Social Indicators Wax Bullish Leading up to Bitcoin's Halving

Bitcoin is trending up, which has taken investors by surprise as many anticipated a dump before the upcoming halving.

Key Takeaways

- Betting against the wisdom of the crowd has proved to be a profitable strategy over the years.

- Now that a significant number of analysts have argued that Bitcoin is bound for a bearish impulse before the halving, the market could turn around.

- The flagship cryptocurrency appears to be breaking out over the past few hours suggesting a move towards $10,500.

Share this article

The sentiments of crypto market participants often precede price action. And as speculation mounts leading up to Bitcoin’s halving, the wisdom of the crowd can help determine where BTC is headed next.

The Wisdom of the Crowd

Though retail masses can have a powerful effect on the price of any asset, the crypto market is a unique beast.

CNBC, for instance, is widely known within the crypto community for its outrageous predictions about where the flagship cryptocurrency is headed next. But each time the financial media giant makes a prediction, the market tends to move in the opposite direction.

Similar behavior can be observed with the Crypto Fear and Greed Index.

This fundamental indicator analyzes the sentiment from a variety of sources to determine how fearful or greedy investors are regarding Bitcoin. Fear usually leads to bullish momentum while greed signals a future slump in prices.

Now that Bitcoin’s halving is just a few days away, speculation is through the roof. The word “halving” is dominating the narrative around the bellwether cryptocurrency on Twitter, according to data firm The TIE.

Tweet volumes about the next week’s event have quintupled over the past two weeks with 35% of the interactions being bearish. But, what does this say about BTC’s price?

Betting Against Popular Belief

Santiment, a behavior analytics platform, affirmed that price rarely does what the crowd expects.

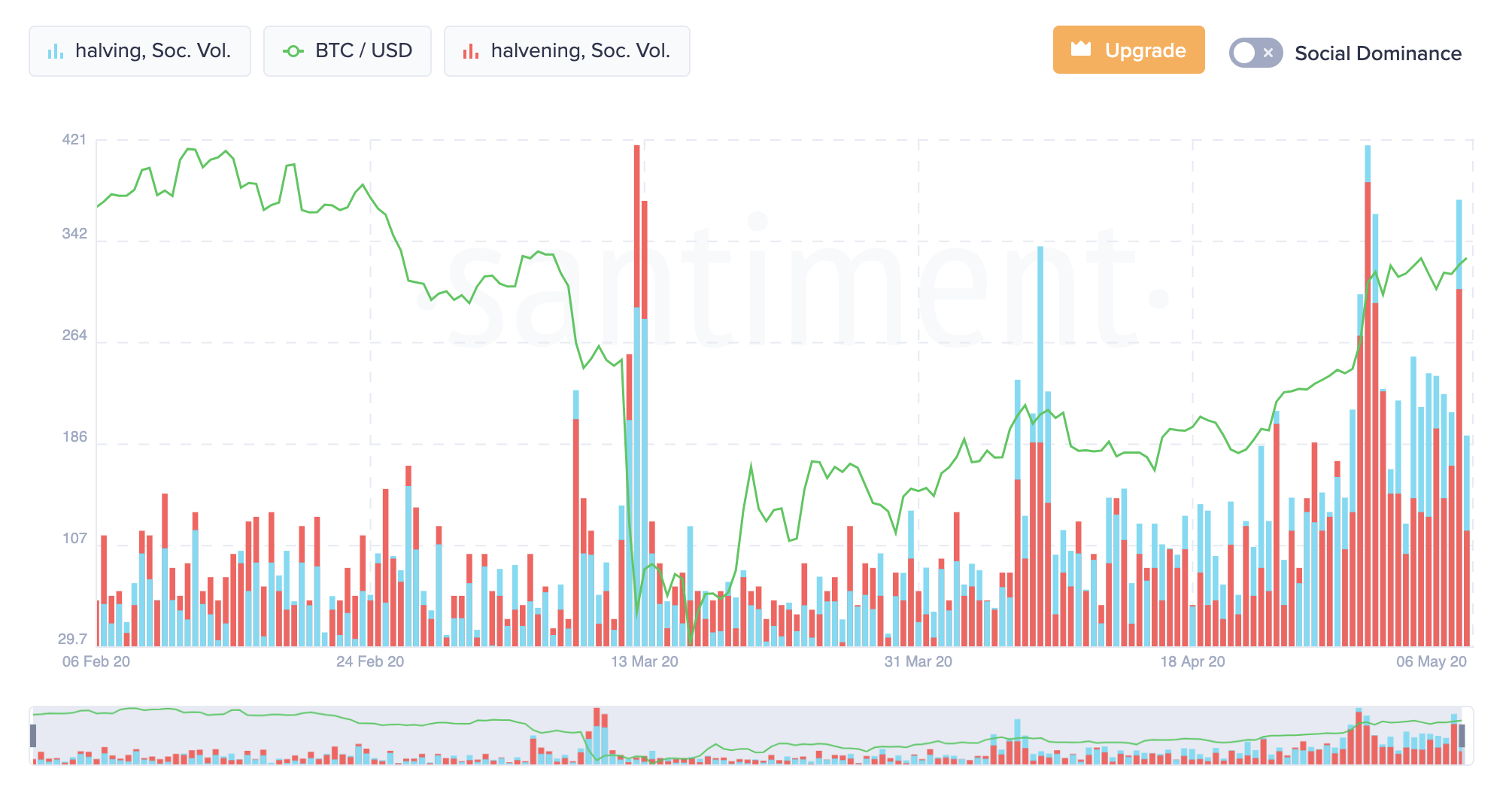

A glimpse at Santiment’s aggregated social volumes for the word “halving” and “halvening” paints a clear picture. Each time the social media chatter around these topics surged over the past three months, Bitcoin’s price moved differently.

During the March market meltdown, for example, talks about the upcoming block rewards reduction event skyrocketed, which led to a price increase.

Then, as the pioneer cryptocurrency reclaimed the $7,000 support level in early April, conversations about the halving across multiple social media networks spiked up. This, however, was followed by a retracement that pushed BTC down to $6,600.

As the month of May begins, mention of the halving is once again rising. However, the mood around market participants feels different this time around.

“Our sentiment algorithm suggests that the crowd is turning increasingly sheepish about the upcoming halvening, and Bitcoin’s short-term PA,” said Dino Ibisbegovic, head of content and SEO at Santiment.

Ibisbegovic also analyzed Santiment’s social data feed to determine the overall view among market participants across more than 1,000 social media channels. There, the analyst noticed that the pessimistic outlook currently outweighs the more bullish one.

A significant number of people believe that Bitcoin is poised to retrace before the halving. Contrarians have argued that there is an unexpected upswing underway. Such a bullish impulse may even have the ability to trick bears into panic buying as they try to get a piece of the price action.

This erratic behavior will be ideal for the Bitcoin whales to dump their holdings at the top.

Bitcoin Breaking Out of Consolidation

Under this premise, prices could rise substantially before the halving, followed by the steep decline that multiple analysts have suggested.

Although it is too early to tell, this scenario appears to be playing out at the time of writing.

Bitcoin has been consolidating within a narrow trading range over the past week. This consolidation area is defined by the lower and upper Bollinger bands that sit between $8,600 and $9,170. As the Bollinger bands squeeze on BTC’s 4-hour chart, momentum for a period of high volatility has been building up slowly.

The inability to determine in which direction Bitcoin was going to breakout made Crypto Briefing condemn the trading range between $8,600 and $9,170 a reasonable no-trade zone.

Today, however, the flagship cryptocurrency seems to be slicing through resistance, which may lead to a substantial upswing.

A further increase in the buying pressure behind BTC that allows it to turn the $9,170 resistance into support could send it towards new yearly highs.

If this were to happen, the next critical supply barriers to pay attention to are BTC’s February high of $10,500 and the 127.2% Fibonacci retracement level at $10,900.

Only time will tell whether or not the price action seen in the last few hours will be supported by a spike in demand.

Moving Forward with Bitcoin

On-chain analyst Willy Woo noted that the number of addresses with 1,000 BTC has been steadily rising since the beginning of the year. This continuous accumulation despite the commotion in the global financial markets is a “macro bullish” sign, according to Woo.

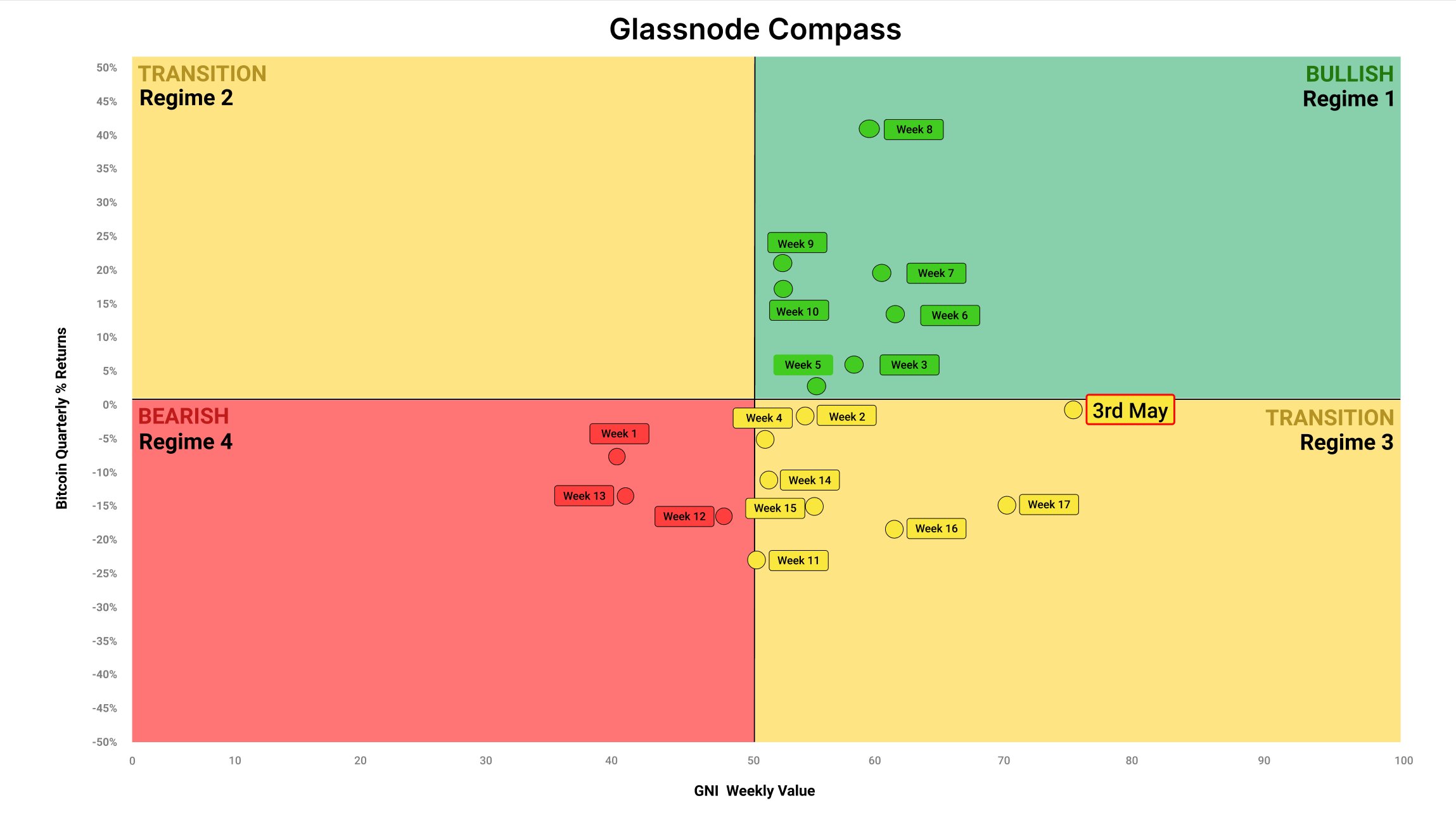

This long-term outlook coincides with Glassnode’s new compass index, which suggests that throughout the month of May “Bitcoin has been moving strongly towards the bullish quadrant.”

As emotions heat up in proximity to Bitcoin’s halving, exuberance and high levels of volatility can be expected. Thus, it is important to remain cautious to avoid getting caught on the wrong side of the trend.

Share this article