Shutterstock image by Mark Van Scyoc

SEC Claims it Will “Act to Protect Retail Investors” Amid Market Outrage

The SEC stated it will seek to maintain "fair" markets despite rising sentiment that retail traders are being unfairly treated.

The SEC statement on stock market volatility due to the GameStop stock price activity may fall on deaf ears in an increasingly angry retail trading community.

SEC Statement Unlikely to Comfort Retailer Investors

The SEC stated today that it is “closely monitoring and evaluating the extreme price volatility” of certain stocks’ trading price.

While it didn’t mention specific stocks, it’s safe to assume that the recent GME short squeeze carried out by the r/wallstreetbets community is the focus of the statement.

So let me get this straight: Redditors rallying GameStop is market manipulation, but hedge fund billionaires shorting a stock is just an investment strategy?

— Robert Reich (@RBReich) January 28, 2021

The SEC said that certain stocks’ extreme volatility could be dangerous to investors and undermine market confidence, even adding that it would work to “maintain fair, orderly, and efficient markets.”

However, public sentiment does not indicate a sense of fairness regarding the latest market activity.

Outrage Over Wall Street’s Monopoly

Recent days have given many the impression that Wall Street and institutional traders have more of a monopoly over the trading world than previously imagined. The short squeeze organized by the r/wallstreetbets Reddit community was arguably the first instance of an organized group of retail investors taking on a hedge fund.

The community noticed that the Melvin Capital hedge fund had a huge short position on GameStop (GME) stock and began buying up the stock through the Robinhood app, among other platforms, resulting in over $5 billion worth of liquidations for institutional traders. The community has shown an interest in pumping the prices of AMC and Dogecoin, among other assets.

Has Doge ever been to a dollar?

— Chairman (@WSBChairman) January 28, 2021

The launch of apps like Robinhood, which give non-accredited retail investors unprecedented access to the stock market, has made this kind of activity possible. However, Robinhood has now banned the trade of GME and DOGE, even going so far as to cancel user transactions without their permission.

Robinhood’s co-founder blamed SEC regulations on capital obligations for the decision. Many users allege that the platform sold their stocks at a loss in favor of Wall Street traders and simply freezing their access to it, taking retail money while giving Wall Street free rein over the price action.

Can someone who understands stonks explain this to me? It looks like naked manipulation of the market to privilege and protect the wealthy by literally just seizing control of individual investors' property. Is that what it is, or am I reading this wrong? https://t.co/6PxccWfHln

— Rishus Cold Yetzer (@JustSayXtian) January 28, 2021

To many, the SEC claims to “protect” retail investors will ring false. Public sentiment suggests that smaller traders have been unfairly treated in favor of major institutes in a blatant imbalance of power.

Robinhood has used language implying that users are suspected of market manipulation. Simultaneously, it seems the app itself is playing a major role in curbing retail investors’ ability to participate in the market.

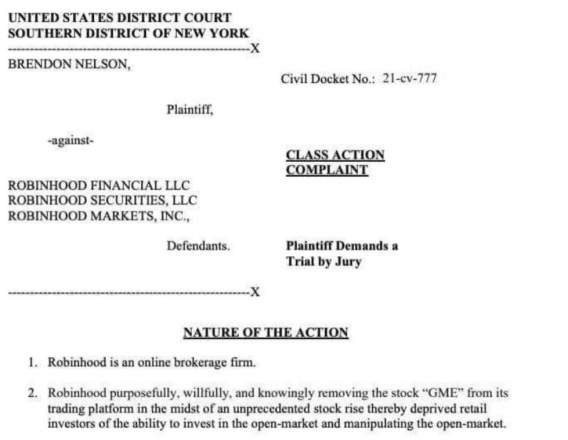

Twitter users claim that a lawsuit has now been filed against Robinhood for market manipulation.

In protest of the Robinhood’s actions, the trading community sunk Robinhood’s Google rating to one star. However, Google has just deleted over 100,000 negative reviews for Robinhood, sending the app rating back above four stars.