Raiden ICO Review And Token Analysis

Share this article

The Raiden ICO joins a series of successful tokens that serve as a platform, with a focus firmly on enabling the scalability of the Ethereum network and reducing its trademark clogs.

One of the most prominent people to tell the world that Ethereum scalability isn’t great was Vitalik Buterin himself, who can be quoted as saying it “sucks.” This is important when establishing that there is a problem to be solved through a scaling solution. The solution we examine today is the Raiden ICO (token: RDN), and it’s one of the hottest things out there at the moment.

At the highest level, what Raiden represents is a Lightning Network-style approach to Ethereum scaling, making use of “off-chain” transactions with on-chain settlement.

The Raiden Network will provide a payment system based on payment channel technology that scales with the number of its users. This means that the bigger the Raiden Network becomes, the higher its maximum throughput will be, with practically no upper limit in sight.

Several ideas underly the intentional design of the Raiden network. They intend to lower transaction fees and increase the speed of transactions; and the larger the network grows, the more it can handle. This is the ideal situation for a decentralized network, but in the case of many existing attempts, what we’ve seen is centralization at various choke points within each individual blockchain.

Many scaling solutions are better than one, especially if there is no solid reason they cannot all co-exist. Vitalik Buterin may simultaneously be opposed to the notion of scaling solutions garnering funding through the ICO model as he is wont to use the products that are born out of scaling efforts.

In addition to the above proclaimed benefits of the Raiden Network, the transactions will be private. Only the sender, receiver, and the nodes who actually relay the transactions will have any opportunity to know who the parties are. This is a more sound design in principal because it helps to limit the potential of several types of threat against an average crypto holder who may be smart enough to take advantage of the application.

In addition to all of this, before we discuss the token’s properties, there is a “lite” version of the Raiden network called μRaiden which:

“…shares some properties with the Raiden Network. It can provide trustless, instant and free transfers between two parties. It is intended for many-to-one payment setups, like users interacting with a Dapp. However, it is not suitable for many-to-many payment setups as it requires users to lock up tokens upfront for every potential payee.” (Source: whitepaper.)

Payment Channels

Payment Channels, the heart of Raiden, are not a new concept in cryptocurrency scaling. One of the most prominent scaling solutions presented to solve the blocksize crisis faced in Bitcoin is the Lightning Network.

It functions by having established payment routes already in place for which transactions can be guaranteed to clear later on. The way Raiden describes a payment channel is like a guaranteed check, one where you can verify the funds are there and are already in physical possession of them.

Once you receive a Raiden check from someone, you can be absolutely certain that this check is real and that you are now richer than you were moments ago. But neither you nor your payer had to stand in line at the bank or wait for the clerk to perform a wire transfer. You can decide to cash this check at the bank at any time, potentially with hundreds and thousands of other checks simultaneously, and you only need to pay fees once when turning all of these checks in.

Checks are less secure because they can be written by anyone with access to the checkbooks, and they do not have to be honored. But payments made in payment channels are guaranteed in the same way that regular transactions on the Ethereum network are – the full settlement simply takes place later. Likewise, it makes sense that tokens within the Raiden system can then be used elsewhere.

The idea is to create side channels for people to conduct commerce when the main network is busy. One interesting use of payment channels, for example: Raiden might be in ICO funding. By opening a guaranteed payment channel, many of the issues with funding ICOs will be eliminated. Raiden can facilitate the transfer of any token on the Ethereum blockchain, including Ethereum itself, although this is a bit more complex and is addressed in their documentation.

“While ETH currently does not qualify as an ERC20 token, simple wrapper contracts exist that allow ETH to be treated just like an ERC20 token.”

The Raiden ICO requires its own token and network to function because tokens are locked up for the lifetime of a usable payment channel, in order to guarantee the payments. This is like an insurance policy, in a sense, on the funds being transferred. For a payment channel to exist, an on-chain deposit has been made. The methodology used to make payments is called a “balance proof.”

These transfers can be performed instantaneously and without any involvement of the actual blockchain itself, except for an initial one-time on-chain creation and an eventual closing of the channel.

The Hidden Costs of Global Consensus

Each payment channel is limited by the amount of money it can actually transmit, according to the amount that was deposited to open it, and on the face this may seem inefficient – people have to open individual payment channels, why not just send the funds directly? The answer is in the way the Raiden network protocol handles requests. If a route already exists for a payment, then the network will use the existing route instead of opening a new path. Since transactions are settled off-chain already, it doesn’t matter too much how long it actually takes the funds to ultimately settle.

The authors may not fully understand payment channels, however we feel equipped to make some real-world predictions of how this token and its network might be used.

- A busy cell phone accessories store receives thousands of payments a week in Eth, and often enough there is confusion in these payments as gas fees and other things including transaction time are variable on the network. Using the Raiden ICO network, they can open a channel to receive payments of a multiple of their highest priced item, to ensure that they can instantly settle transactions with clients, and ultimately the cost of actually receiving their money is significantly lower. Barring that, or for less-active use cases, the merchant could simply rent out someone else’s payment channel – this is to say, services could crop up powered by Raiden network which enable merchants to receive payments faster.

Other Brief Raiden ICO Technical Notes

- Raiden is composed of four actual products, as follows:

- Raiden Network, which underpins the whole thing.

- μRaiden, a product which could work in the above mentioned scenario (one recipient, many senders).

- Raidos (version 2.0), which is “a proposed sidechain technology to generalize state channels.” In short they want to find a way to scale the entire ecosystem by making the processes which make it work more efficient (and therefore less expensive).

- RaidEx (see next section)

RaidEx – Trading Versus Raiding?

A potentially exciting element of the Raiden offering is the existence of a working cryptocurrency exchange built on its technology – potentially exciting because this exchange is not yet working, nor is a preview version available for public view. When we run into things like this, we ask: why the hurry on the token sale, then?

Down To Brass Tacks – The Raiden Token

The utility of the Raiden ICO token is to open payment channels on the Raiden network in order to quickly transact in ERC20 tokens as well as Ethereum itself. Other currencies can be represented potentially in the network if third-party services make it so. Any ERC20 token can be transacted through Raiden, so it stands to reason that tokens issued by private banks and the like will one day find their way to the network.

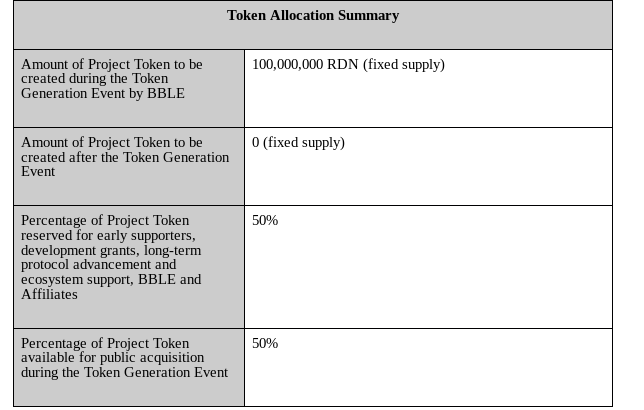

100,000,000 tokens have been generated in the Raiden ICO auction; 50 million of them are for sale to the public at present time. They are currently worth more than 1 Ether each due to the Dutch auction method used in the sale. The price can go as low as .00004699 Ether by November 17th – the nature of the Dutch auction is to discourage early buyers from being overly rewarded with target tokens.

34 million tokens are being kept by the Raiden Foundation while 16 million will go to external development efforts. This is what’s on the page, but on the T&C portion of the page, which pops up when one goes to “participate,” we see this:

Thus, we ascertain there are many uses for the 50 million tokens being held back. Most importantly to make sure our readers understand is the following passage from token.raiden.network:

The Acquirer acknowledges and agrees that, to the fullest extent permitted by any applicable law, it will not hold BBLE and its Affiliates liable for any direct, indirect, special, incidental, consequential or exemplary damages (including but not limited to loss of income, revenue and profits, or goodwill, or data) or injury whatsoever caused by or related to the acquisition, possession or use (or inability to use) of the Project Tokens or the use (or inability to use) of the Smart Contract Systems under any cause of action whatsoever of any kind in any jurisdiction.

The terms and conditions for buying the token are an interesting read, including some other gems such as:

You furthermore understand and accept that the Smart Contract Systems, the underlying software applications and software platform (e.g. the Ethereum blockchain) may be exposed to attacks by malicious third parties which could result in theft or loss of your Project Tokens or your Ether, or alternatively BBLE’s Project Tokens or BBLE’s Ether and therefore negatively affecting BBLE’s ability to develop the Project.

And:

It is possible that third parties may utilize or develop the same or similar open source code and protocol underlying the Project and attempt to replicate, duplicate or mimic the Project.

Such an action could negatively impact the Raiden Project and RDN Project Tokens, including but not limited to the value and utility of the Project Tokens.

UPDATE: We ware advised by the Brainbot team that “RDN Tokens are not necessary at the core of the Raiden Protocol Network (and in theory anyone can use the network without RDN tokens).”

Brainbot And The Raiden ICO

Brainbot Technologies is based in the German state of Rhineland-Palatinate and is fully responsible for development (minus the 16 million RDN they are allocating to external development efforts) and launch of the Raiden Network. Raiden, Raidos, and RaidEx will be their first actual stable offerings in terms of products. This indicates that their incentive to see Raiden succeed is very high.

Founder Heiko Hees continues his work at Ethereum, ranking as currently the 38th most active contributor on that major community project. He and fellow Brainbotter Gustav Friis are also working on a mobile payment solution called Trustlines.Network.

Raiden ICO – Conclusion

We foresee long-term high utility value of the Raiden token (RDN) due to its small supply, although the Dutch auction method of sale makes prices a bit less predictable following token release. UPDATE: This format ensure that all bidders will receive their token for the same, lowest price (valuation) at the end of the auction.

We understand this technology will probably be utilized in surprising ways, and that the full utility and value of it cannot be stated until it is seen in practice. Third-party developments will be paramount to instituting the full vision, but the establishment of RaidEx will act as a working example. We are concerned about 50% of tokens being held back, as often we see this as a method of double-dipping which is difficult in real terms to justify.

We must ask ourselves what actual value is given to the network or token by issuing it for free to those who are selling it to us. We ask ourselves this every time, and this case we see it as a non-relevant question due to the overwhelming utility of the Raiden token.

In concert with other scaling solutions, we see the future of Ethereum definitely having the Raiden ICO token as part of it.

Know-Your-Customer Whitelist

The Raiden ICO has a whitelist; if you want to contribute more than 2.5 Ether, you’ll need to complete this procedure.

Learn More about Raiden in our TELEGRAM CHAT (https://t.me/CryptoBriefingSupporters)

Project Name: Raiden Network

Token Symbol: RDN

Official website: http://www.raiden.network

Whitepaper: Unreleased

Whitelist date:

TGE Date: October 18th, 2017

Hard Cap: 90,779,226 Ether (~$2.77 billion)

Total Token Supply: 100 million

% of tokens distributed to Crowdsale: 50

Exchange Rate: Dutch – .00004699 lowest.

Token distribution Date: 2 weeks after contribution

ICO Review Disclaimer

The team at Crypto Briefing analyzes an initial coin offering (ICO) against ten criteria, as shown above. These criteria are not, however, weighted evenly – our proprietary rating system attributes different degrees of importance to each of the criteria, based on our experience of how directly they can lead to the success of the ICO in question, and its investors.

Crypto Briefing provides general information about cryptocurrency news, ICOs, and blockchain technology. The information on this website (including any websites or files that may be linked or otherwise accessed through this website) is provided solely as general information to the public. We do not give personalized investment advice or other financial advice.

Decentral Media LLC, the publisher of Crypto Briefing, is not an investment advisor and does not offer or provide investment advice or other financial advice. Accordingly, nothing on this website constitutes, or should be relied on as, investment advice or financial advice of any kind. Specifically, none of the information on this website constitutes, or should be relied on as, a suggestion, offer, or other solicitation to engage in, or refrain from engaging in, any purchase, sale, or any other any investment-related activity with respect to any ICO or other transaction.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media LLC makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media LLC expressly disclaims any and all responsibility from any loss or damage of any kind whatsoever arising directly or indirectly from reliance on any information on or accessed through this website, any error, omission, or inaccuracy in any such information, or any action or inaction resulting therefrom.

Cryptocurrencies and blockchain are emerging technologies that carry inherent risks of high volatility, and ICOs can be highly speculative and offer few – if any – guarantees. You should never make an investment decision on an ICO or other investment based solely on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional of your choosing if you are seeking investment advice on an ICO or other investment.

See full terms and conditions for more.

Founding Team

This category accounts for the leaders, developers, and advisors.

Poor quality, weak, or inexperienced leadership can doom a project from the outset. Advisors who serve only to pad their own resumes and who have ill-defined roles can be concerning. But great leadership, with relevant industry experience and contacts, can make the difference between a successful and profitable ICO, and a flub.

If you don’t have a team willing and able to build the thing, it won’t matter who is at the helm. Good talent is hard to find. Developer profiles should be scrutinized to ensure that they have a proven history of working in a field where they should be able to succeed.

Product

What is the technology behind this ICO, what product are they creating, and is it new, innovative, different – and needed?

The IOTA project is a spectacular example of engineers run amok. The technology described or in use must be maintainable, achievable, and realistic, otherwise the risk of it never coming into existence is incredibly high.

Token Utility

Tokens which have no actual use case are probably the worst off, although speculation can still make them have some form of value.

The best tokens we review are the ones that have a forced use case – you must have this token to play in some game that you will probably desire to play in. The very best utility tokens are the ones which put the token holder in the position of supplying tokens to businesses who would be able to effectively make use of the platforms in question.

Market

There doesn’t have to be a market in order for an ICO to score well in this category – but if it intends to create one, the argument has to be extremely compelling.

If there is an existing market, questions here involve whether it is ripe for disruption, whether the technology enables something better, cheaper, or faster (for example) than existing solutions, and whether the market is historically amenable to new ideas.

Competition

Most ideas have several implementations. If there are others in the same field, the analyst needs to ensure that the others don’t have obvious advantages over the company in question.

Moreover, this is the place where the analyst should identify any potential weaknesses in the company’s position moving forward. For instance, a fundamental weakness in the STORJ system is that the token is not required for purchasing storage.

Timing

With many ICO ideas, the timing may be too late or too early. It’s important for the analyst to consider how much demand there is for the product in question. While the IPO boom funded a lot of great ideas that eventually did come to fruition, a good analyst would recognize when an idea is too early, too late, or just right.

Progress To Date

Some of the least compelling ICO propositions are those that claim their founders will achieve some far-off goal, sometime in the future, just so long as they have your cash with which to do it.

More interesting (usually) is the ICO that seeks to further some progress along the path to success, and which has a clearly-identified roadmap with achievable and reasonable milestones along the way. Founders who are already partially-invested in their products are generally more invested in their futures.

Community Support & Hype

Having a strong community is one of the fundamental building blocks of any strong blockchain project. It is important that the project demonstrates early on that it is able to generate and build a strong and empowered support base.

The ICO marketplace is becoming more crowded and more competitive. While in the past it was enough to merely announce an offering, today’s successful ICO’s work hard to build awareness and excitement around their offering.

Price & Token Distribution

One of the biggest factors weighing any analysis is price. The lower the price the more there is to gain. But too low of a price may result in an under capitalized project. It is therefore important to evaluate price relative to the individual project, its maturity and the market it is going after.

The total supply of tokens should also be justified by the needs of the project. Issuing a billion tokens for no reason will do nobody any good.

Communication

Communication is key. The success of a project is strongly tied to the project leaders’ ability to communicate their goals and achievements.

Things don’t always go as planned but addressing issues and keeping the community and investors in the loop can make or break a project.

Share this article