economy, when job growth has been steady and the stock market has enjoyed its longest ever period of sustained growth.

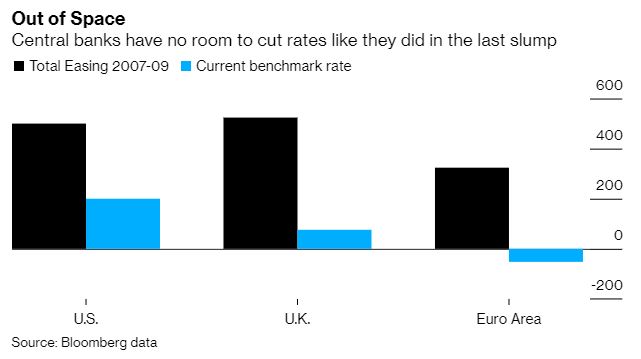

Now, with growth appearing to slow and threats to the global economy stemming from Trump’s crusade against Chinese expansionism and WTO violations, the Fed has very little wriggle room. The same can be said of most central banks.

Current benchmark rates in the U.S. and the U.K. are extremely low. Most of Europe and much of Asia is interest rate negative. Monetary policy will prove entirely impotent in dragging the world economy out of a genuine slump – if it falls into one – given there is little cutting left to do.

Avoiding a Tech Wrecking Ball With Quantitative Easing

Jerome Powell has begun a path of interest rate shaving, with Trump actually calling for negative interest rates to follow the lead of many European and Asian countries. If the famously independently-minded Powell continues his series of rate cuts, is he propping up the tech sector, cryptos included, to avoid being tarred by the Greenspan brush?

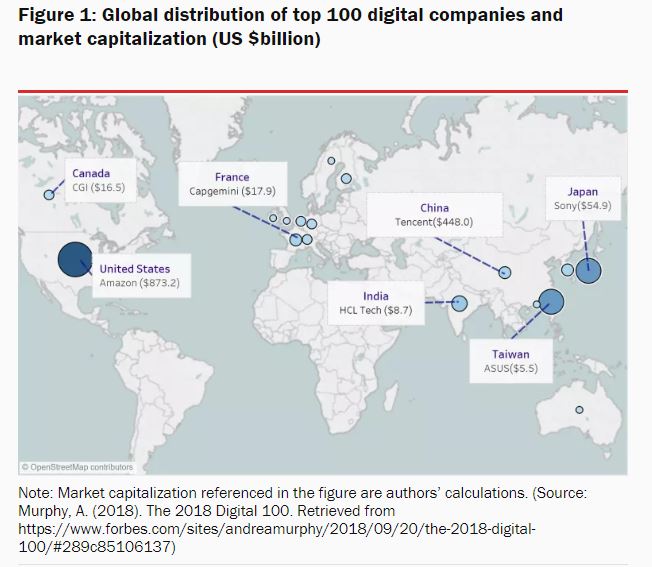

By its nature, the tech sector is difficult to measure in terms of contribution to economic output. However, according to the Brookings Institute, the ICT industry accounts for around six percent of U.S. GDP. Significantly, the think tank found that:

The sector is clearly more important to the United States than it is to any other country.

Cyberstate 2018 presents far more favorable metrics, placing the industry as worth 10.2 percent of the economy, with “employment growth projected to grow to 13 percent from 2016 to 2026”, ahead of the average for all other industries combined, and “ranked in the top five of economic contributors in 22 states and in the top 10 of 42 states.”

After Ben Bernanke’s Hanky Panky, Powell is Toweled… And Nobody’s Yellen

Bernanke and Yellen refused to pull the rug out from underneath an economy growing at an underwhelming pace. And with Greenspan helping bust the dot com bubble with a regime of interest rate hikes in 2000, Powell is quite possibly reluctant to be the one left holding the bag of a tech sector in ruins should the economy recover and rates return to normal.

The old maxim of “never betting against the Fed” augurs well for cryptocurrencies as things currently stand. What happens if the economy begins to show green shoots and higher rates follow is anyone’s guess.

If crypto bursts like the dot com bubble after the end of quantitative easing, history may well repeat itself. That is, if high interest rates are what ends up popping the bubble.

One feels, however, that that is many years, and probably another recession, away.

Share this article