The Birth of Based Finance: Ampleforth to Build “Elastic” DeFi Stack

DeFi? That's so Q2 2020. Say hello to E-Fi.

Ampleforth has announced the launch of a suite of financial tools to improve the utility of AMPL, its native asset, and other elastic tokens. If the concept of countercyclical money succeeds, Ampleforth’s “E-Fi” layer can become the base for an entirely new ecosystem.

Ampleforth to Build a Base for Elastic Tokens

Ampleforth’s roadmap, which was recently made public, discloses plans to build an automated market maker (AMM), money market, and on-chain derivatives.

This infrastructure has been dubbed as elastic finance or “E-Fi.”

The team will build an AMM that enforces “efficient supply discovery” to maximize the utility of elastic money. Further, the derivatives segment will include on-chain futures, insurance, and perpetual contracts built with elastic tokens in mind. All of this put together can create real usage for Ampleforth’s native token, AMPL.

As is stands today, the token does not have much utility aside from speculation and portfolio diversification.

Extracting Value from Forks

AMPL’s unique rebasing mechanism drew attention after the launch of its incentivized Uniswap pool.

Uniswap is the only automated market maker that can support a rebasing token. But the liquidity pool must have a special function enabled to host the rebase.

Ampleforth’s new financial infrastructure will, however, be completely rebase-friendly with a few extra touch-ups.

This means forks like YAM and Based will benefit from creating liquidity on Ampleforth’s AMM and futures market, which will end being a net positive for AMPL.

This dynamic of cannibalizing forks was previously observed with yEarn Finance and its token, YFI.

YFI had tens of forks that ultimately became slaves to YFI. yEarn Finance implemented automated investment strategies that farmed these forks and dumped them for stablecoins. As more people joined in, this eventually pushed prices down.

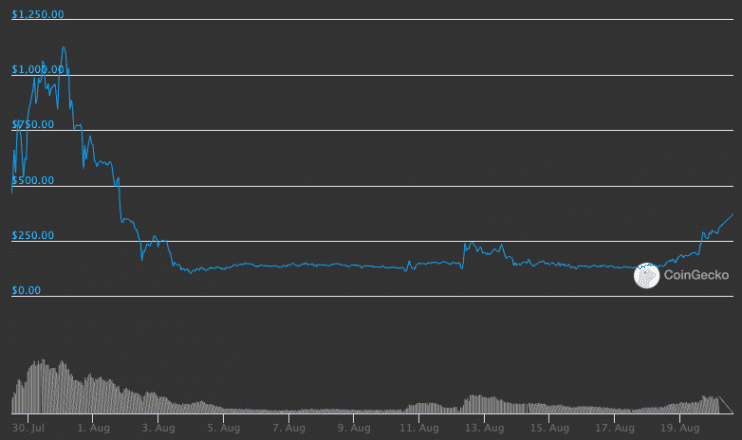

The price of YFII, the first fork, is down 68% since its high, despite rallying 55% in the last 24 hours.

Other protocols built with elastic money, like Terra, will also benefit from Ampleforth’s new products. Eventually, if elastic tokens prove to be a valuable monetary model, it can become the base layer for E-Fi.

Earn with Nexo

Earn with Nexo