Sentinel Chain ICO Review And SENC Token Analysis

Share this article

Sentinel Chain ICO Overview

The Sentinel Chain ICO and SENC Token are sourcing funding to bring formal financial services to the unbanked. Without access to formal financial services, the unbanked are subjected to high interest rates for loans as providers require greater incentives to offer higher-risk credit.

Sentinel Chain is built on the premise that if farmers could turn their “dead capital” i.e. livestock into a fungible asset, a greater incentive would exist for more secure lending services to provide access to credit and a range of other financial services. Simply put, Sentinel Chain collateralizes cattle for crypto.

Sentinel Chain ICO Value Proposition

The Sentinel Chain ICO ecosystem provides affordable and secure financial services to the unbanked by providing a link between unbanked farmers and large-scale financial institutions. The first step in this process is to introduce a physically tamper-proof and digitally-immutable system via RFID tags capable of turning livestock into a fungible asset with transparent and clearly defined value. The second step is to create an open marketplace that connects the unbanked to a network of global financial providers from whom they can borrow against their livestock.

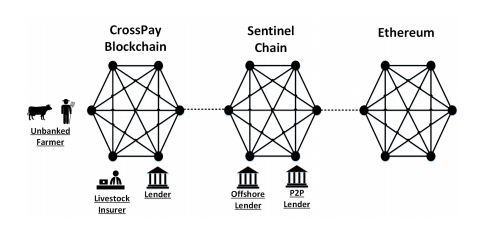

The Sentinel Chain Ecosystem is comprised of 5 components:

The CrossPay Blockchain– a B2C financial ecosystem of separate blockchains for each local geography accessible via the CrossPay Mobile Application (a mobile interface built for Android). The CrossPay Blockchain consists of (a) the Tamper-Proof RFID-enabled Livestock Tag, (b) the CrossPay Mobile application, and (c) the blockchain. Each CrossPay Blockchain will use a native cryptocurrency token called Local CrossPay Token (LCT) pegged to the value the respective national currency.

The CrossPay Mobile Application– a mobile interface built for Android. The app provides users with the ability to track assets, a digital identity and access to other financial services. Through the app, farmers will have access to various financial services including loans, insurance, crowdfunding and e-payments.

The Livestock Identification Tag– a tamper-proof and theft-proof device on both the design and data level. The tag stores the geolocation and time stamp information of each asset on to the CrossPay Blockchain. Immutability of the information ensures the authenticity and traceability, thereby creating a digital “passport” that proves the existence of the asset and verifies ownership by an individual.

The Sentinel Chain– a blockchain designed for the purpose of creating a low-cost, cross-border financial infrastructure connecting the unbanked to a global network of financial providers. The Sentinal Chain will be connected to the multitude of CrossPay Blockchains. The chain facilitates access by offshore financial service providers to local lending companies who act as a bridge to the unbanked farmers.

The Sentinel Chain Token (SENC) is an ERC20 token that allows financial service providers and cryptocurrency holders access to the Sentinel Chain marketplace. Activity on the Sentinel Chain will be facilitated using SENC.

Sentinel Chain ICO Team

Sentinel Chain is incorporated in Singapore under Infocorp Foundation Limited as a non-profit organization. For this reason, three of the four heads hold the formal title of “Foundation Member”. A complete list of the team members and advisors can be found here.

Roy Lai is Founder, CEO and CTO of Sentinel Chain. He has an extensive background in fintech, including experience designing distributed ledger systems for inter-bank transactions in emerging countries with parent company InfoCorp.

Chia Hock Lai is a Foundation Member of Sentinel Chain. He is President of the Singapore Fintech Association and has over a decade of experience in the field.

Anson Zeall is the second Foundation Member of the project. He has experience both in finance as Managing Director of a private investment firm and has also launched several startups.

Kann Zwan is the final Foundation Member of Sentinel Chain. She is the CEO of the first Bitcoin ATM company in Singapore and has served as Vice President with three separate private investment companies in both Singapore and the United States.

Advisors of the project include CEO of RSK Labs, Diego Gutiérrez Zaldívar, and David Lee of Block Asset.

Sentinel Chain ICO Strengths and Opportunities

Cash for cows is not a new concept. Five years ago, Zimbabwe enacted a law that allowed farmers to literally deposit their cows with lenders for access to cash. But the dual issues of trust and accessibility to rural populations remain prohibitive for banks to scale these services.

Firstly, farmers must trust the lenders with whom they deposit their livestock. Secondly, banks must develop highly sophisticated, costly channels for reaching borrowers. The Sentinel Chain ICO addresses both of these issues head on through the CrossPay Mobile Application and Livestock Identity Tag. The immutable data stored on the Identity Tag provides guarantee of the existence of the asset and the identity of the owner, nixing the need for a cattle depository. To simplify the accessibility issue for banks, the CrossPay Mobile app brings borrowers (plus their cattle) and lenders together via the digital marketplace.

Sentinel Chain have made progress on their offchain product with a demo version of the CrossPay Mobile App and RFID Tag system. A video demonstration of the product can be seen here.

Sentinel Chain also has a pilot project lined up with partners CloudWell (a more detailed background on the company can be found here) and Green Delta Insurance, two Bangladeshi fintech companies which operate payment and insurance services for rural farmers. Through these existing channels, an infrastructure is already in place to deploy Sentinel Chain and test its viability on the ground. These partnerships are a significant step in the right direction for proving the product concept and therefore, adding value to the project.

Sentinel ICO Weaknesses and Threats

The Sentinel Chain ICO aims to facilitate adoption and utilization of the Sentinel Chain by both local lending companies and offshore financial service providers. The incentive for offshore financial service providers to join the system is therefore contingent firstly on the system’s viability in the field.

To this end, the pilot project partnerships with CouldWell and Green Delta Insurance will play a crucial role in demonstrating proof of concept. Still, as this variable at present remains an unknown, there is no guarantee without partnerships with offshore financial service providers that the ecosystem has a clear path to scale.

The capacity of Sentinel Chain to produce lower interest rates still remains a fundamental question that will only be resolved once the system is in full operation. One of the main value propositions of the project is that access to more formal financial service providers will help to lower the interest rates of borrowers, but this has not always been the case in practice.

Referring back to the example of Zimbabwe, one economist raised the issue that banks will likely view livestock as a higher-risk form of collateral. When turning any asset into collateral, the lender has to have guaranteed access to the livestock for it to hold any value. As livestock are subject to the threats of drought, famine and disease, the chances of default are much higher than with more secure assets.

Sentinel Chain have stated in their partnership announcement that they plan to mitigate these risks by providing livestock insurance to farmers, which will offer more security for financial companies issuing loans. Though this solution sounds attractive in theory, the market is still high-risk and how financial institutions choose to structure their policies in response remains uncertain.

The Verdict on Sentinel Chain ICO

The Sentinel Chain ICO offers a highly sophisticated solution to one of the largest problems facing the world’s poorest population. The project has shown encouraging signs of progress on both product development and partnerships to launch the pilot program.

On the other hand, the uncertainty remains very high when it comes to adoption by both financial institutions and farmers themselves. Before any serious prospects for scaling exist, the pilot program must demonstrate the product is both technically and financially viable for an extended period of time. Having taken all these factors into consideration, we will be placing a small bet on the Sentinel Chain ICO.

Learn more about the Sentinel ICO from our Telegram Community by clicking here.

Today’s Date: 2/8/17

Project Name: Sentinel Chain

Token Symbol: SENC

Website: https://sentinel-chain.org/

White Paper: Sentinel Chain Whitepaper

Crowdsale Hard Cap: $14.4 million

Total Supply: 500,000,000

Token Distribution: 40% to crowdsale, 30% to treasury and reserve fund, 20% to early supporters, 10% to founding team

Price per Token: Price per ETH TBA on 26th February at 00:00 GMT

Maximum Market Cap (at crowdsale price): $36 million

Accepted Payments: ETH

Excluded Countries: US, China

Bonus Structure: Presale- 25%

Presale Terms: Closed

Whitelist: February 10th

Important Dates: Crowdsale- Early March exact date TBA

Expected Token Release: TBA

ICO Review Disclaimer

The team at Crypto Briefing analyzes an initial coin offering (ICO) against ten criteria, as shown above. These criteria are not, however, weighted evenly – our proprietary rating system attributes different degrees of importance to each of the criteria, based on our experience of how directly they can lead to the success of the ICO in question, and its investors.

Crypto Briefing provides general information about cryptocurrency news, ICOs, and blockchain technology. The information on this website (including any websites or files that may be linked or otherwise accessed through this website) is provided solely as general information to the public. We do not give personalized investment advice or other financial advice.

Decentral Media LLC, the publisher of Crypto Briefing, is not an investment advisor and does not offer or provide investment advice or other financial advice. Accordingly, nothing on this website constitutes, or should be relied on as, investment advice or financial advice of any kind. Specifically, none of the information on this website constitutes, or should be relied on as, a suggestion, offer, or other solicitation to engage in, or refrain from engaging in, any purchase, sale, or any other any investment-related activity with respect to any ICO or other transaction.

The information on or accessed through this website is obtained from independent sources we believe to be accurate and reliable, but Decentral Media LLC makes no representation or warranty as to the timeliness, completeness, or accuracy of any information on or accessed through this website. Decentral Media LLC expressly disclaims any and all responsibility from any loss or damage of any kind whatsoever arising directly or indirectly from reliance on any information on or accessed through this website, any error, omission, or inaccuracy in any such information, or any action or inaction resulting therefrom.

Cryptocurrencies and blockchain are emerging technologies that carry inherent risks of high volatility, and ICOs can be highly speculative and offer few – if any – guarantees. You should never make an investment decision on an ICO or other investment based solely on the information on this website, and you should never interpret or otherwise rely on any of the information on this website as investment advice. We strongly recommend that you consult a licensed investment advisor or other qualified financial professional of your choosing if you are seeking investment advice on an ICO or other investment.

See full terms and conditions for more.

Founding Team

This category accounts for the leaders, developers, and advisors.

Poor quality, weak, or inexperienced leadership can doom a project from the outset. Advisors who serve only to pad their own resumes and who have ill-defined roles can be concerning. But great leadership, with relevant industry experience and contacts, can make the difference between a successful and profitable ICO, and a flub.

If you don’t have a team willing and able to build the thing, it won’t matter who is at the helm. Good talent is hard to find. Developer profiles should be scrutinized to ensure that they have a proven history of working in a field where they should be able to succeed.

Product

What is the technology behind this ICO, what product are they creating, and is it new, innovative, different – and needed?

The IOTA project is a spectacular example of engineers run amok. The technology described or in use must be maintainable, achievable, and realistic, otherwise the risk of it never coming into existence is incredibly high.

Token Utility

Tokens which have no actual use case are probably the worst off, although speculation can still make them have some form of value.

The best tokens we review are the ones that have a forced use case – you must have this token to play in some game that you will probably desire to play in. The very best utility tokens are the ones which put the token holder in the position of supplying tokens to businesses who would be able to effectively make use of the platforms in question.

Market

There doesn’t have to be a market in order for an ICO to score well in this category – but if it intends to create one, the argument has to be extremely compelling.

If there is an existing market, questions here involve whether it is ripe for disruption, whether the technology enables something better, cheaper, or faster (for example) than existing solutions, and whether the market is historically amenable to new ideas.

Competition

Most ideas have several implementations. If there are others in the same field, the analyst needs to ensure that the others don’t have obvious advantages over the company in question.

Moreover, this is the place where the analyst should identify any potential weaknesses in the company’s position moving forward. For instance, a fundamental weakness in the STORJ system is that the token is not required for purchasing storage.

Timing

With many ICO ideas, the timing may be too late or too early. It’s important for the analyst to consider how much demand there is for the product in question. While the IPO boom funded a lot of great ideas that eventually did come to fruition, a good analyst would recognize when an idea is too early, too late, or just right.

Progress To Date

Some of the least compelling ICO propositions are those that claim their founders will achieve some far-off goal, sometime in the future, just so long as they have your cash with which to do it.

More interesting (usually) is the ICO that seeks to further some progress along the path to success, and which has a clearly-identified roadmap with achievable and reasonable milestones along the way. Founders who are already partially-invested in their products are generally more invested in their futures.

Community Support & Hype

Having a strong community is one of the fundamental building blocks of any strong blockchain project. It is important that the project demonstrates early on that it is able to generate and build a strong and empowered support base.

The ICO marketplace is becoming more crowded and more competitive. While in the past it was enough to merely announce an offering, today’s successful ICO’s work hard to build awareness and excitement around their offering.

Price & Token Distribution

One of the biggest factors weighing any analysis is price. The lower the price the more there is to gain. But too low of a price may result in an under capitalized project. It is therefore important to evaluate price relative to the individual project, its maturity and the market it is going after.

The total supply of tokens should also be justified by the needs of the project. Issuing a billion tokens for no reason will do nobody any good.

Communication

Communication is key. The success of a project is strongly tied to the project leaders’ ability to communicate their goals and achievements.

Things don’t always go as planned but addressing issues and keeping the community and investors in the loop can make or break a project.

Share this article