Ripio ICO Review And Analysis (RCN Token)

Our Ripio ICO review (RPN token) suggests that there's a great deal to interest cryptocurrency enthusiasts here. A very solid 81% positive.

The upcoming Ripio ICO is one of the more eagerly-awaited initial coin offerings of Q4, and our preliminary analysis and review suggests that there’s a great deal to interest cryptocurrency enthusiasts here.

Ripio has been in business for quite some time, servicing the digital currency demand in Latin America. This is their primary regional focus, and it’s an area that is severely impacted by inflationary and poorly managed national currencies. So badly impacted, in fact, that people have already flocked to cryptocurrencies.

Developing a safe method for people in these regions to access capital as well as store their funds is likely to be a profitable endeavor. Now that Ripio has established itself – they have recently rebranded, having previously been known as BitPagos – they are looking to run a token sale and launch an entirely new platform which they believe will be superior to traditional peer-to-peer lending strategies. They offer several reasons for this:

- In traditional peer-to-peer schemes, the lender has a singular binary risk. In most cases, it’s win or lose all. In some cases, some lenders will get paid, but not all. And in still other cases, most lenders get paid, but one does not at all. The problems are myriad, but Ripio believes that smart contracts will answer the problem suitably.

- In this respect, the most interesting thing the Ripio ICO brings to the table is the “Cosigner.” If you want to join the Ripio network and lend, a Cosigner will act as a go-between for your borrower and the network.

- It can be expected that multiple local currencies will actually be traded in order to get RCN tokens and thus access the decentralized borrowing and lending network. This is superior to many peer-to-peer lending sites which may either only support a few national currencies or in more modern times only cryptocurrencies or only PayPal, or some such. With this network, one superior aspect will be that virtually any method could be used to get on board.

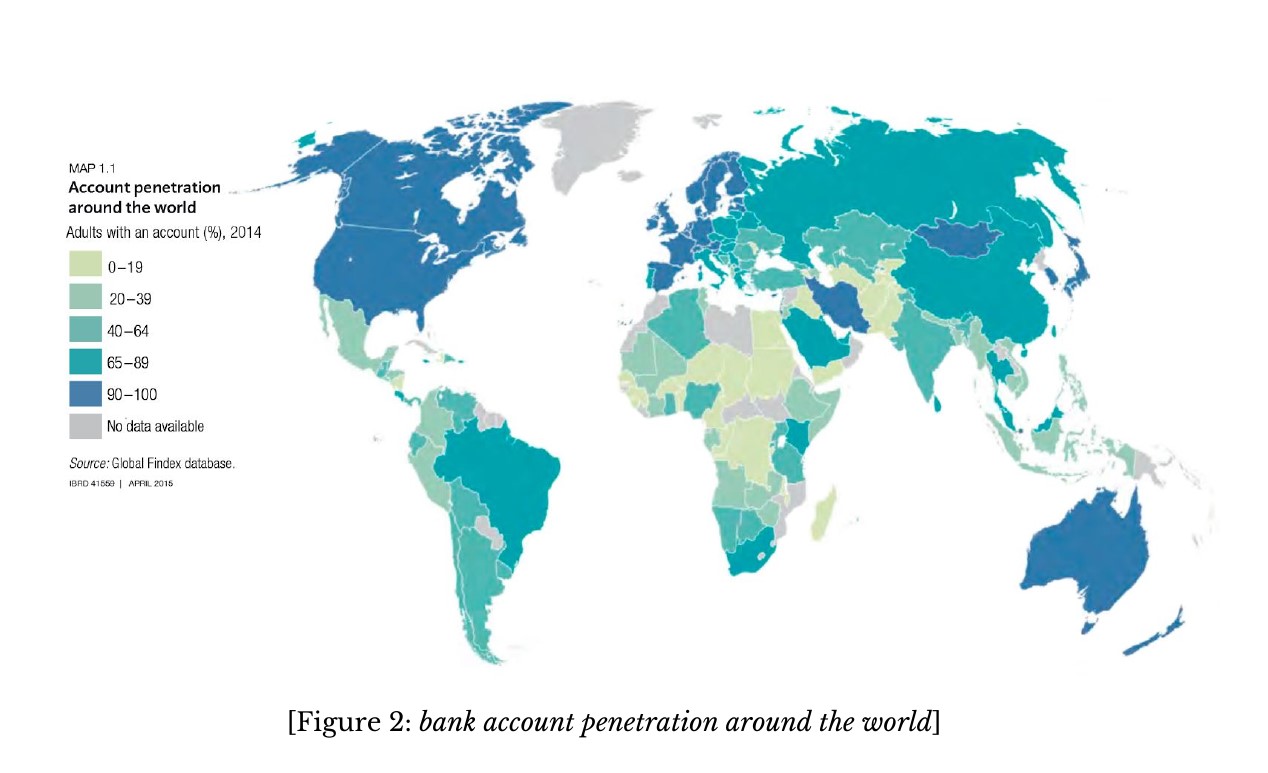

Although potentially obscure for many people, the problem that Ripio establishes is real: credit markets don’t reach even a fraction of the world’s population, and lenders have no idea how to accurately assess risk in some cases. From their whitepaper:

However, smart contracts can go a long way to find viable borrowers and lenders across the globe, especially outside of the banking barricades and beyond. This is not to suggest that Ripio is specifically meant to subvert traditional systems – instead, it wants to improve one of the fundamental aspects of the economy, which is credit.

The Ripio ICO whitepaper outlines a method by which the lending could be enforced: using legal means, of course, through the Cosigner. Fundamentally, this gives the Cosigner a great responsibility – if Cosigners are incapable of actually enforcing loans for any reason, the overall value of the network would begin to slip.

An interesting aspect of Ripio’s model is that they also report to credit agencies, whenever possible. This is odd since that system is legacy and likely a contributor to the difficulty for people to acquire loans in the first place.

[…] the Lender will lose a larger amount of his investment in the case of a default, but his profit will be higher if there’s no default event. In other words, the risk transferred to the Cosigner is smaller, but the cost (pure premium) is lower on the Lender side.

The Ripio ICO RCN Token

The RCN token will function at the core of the system. The system will facilitate loans via smart contracts, and RCN tokens will be required for access to the platform.

The requirement of the token means its inherent value is in relation to demand for use of the network – ultimately, probably a positive aspect when considering the purpose of the token.

Nevertheless, without having yet advertised the price of the token, Ripio has said they will be generating a total of 1 billion tokens, and that 490 million of them will remain in their custody. Depending on the opening price of the token, it may not matter. Again, we do not currently have this information, and this review will be updated when and as the information becomes available.

The Ripio ICO token will be used to execute smart contracts by the several types of participants in the Ripio Credit Network. The types of participants are:

- Borrower

- Lender

- Wallet provider

- Scoring agent

- Oracle

- ID verifier

- Cosigner

- Credit exchange

Perhaps the two most important types of participant are the wallet provider and the Cosigner, at least when it comes to the network in practice. Lenders will (we assume) inevitably find their way to the platform through self-interest alone, although we are prepared to admit that this is an assumption and not an assurance.

The interesting thing is that local currencies are expected. There’s no direct reliance on Bitcoin, Ethereum, or anything else. The expectation is that wallet providers will find a way to accept local currencies both for repayment of loans, which they will facilitate and for which they will be responsible. Things get a bit interesting here, and perhaps it is worth noting that the firm intends to allow providers to continue participating even if they facilitate a default.

The Cosigner will evaluate his participation on the loss and ponder that participation when iterating and estimating his pure premium when he undertakes his next responsibility.

While there will be fees for getting capital through the RCN network, the overhead is significantly lower. The wallet provider is incentivized to ensure that the loans they facilitate are actually carried through, but one actual problem is that they first get paid when the loan is funded.

The fees are funded in the difference between the take of the lender and the rate the borrower pays. We think a small improvement to this strategy might have been to force the Cosigner to wait until the loan is actually repaid to receive a payout, instead of issuing it when the loan is funded. The lender is still somewhat left to fend for themselves in such a case.

A typical loan on the network is described in the following passage, which adequately explains who benefits from the network in action, as well:

The smart contract is then settled in RCN, however, the value of settlement is represented in US dollars (“USD”) in accordance with the data supplied by the Oracle.The equivalent to USD $0.85 in RCN goes to the ID Verifier, USD $1.10 in RCN goes to the Scoring Agent, USD $111.69 in RCN goes to the Cosigner, and USD $2,978 in RCN are transferred to Pedro’s Wallet Provider. Then, the Wallet Provider trades those RCN for the amount in BRL that Pedro requested as a loan to buy his car.

Ripio Is Disrupting P2P Lending

We think it will be a fundamentally disruptive force if a legion of wallet providers descend on the public offering loans with good terms. These people will be responsible for the making or breaking of the network; the wallet providers and Cosigners. These parties therefore should need some stake in the system as a whole as a basic requirement for them to perform the function, and that stake should be significant enough that they suffer financial injury if their class of participant does not provide sufficient value to the network.

The Ripio ICO whitepaper makes it clear that they are not opposed to getting legacy banking and other types of financial institutions into the game. If some of these were to be considered as the first partners in the wallet provider arena, as well as and perhaps more importantly in the Cosigner arena, then the whole thing would seem much more sure.

While it may seem unreasonable to expect a bank to dip its toes into cryptocurrency by attempting to service loans around the world, or even facilitate them, it’s perfectly imaginable that this will become a contemporary reality as the spread of blockchain technology continues.

While wallet providers and other participants will be required to purchase RCN tokens to take part, we would prefer there were some forced stakeholding scheme wherein profit-taking couldn’t happen until the lender had actually received a matured lending – or perhaps it could be done in proportion to the fees. Instead, at present, the fees are paid when the loan is delivered, and simply come off the top of the principal that the borrower will be paying back. While this system will probably work just fine, we think the design leaves it vulnerable to alternatives that are likely to emerge.

Conclusion

We think that peer-to-peer lending is a primary application of the blockchain, and that disrupting its current models is likely to be a very profitable pursuit. We have a lot of confidence in the Ripio ICO project engendered by the excellent team behind it; high-profile (and wise) investor-advisors such as Tim Draper; and a technological platform that seems aimed at non-technical people.

We think this token will be successful, but we caution against overestimating the actual per-token price, and therefore suggest waiting for the actual price to be revealed before making up your mind on the Ripio ICO.

With a supply this high, and a technology so nascent, there is no reason to expect that wallet providers will come out of the woodwork and launch all over the place right away.

Ripio ICO Summary

Ripio Credit Network is an established business in the crypto industry and there is little doubt they will deliver on their extensive road map. The supply of generated RCN tokens on October 24th will be 1 billion tokens, 510 million of which will be available at a price that has not yet been specified.

The Ripio ICO price would certainly be a useful metric to judge this one on, but we can carry forward without it. Additionally, they offer numerous benefits to both lenders and borrowers that will make the platform legitimately attractive:

- Borrowers and lenders actually aren’t forced to interact with the RCN token, as that is the business of the wallet providers and cosigners.

- Lenders have the same benefit, and the added benefit of the Cosigner being motivated to return the loan so that their reputation remains intact. This way they can make more money in the future from their services, which may include employing the legal system to recoup lost debts.

Learn more about Ripio in our TELEGRAM CHAT (https://t.me/CryptoBriefingSupporters)

ICO Review Disclaimer

The team at Crypto Briefing analyzes an initial coin offering (ICO) against ten criteria, as shown above. These criteria are not, however, weighted evenly – our proprietary rating system attributes different degrees of importance to each of the criteria, based on our experience of how directly they can lead to the success of the ICO in question, and its investors.

Crypto Briefing provides general information about cryptocurrency news, ICOs, and blockchain technology. The information on this website (including any websites or files that may be linked or otherwise accessed through this website) is provided solely as general information to the public. We do not give personalized investment advice or other financial advice.

Decentral Media LLC, the publisher of Crypto Briefing, is not an investment advisor and does not offer or provide investment advice or other financial advice. Accordingly, nothing on this website constitutes, or should be relied on as, investment advice or financial advice of any kind. Specifically, none of the information on this website constitutes, or should be relied on as, a suggestion, offer, or other solicitation to engage in, or refrain from engaging in, any purchase, sale, or any other any investment-related activity with respect to any ICO or other transaction.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media LLC makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media LLC expressly disclaims any and all responsibility from any loss or damage of any kind whatsoever arising directly or indirectly from reliance on any information on or accessed through this website, any error, omission, or inaccuracy in any such information, or any action or inaction resulting therefrom.

Cryptocurrencies and blockchain are emerging technologies that carry inherent risks of high volatility, and ICOs can be highly speculative and offer few – if any – guarantees. You should never make an investment decision on an ICO or other investment based solely on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional of your choosing if you are seeking investment advice on an ICO or other investment.

See full terms and conditions for more.

Founding Team

This category accounts for the leaders, developers, and advisors.

Poor quality, weak, or inexperienced leadership can doom a project from the outset. Advisors who serve only to pad their own resumes and who have ill-defined roles can be concerning. But great leadership, with relevant industry experience and contacts, can make the difference between a successful and profitable ICO, and a flub.

If you don’t have a team willing and able to build the thing, it won’t matter who is at the helm. Good talent is hard to find. Developer profiles should be scrutinized to ensure that they have a proven history of working in a field where they should be able to succeed.

Product

What is the technology behind this ICO, what product are they creating, and is it new, innovative, different – and needed?

The IOTA project is a spectacular example of engineers run amok. The technology described or in use must be maintainable, achievable, and realistic, otherwise the risk of it never coming into existence is incredibly high.

Token Utility

Tokens which have no actual use case are probably the worst off, although speculation can still make them have some form of value.

The best tokens we review are the ones that have a forced use case – you must have this token to play in some game that you will probably desire to play in. The very best utility tokens are the ones which put the token holder in the position of supplying tokens to businesses who would be able to effectively make use of the platforms in question.

Market

There doesn’t have to be a market in order for an ICO to score well in this category – but if it intends to create one, the argument has to be extremely compelling.

If there is an existing market, questions here involve whether it is ripe for disruption, whether the technology enables something better, cheaper, or faster (for example) than existing solutions, and whether the market is historically amenable to new ideas.

Competition

Most ideas have several implementations. If there are others in the same field, the analyst needs to ensure that the others don’t have obvious advantages over the company in question.

Moreover, this is the place where the analyst should identify any potential weaknesses in the company’s position moving forward. For instance, a fundamental weakness in the STORJ system is that the token is not required for purchasing storage.

Timing

With many ICO ideas, the timing may be too late or too early. It’s important for the analyst to consider how much demand there is for the product in question. While the IPO boom funded a lot of great ideas that eventually did come to fruition, a good analyst would recognize when an idea is too early, too late, or just right.

Progress To Date

Some of the least compelling ICO propositions are those that claim their founders will achieve some far-off goal, sometime in the future, just so long as they have your cash with which to do it.

More interesting (usually) is the ICO that seeks to further some progress along the path to success, and which has a clearly-identified roadmap with achievable and reasonable milestones along the way. Founders who are already partially-invested in their products are generally more invested in their futures.

Community Support & Hype

Having a strong community is one of the fundamental building blocks of any strong blockchain project. It is important that the project demonstrates early on that it is able to generate and build a strong and empowered support base.

The ICO marketplace is becoming more crowded and more competitive. While in the past it was enough to merely announce an offering, today’s successful ICO’s work hard to build awareness and excitement around their offering.

Price & Token Distribution

One of the biggest factors weighing any analysis is price. The lower the price the more there is to gain. But too low of a price may result in an under capitalized project. It is therefore important to evaluate price relative to the individual project, its maturity and the market it is going after.

The total supply of tokens should also be justified by the needs of the project. Issuing a billion tokens for no reason will do nobody any good.

Communication

Communication is key. The success of a project is strongly tied to the project leaders’ ability to communicate their goals and achievements.

Things don’t always go as planned but addressing issues and keeping the community and investors in the loop can make or break a project.

Earn with Nexo

Earn with Nexo