Solana Breaks $100 for the First Time, $120 in Target

Solana has stolen the crypto spotlight, gaining over 330% in market value in the last 40 days.

Key Takeaways

- Solana has made another new all-time high, surpassing the $100 mark.

- SOL-related mentions across social media networks have skyrocketed.

- The extreme levels of optimism among market participants could point to a correction.

Share this article

Solana has shrugged off the recent bearishness around the top cryptocurrencies by market cap. Still, market participants seem to be growing extremely optimistic, which could lead to a pullback.

Sentiment is Bullish

Solana has hit $100 for the first time.

According to data from CoinGecko, SOL is now the eighth-largest cryptocurrency by market cap, ahead of both Polkadot and Uniswap.

The asset has outperformed much of the crypto market over the last few weeks. It’s up 330% in the last 40 days.

Solana is a high-throughput smart contract blockchain. It’s sometimes described as an “Ethereum killer,” partly because it has its own fast-growing DeFi and NFT ecosystems.

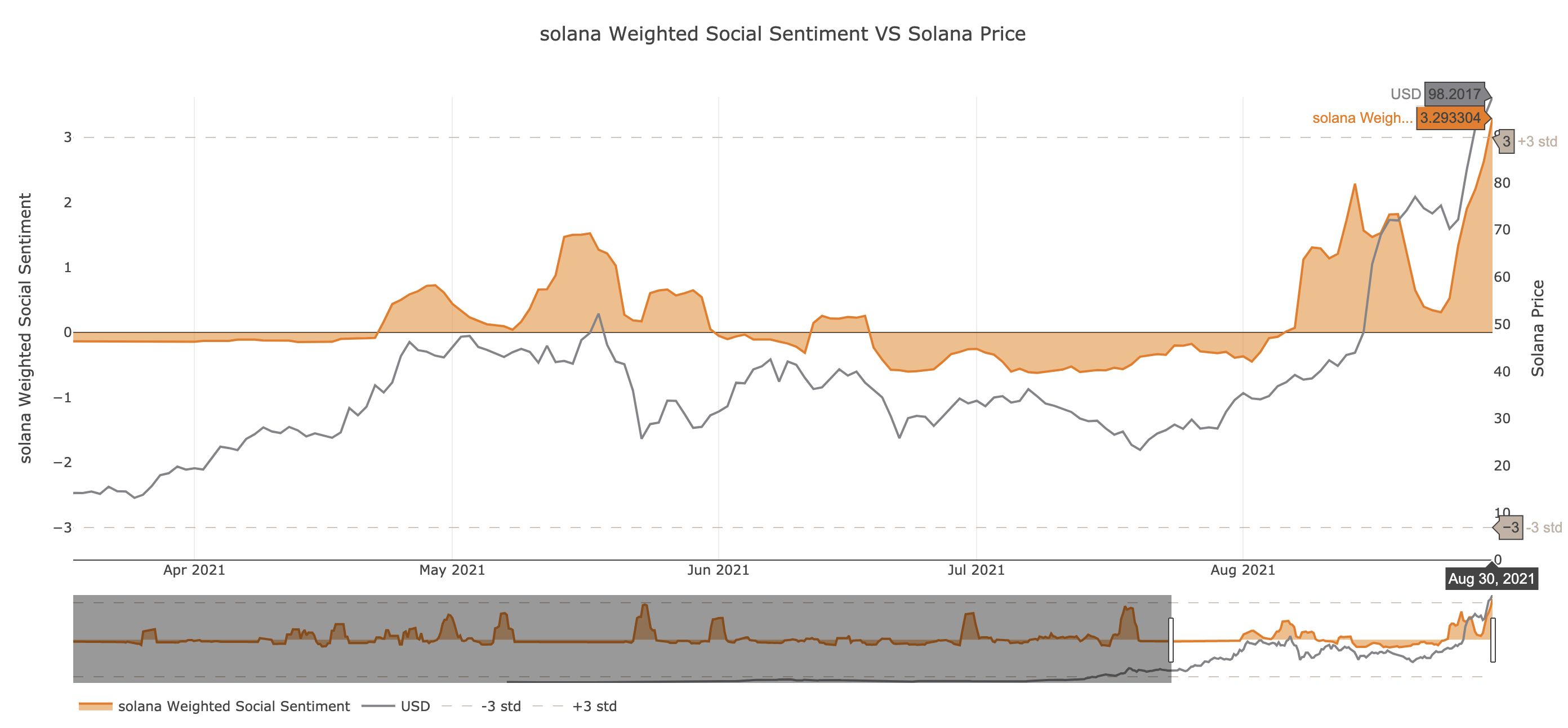

As the SOL price has increased, the conversation surrounding its promise has also surged. Data from Santiment reveals that the number of Solana-related mentions across social media networks surpassed 32 million. Meanwhile, Solana’s weighted social sentiment has reached the highest positivity level since its inception.

It appears that market participants are bullish about the recent price action and are possibly expecting further gains on the horizon. Still, such confidence among cryptocurrency enthusiasts could be considered a negative sign based on this on-chain metric.

Solana’s price tends to tumble when social perception is high. The question now is how to time an incoming correction, its depth, and its duration.

Solana Sits On Stable Support

The Fibonacci retracement indicator (measured from Solana’s high of $58.40 on May 18 to a low of $19.10 on to May 23) suggests that only a sustained daily candlestick close below the $97.60 can serve as validation of the pessimistic outlook.

Such a downswing could translate into a significant spike in profit-taking, pushing Solana’s price towards $82 or even $74.

It is worth noting that if SOL manages to print a decisive daily candlestick close above the $97.60 support level, higher highs can be expected. In this eventuality, it would likely aim for further gains, targeting $108 or even $121.

Share this article