Ripple's On-Demand Liquidity Services Grew Six-Fold Last Quarter

But sales to exchanges are on the decline.

Share this article

Ripple Insights has published its quarterly markets report, which reveals that the company and its XRP token experienced mixed growth in 2019.

Ripple’s On-Demand Liquidity (ODL) services, which facilitate cross-border settlements, saw noticeable growth. These services handled 550% more value in Q4 of 2019 than they did in Q3. In raw transactions, those services saw a 290% increase in activity.

This growth is reportedly due to greater adoption. In less than a year, over 24 financial companies signed on for ODL, including Viamericas, FlashFX and Interbank Peru.

Ripple’s most notable client may be MoneyGram, which began to use Ripple’s services last August. This partnership has been particularly successful in Mexico, a market where MoneyGram is moving 10% of its volume through ODL.

Fewer Exchange Sales

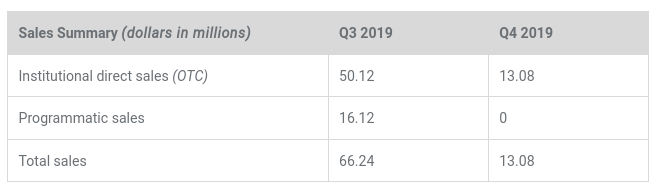

Despite growing demand for ODL, Ripple sold relatively little the XRP token in Q4. Though this was partially due to a change in its measurements, Ripple also cut back its sales deliberately in order to act as “disciplined, responsible stakeholders.”

The company paused programmatic sales entirely in Q4, causing sales in that category to fall to zero. In a separate category, Ripple executed over-the-counter (OTC) sales with a “few strategic partners,” but significantly reduced those sales as well.

The end result is that Ripple sold just $13 million XRP tokens over the course of Q4. This represents a five-fold decrease from Q4, when it sold $66 million worth of XRP.

Additionally, XRP’s daily trading volumes fell to $187 million in Q4. By contrast, the token’s daily volume in Q3 was $198 million, and its daily volume in Q2 was $430 million.

Token Supply and Demand

At first glance, these trends suggest that XRP is no longer highly sought after. However, Ripple seems to be releasing its XRP token into circulation in a calculated way.

It’s not yet clear if this strategy will affect prices positively. In the short term, XRP lost about 23% of its market value during the last quarter of 2019. By comparison, Bitcoin only lost about 14% of its market value during the same period.

It is possible that XRP token prices may not be a concern in the future: Ripple CTO David Schwartz recently proposed an XRP-backed stablecoin to help users avoid volatility.

In the meantime, practical applications targeted at consumers may drive up demand for the token. This week, the popular payment processor BitPay integrated XRP payments, allowing merchants to accept the cryptocurrency.

Share this article