S9 Miners Return to Bitcoin as Network Hashrate Stabilizes

Despite recent blows to Bitcoin's hashrate, Antminer S9s are returning to the network. The resurgence indicates that miners are confident in sustained BTC prices.

Key Takeaways

- Bitmain Antminer S9 devices currently account for 32% of Bitcoin's hashrate, up from previous weeks.

- This has modest security implications for Bitcoin-related coins, such as Bitcoin Cash and Bitcoin SV.

- Bitcoin transaction fees now make up a much greater portion of miner revenues after the halving.

Share this article

After last week’s halving, miners took their S9 ASICs offline as Bitcoin revenues dropped. Now, S9s are making a resurgence as BTC prices rise, showing that miners have confidence in sustained prices above $9,000.

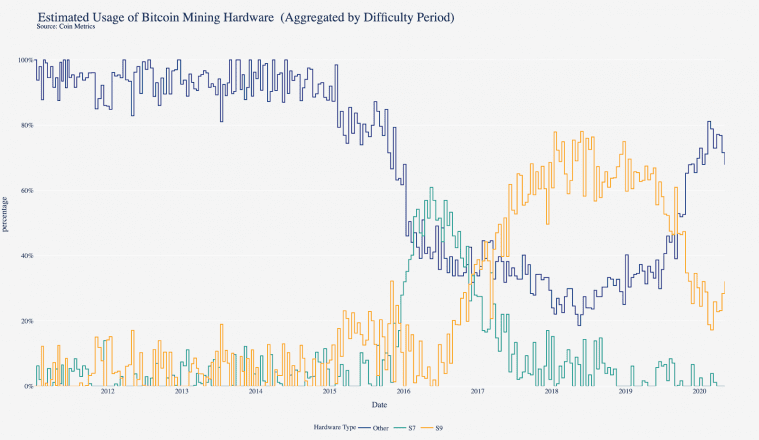

Bitmain’s Antminer S9 has historically been a popular mining machine, but newer, more efficient models have gradually replaced it. Following the halving, the S9 only accounted for 18% of the network hashrate. Yet, this week saw a surge in S9 miners, with the devices now accounting for 32% of Bitcoin’s total hashpower.

Though the halving drove down miner rewards and caused some miners to leave the network, rising Bitcoin prices are attracting S9 owners back to mining once again. The widespread availability of S9 miners on the second-hand market combined with China’s low electricity prices are also contributors to the device’s resurgence.

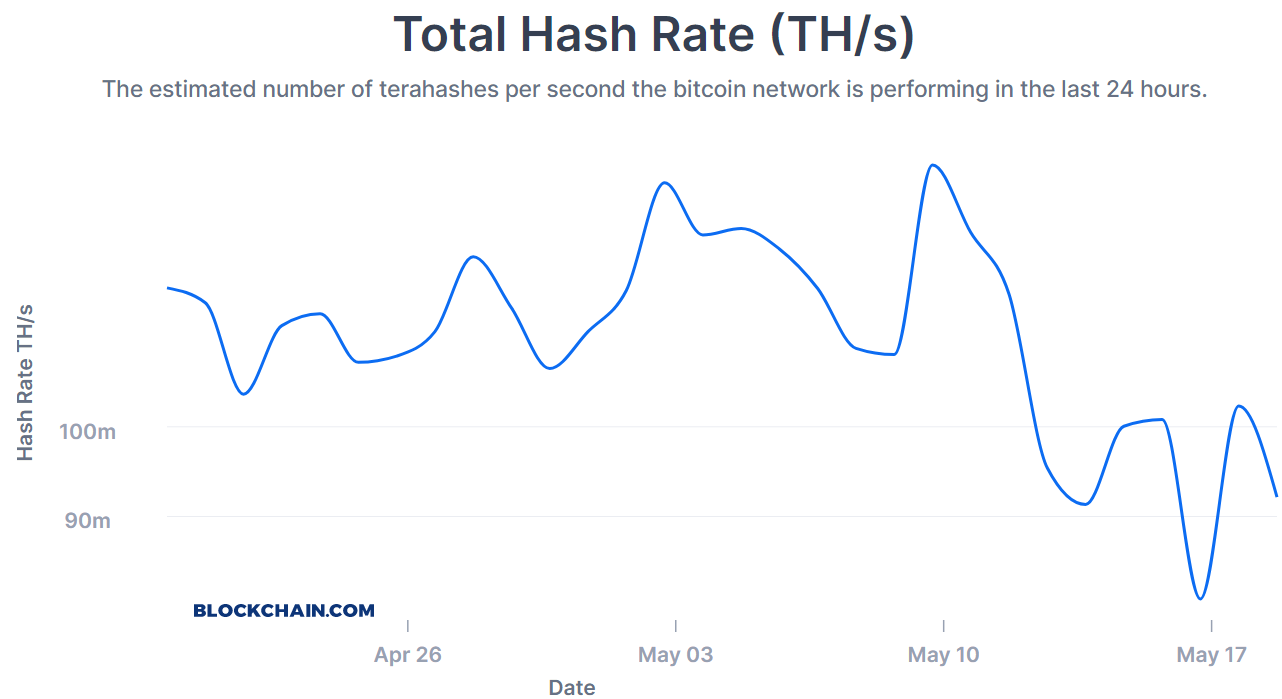

Another reason for the return of the S9 is volatility around Bitcoin’s hashrate, which makes mining riskier for older machines on the brink of profitability. Now that the network hashrate has stabilized, older devices can safely return to mining.

The Bitcoin network hashrate dropped from a monthly peak of 136 terahashes per second on May 9 to a local low of 82 terahashes. It has since stabilized around 92 terahashes per second, representing a 32% drop from the monthly peak.

Coinmetrics noted that the absence of S9 mining devices is not enough to risk a 51% attack, but that their “presence is significant” nonetheless. The fact that old machines are inexpensive but capable of competing with newer ASICs could make 51% attacks slightly more affordable on other SHA-256 blockchains, such as Bitcoin Cash and Bitcoin SV.

Coinmetrics also observed that transaction fees are rising as a proportion of overall revenue to compensate for lower block rewards. A higher proportion of transaction fees relative to block rewards is an indicator of network health. As future halvings decrease miner income from block rewards, then the security of the Bitcoin network will depend more and more on transaction fees.

Right now, transaction fees make up 17% of miner revenues, as opposed to 4% before the halving.

Share this article