SushiSwap Launches New Lending and Margin Trading Platform

SushiSwap released two new products that will allow users to make the most out of their cryptocurrencies.

Key Takeaways

- SushiSwap launched a new cryptocurrency lending and margin trading platform.

- The new DEX will allow users to margin trade tokens that were not available before.

- Investors seem to expect a positive price reaction as a significant number of SUSHI tokens were purchased in the past 48 hours.

Share this article

SushiSwap will allow margin trading of some crypto trading pairs that are not available in the market due to lack of liquidity. The move has seen many mid-sized whales enter the network in anticipation of a bullish impulse.

Making the Most Out of Cryptos

SushiSwap announced the launch of a cryptocurrency lending and margin trading platform, dubbed Kashi.

The platform supports a wide variety of trading pairs that were not available before. Using an elastic interest rate with a “target utilization rate of 70-80% of the total supply,” Kashi makes high-risk assets accessible for margin transactions. Traders will be able to short a large selection of tokens and create leveraged short positions.

Kashi will rely on BentoBox, a highly-anticipated token vault, to help users generate yield from flash loans.

“The crucial role that the vault plays is that it allows users to earn interest by lending out their assets to margin traders, while simultaneously earning yield on the same tokens from liquidity providing or farming on DeFi protocols,” the team reports.

Users can now make the most out of their cryptocurrencies by simply transferring their tokens to BentoBox and linking the vault to Kashi. They will be able to create the supply or borrow pair of their choice or short a wide range of altcoins.

It is worth noting that another iteration of the DEX will be released in the next few weeks.

SushiSwap Whales Buy-In

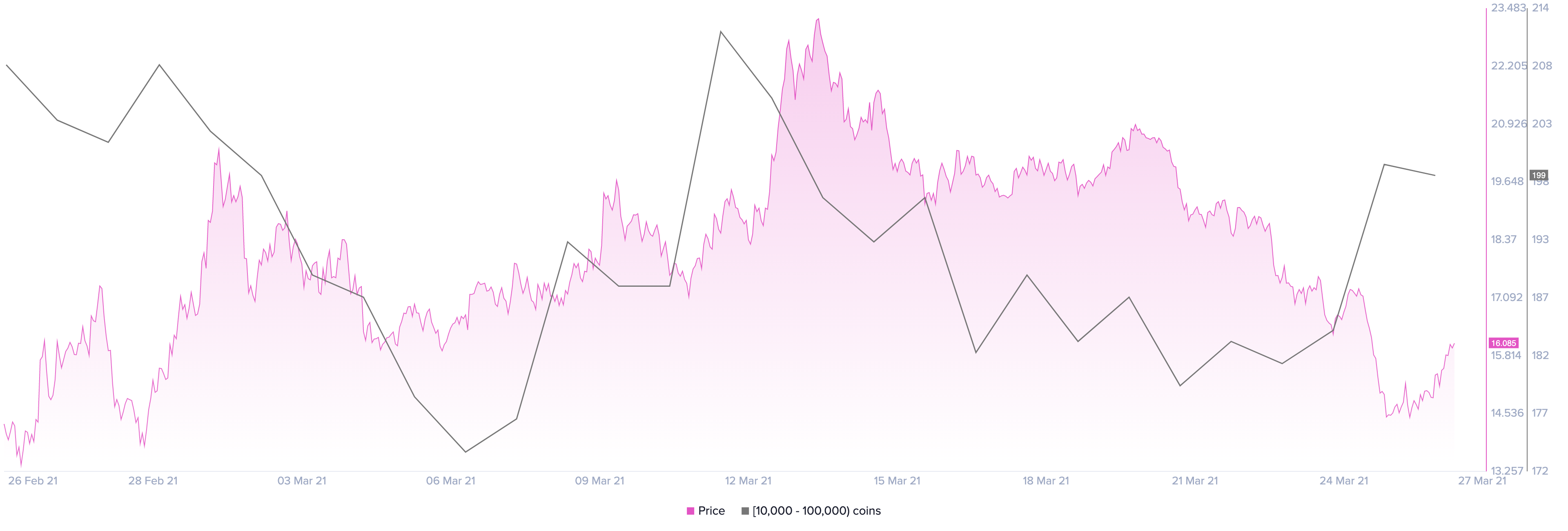

Santiment’s holder distribution chart shows that insiders may have prepared for a bullish price reaction to Kashi’s release. The behavioral analytics firm recorded a significant spike in the number of addresses holding 10,000 to 100,000 SUSHI in the past 48 hours.

Roughly 15 new mid-sized whales have joined the network since Mar. 24, representing an 8.10% increase in such a short period.

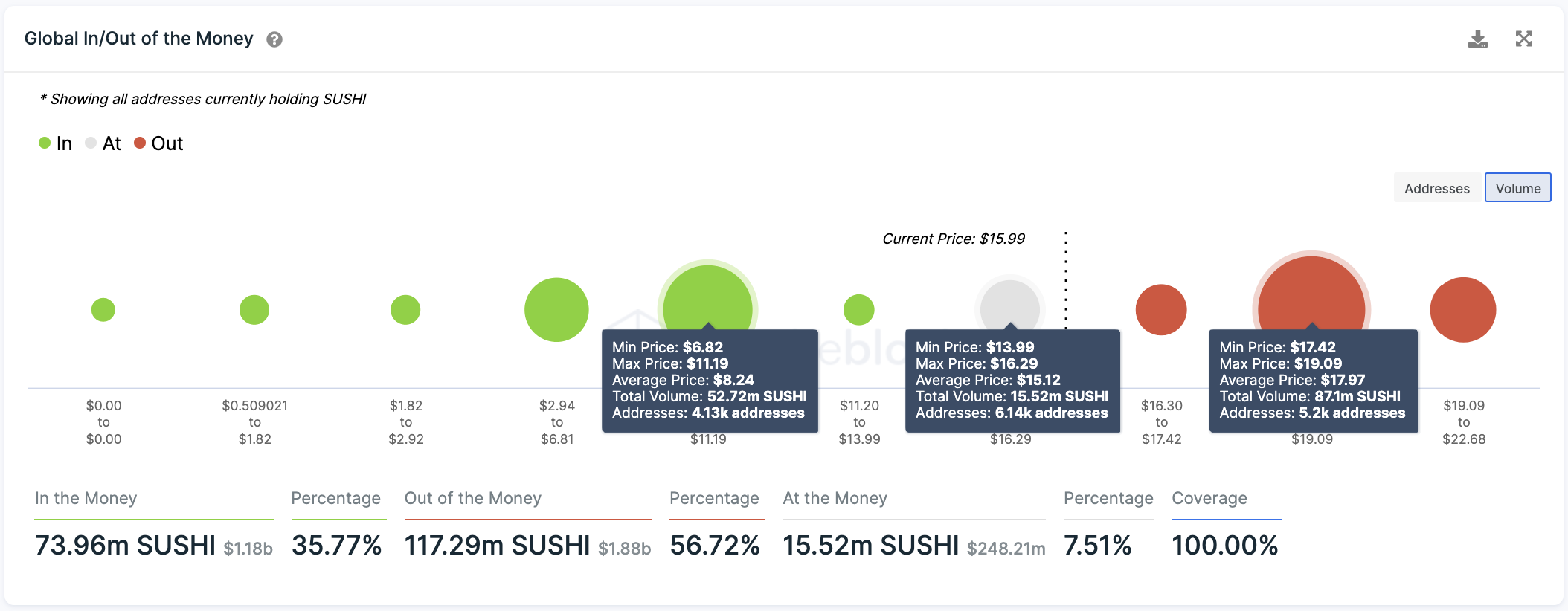

Despite the mounting buying pressure, IntoTheBlock’s Global In/Out of the Money (GIOM) model reveals that SushiSwap faces stiff resistance ahead.

Roughly 5,200 addresses had previously purchased more than 87 million SUSHI between $17.49 and $19. As such, further price appreciation may prove challenging as holders within this price range will likely try to break even on their positions.

If the formidable supply wall ahead of SushiSwap rejects the upward price action, the GIOM shows stable support at $15. Here, over 6,000 addresses bought 15.50 million SUSHI.

Failing to hold above this crucial area of support could see this cryptocurrency drop towards the next significant support area between $7 and $11, where approximately 4,000 addresses are holding more than 52.70 million SUSHI.

Disclosure: At the time of writing, this author owned Bitcoin and Ethereum.

Share this article