Solana Looks Ready for Relief Rally to $200

Solana appears to be forming a local bottom after enduring a three-month downtrend.

Key Takeaways

- Solana is down more than 50% from its all-time high recorded in November.

- SOL appears to be trading in oversold territory, suggesting a rally may be incoming.

- A spike in upward pressure could see SOL rise toward $200.

Share this article

Multiple buy signals have appeared for Solana. If buy orders increase, SOL could have a significant relief rally on the horizon.

Solana Presents Buy Signals

Solana appears to be gearing up for a major bullish impulse despite the recent downturn in the crypto and global markets.

After putting in a major rally throughout most of 2021, SOL has had a rocky few weeks. It’s currently trading around $119, down more than 50% from its all-time high of $259 recorded on Nov. 6.

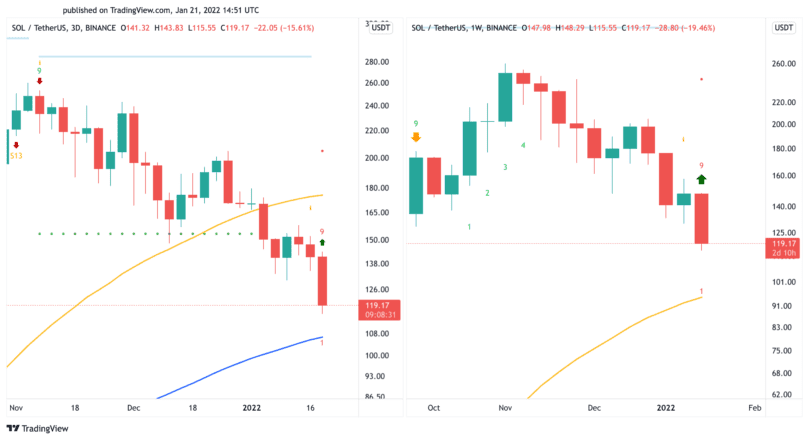

The high-throughput blockchain’s SOL currency appears to be trading in oversold territory, hinting that a local bottom could be about to form. The optimistic outlook is forecasted by the Tom DeMark (TD) Sequential indicator as it is currently presenting buy signals on Solana’s three-day and weekly charts. The bullish formations developed as red 9 candlesticks, which is indicative of a one to four candlesticks upswing in either time frame or the beginning of a new uptrend.

A spike in buying pressure around the current price levels could help validate the thesis presented by the TD Sequential indicator. Under such circumstances, Solana could rise toward its 50-three-day moving average at $180. Breaching this critical area of resistance could push SOL higher as the next important supply wall sits at around $200.

It is worth noting, however, that Solana could dip lower before achieving its upside potential. The 100-three-day moving average and the 50-week moving average are currently hovering around $100, indicating that this is the most stable demand barrier underneath SOL. Any downswing toward this support zone could encourage sidelined investors to re-enter into the market and act as a catalyst for an upward movement.

Still, it remains to be seen whether the $100 support will hold. A decisive candlestick close above this level could spell trouble, invalidating the bullish outlook. Solana could then resume its downtrend toward $82 or even $66.

Disclosure: At the time of writing, the author of this piece owned BTC and ETH.

Share this article