Twitter ‘Likes’ Bitcoin As Sentiment Moons: Clear Skies Ahead?

Favorable sentiment is rising on Twitter

Bitcoin prices are partially set at the watercooler. Since most cryptocurrencies have yet to reach meaningful adoption, market movements depend on the whims of the investing public. Questions like “do most people expect Bitcoin to crash?” have more weight for short-term movements than the technical specifications of PoW mining or the Lightning Network.

Every day Twitter users post thousands of messages about Bitcoin and cryptocurrencies, and these tweets can collectively represent market sentiment. Although it’s difficult to quantify, these messages can provide a bird’s eye view of the investing crowd – assuming you could filter out the spam, that is.

That’s where sentiment analysis comes in. Sentiment analysis mines text from the web and extracts subjective information about the words being used, like ‘HODL’ or ‘Moon’ or even ‘Rekt.’ It uses a sliding scale to determine whether the tweets of other media are positive, neutral, or negative, while simultaneously using logic to ignore spam accounts.

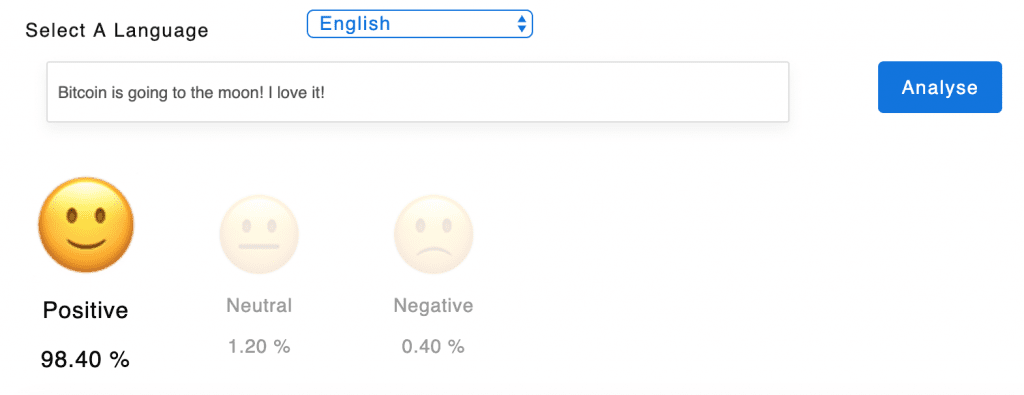

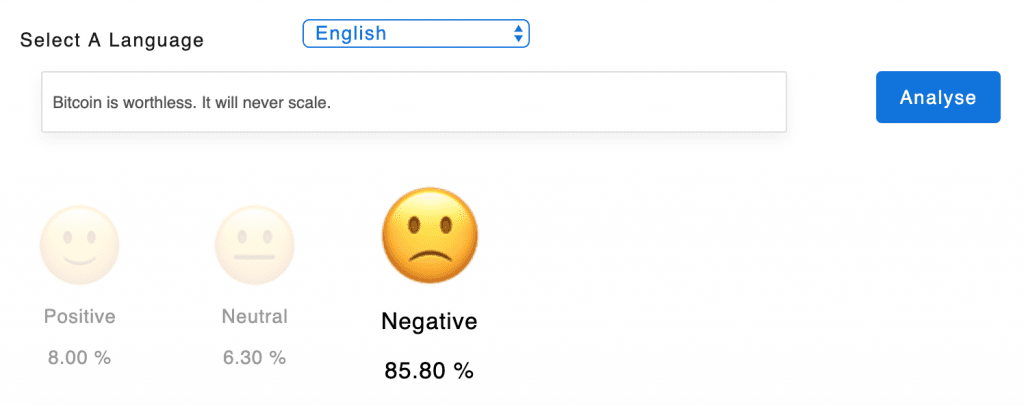

Take the following two sentences for example. We can use the program Parallel Dots to determine their sentiment:

- Bitcoin is going to the moon! I love it!

2. Bitcoin is worthless. It will never scale.

There are approximately 22,000 tweets about Bitcoin per day, according to Bitinfocharts. Sentiment analysis tools take all of those tweets, compile their sentiment data, and spit out a number that represents how people feel about the largest cryptocurrency.

What does this mean for the market?

Circle Research analyzed data from The Tie, an analytics company focused on predicting future price movements using sentiment analysis on Twitter. The Tie describe their data as, “a quantified representation of investor intentions expressed on Twitter void of noise generated by spam accounts.”

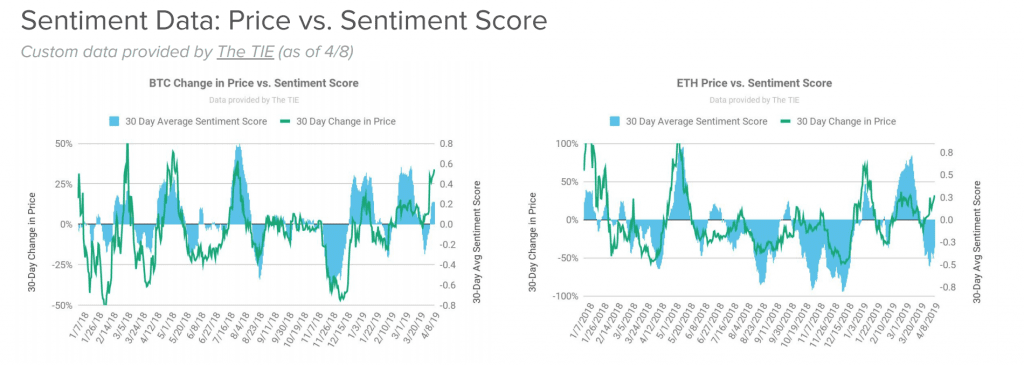

According to The Tie, sentiment analysis has proven to be a powerful leading indicator for future cryptocurrency prices, and it has proven to be more effective with cryptocurrencies than with other assets, such as stocks. In other words: increasingly positive sentiment on Twitter has been strongly correlated to predict upswings in the price of Bitcoin, and vice versa.

The Tie uses a long-short trading strategy based on market sentiment: go long on Bitcoin during periods of favorable sentiment, and short during decreases. This strategy beat the market by 97% from January 1st to June 25th in 2018, and their current data suggest that Bitcoin’s sentiment has successfully transitioned from capitulation to hope.

In their first quarterly report of 2019, Circle marked a strong shift towards positive sentiment, and they weren’t alone. Adamant Capital’s Tuur Demeester also noticed a sea-change, noting in a recent report that “Bitcoin is in the last stage of this bear market: the accumulation phase.” Demeester shared The Tie’s view that the sentiment has changed in 2019, and remarked on a shift to “hope” in his studies.

Strong Correlations Between Sentiment And Price

Circle Research used a regression model to compare sentiment and price for BTC and ETH, and showed that the sentiment score has very strong correlations with the price of both assets: +0.71 and +0.64, respectively.

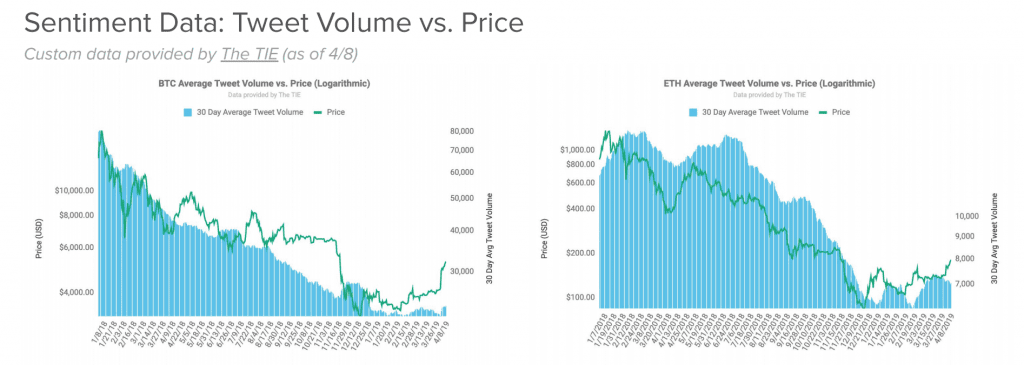

The report also examined tweet volumes, indicating a strong correlation between tweet volume and price, and that tweet volumes have been on the rise in 2019.

Still, these volumes haven’t come anywhere close to the volume we saw in January 2018, when Bitcoin was the subject of 80,000 tweets per day. At present, #Bitcoin is mentioned 22,000 times per day, up from a low of 14,500 last winter.

These strong correlations between tweet volume, sentiment and price, coupled with the fact that tweet volume has been growing and sentiment has become more positive, point toward a strong short-term outlook for both Bitcoin and Ethereum.

That might not be enough to convince the most hardened pessimists, but it’s a strong indication that the market is changing course. The crowd, it seems, is voting with their tweets.

Earn with Nexo

Earn with Nexo