VeChain Poised for Higher Highs as Resistance Weakens

VeChain (VET) sits at a pivotal point that could see it march towards new all-time highs.

Key Takeaways

- VeChain continues to consolidate in an ascending triangle pattern.

- While some technical indicators point to a correction, the VET cryptocurrency sits on top of stable support.

- Breaking through the $0.031 resistance could see this altcoin's market value surge by 37.50%.

Share this article

Ethereum has stolen the spotlight after surging to new all-time highs, but other altcoins such as VeChain (VET) are primed to catch up.

VeChain Waits for Buying Pressure

VeChan has endured a prolonged stagnation period over the past two weeks. While its price has made a series of higher lows since then, the $0.031 resistance level prevents it from advancing further.

Such market behavior seemingly formed an ascending triangle on VET’s 4-hour chart, as a horizontal trendline can be drawn along with the swing highs and a rising trendline along with the swing lows.

An increase in buying pressure around the current price level could push VeChain beyond the overhead resistance at $0.031 to break out of the ascending triangle. If this were to happen, VET’s market value could surge by nearly 37.50% towards $0.043.

This target is found by measuring the distance between the two highest points of the triangle and adding it to the breakout point.

Despite the high probability of an upward breakout, the TD sequential indicator is about to present a sell signal on VET’s 12-hour chart.

The bearish formation would likely develop as a green nine candlestick. If validated, VeChain could retrace for one to four 12-hour candlesticks before the uptrend resumes.

IOMAP Suggests Barrier

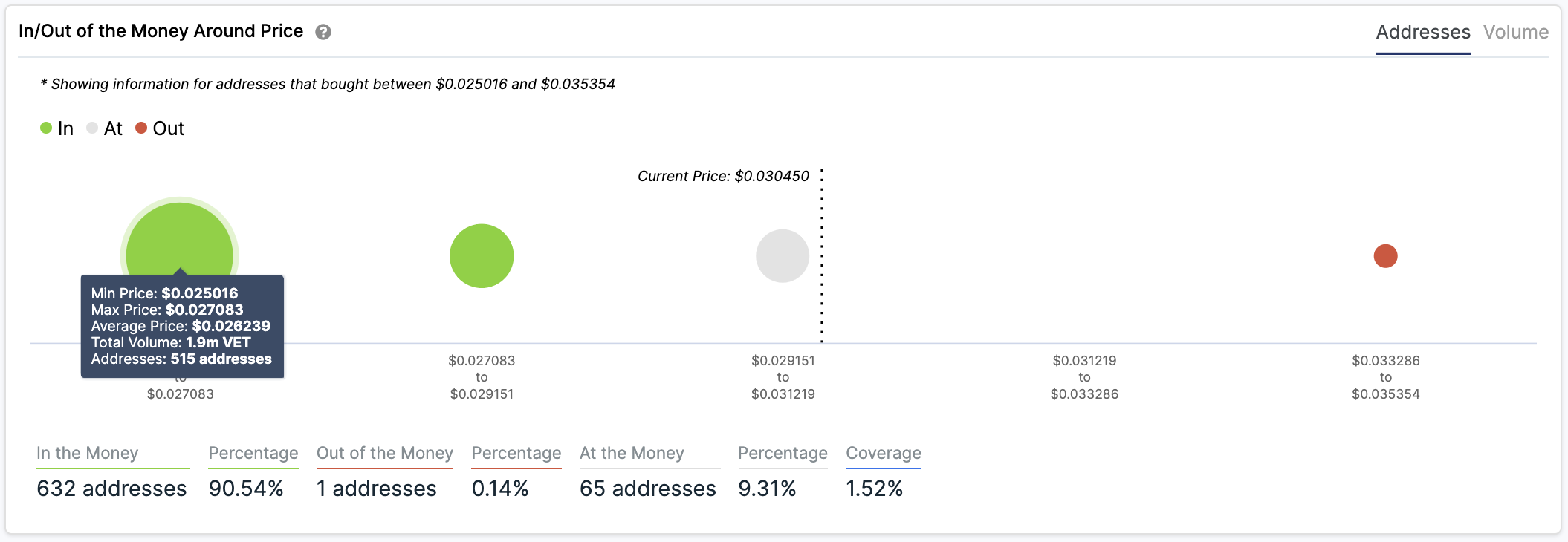

IntoTheBlock’s In/Out of the Money Around Price (IOMAP) model suggests that in the event of a retrace before a potential breakout, the $0.026 barrier might keep falling prices at bay.

Based on the on-chain metric, roughly 520 addresses had previously purchased nearly 2 million VET around this price level. Holders within this range would likely do anything to avoid seeing their investors go into the red. They may even buy more tokens at a discount, propelling prices back up toward the $0.031 resistance.

If the buying pressure is strong enough, VeChain may even slice through this hurdle and reach the triangle’s target of $0.043 as the IOMAP cohorts show little to no supply barriers ahead.

It is worth noting that a candlestick close below the $0.026 support will jeopardize the optimistic outlook.

Under such circumstances, VeChain’s market value would dive by more than 30% to retest the $0.018 support level.

At the time of writing, this author held Bitcoin and Ethereum.

Share this article