VeChain’s Social Metrics Explode and Prices Quickly Follow

VeChain expands its utility while the price of VET aims for new yearly highs.

Key Takeaways

- VeChain social engagement metrics exploded with roughly 78% of all interactions being bullish.

- The chatter seems to be focused on a partnership the VeChain Foundation scored with one of the largest pharmaceutical companies in the world.

- If the hype continues, VET could break above the overhead resistance and march towards $0.009.

Share this article

VeChain is back in the spotlight after proving its utility in a wide range of industries. As the company behind the token scored a new partnership, the price of this token seems poised for a further upward advance.

The Chatter Around VeChain Explodes

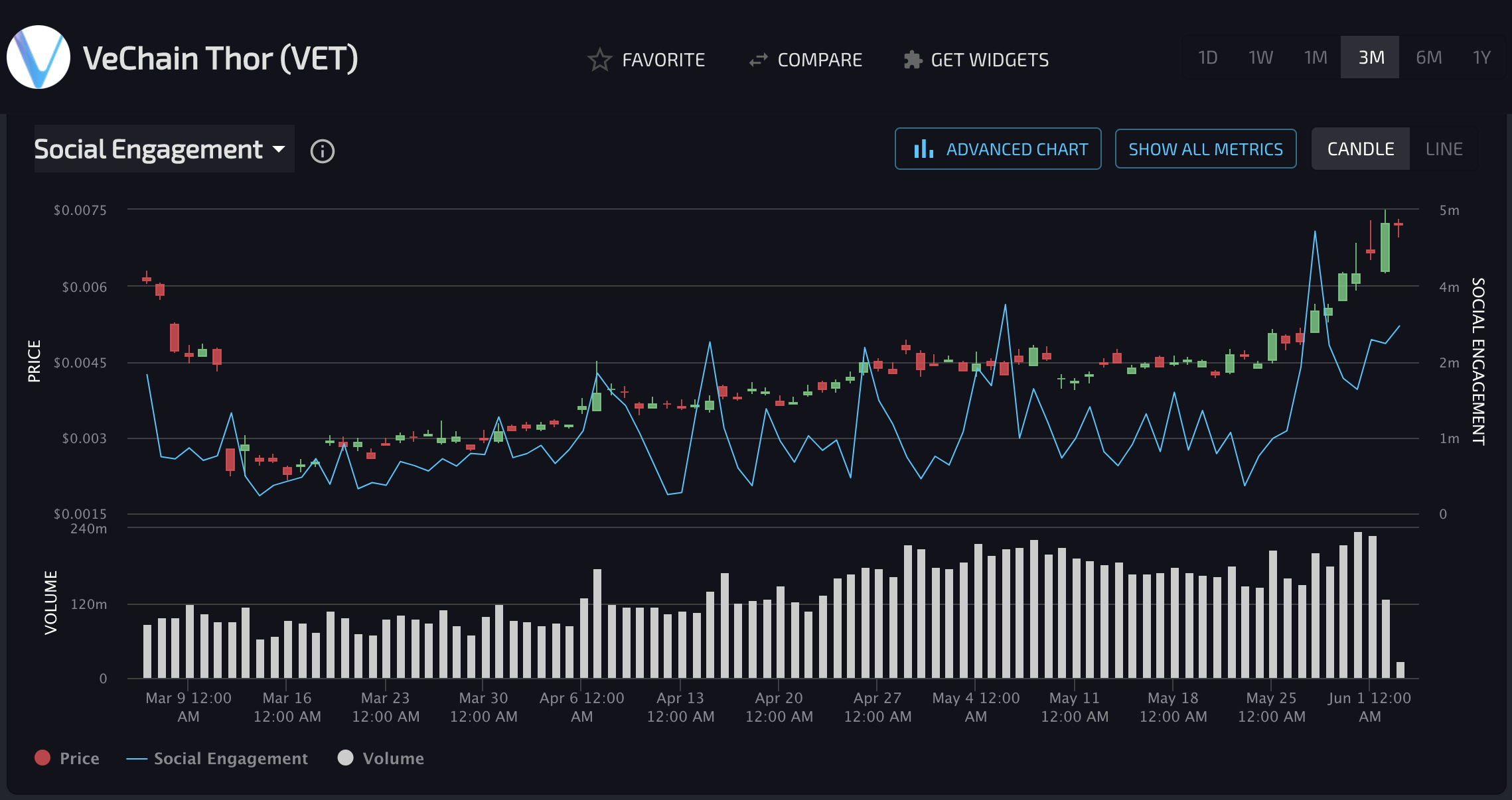

VeChain’s social engagement activity has been steadily increasing over the past two months, according to data from LunarCRUSH. The firm recorded a series of spikes on this fundamental metric that has manifested in equally into higher prices.

LunarCRUSH takes into consideration social media interaction depth using a variety of metrics.

These include favorites, likes, comments, replies, retweets, quotes, and shares to name a few. By analyzing this data, the analytics firm can determine how engaged a community is around a particular digital asset.

The first significant spike in VET’s social engagement metrics took place on Apr. 7, with over 2.2 million engagements on that day alone. But on May 28, social activity around the altcoin skyrocketed, registering over 4.4 million engagements.

More importantly, roughly 78% of all the social interactions have been bullish over the last 24 hours.

The TIE, another data provider, revealed that the high levels of engagement around the VeChain community appear to be related to one focal point.

Bayer, one of the world’s largest pharmaceutical companies, announced that its subsidiary in China is developing a drug traceability, monitoring, security, and auditing solution dubbed “CSecure” powered by VeChainThor technology.

Due to the immutability of blockchain technology, the new platform plans to tackle a series of scandals related to falsely documented vaccines that affected China.

“We’ve experienced the rigorousness of the medical industry by working with Bayer China. I feel Bayer’s professionalism and superb work ethic towards medicine and healthcare causes as a whole,” said Sunny Lu, CEO and co-founder of VeChain.

While the VeChain Foundation continues to expand the utility of its token by tapping a wide range of industries with its traceability solution, the price of VET has done nothing but rise.

This cryptocurrency is up by more than 100% in the last month and on-chain metrics suggest it may have more gas in the tank.

A Bright Future Despite Market-Wide Crash

Despite the latest market crash that saw Bitcoin drop $1,000 in minutes, VeChain was one of the few altcoins that quickly recovered.

VET’s sharp rebound is extremely positive for the continuation of its uptrend.

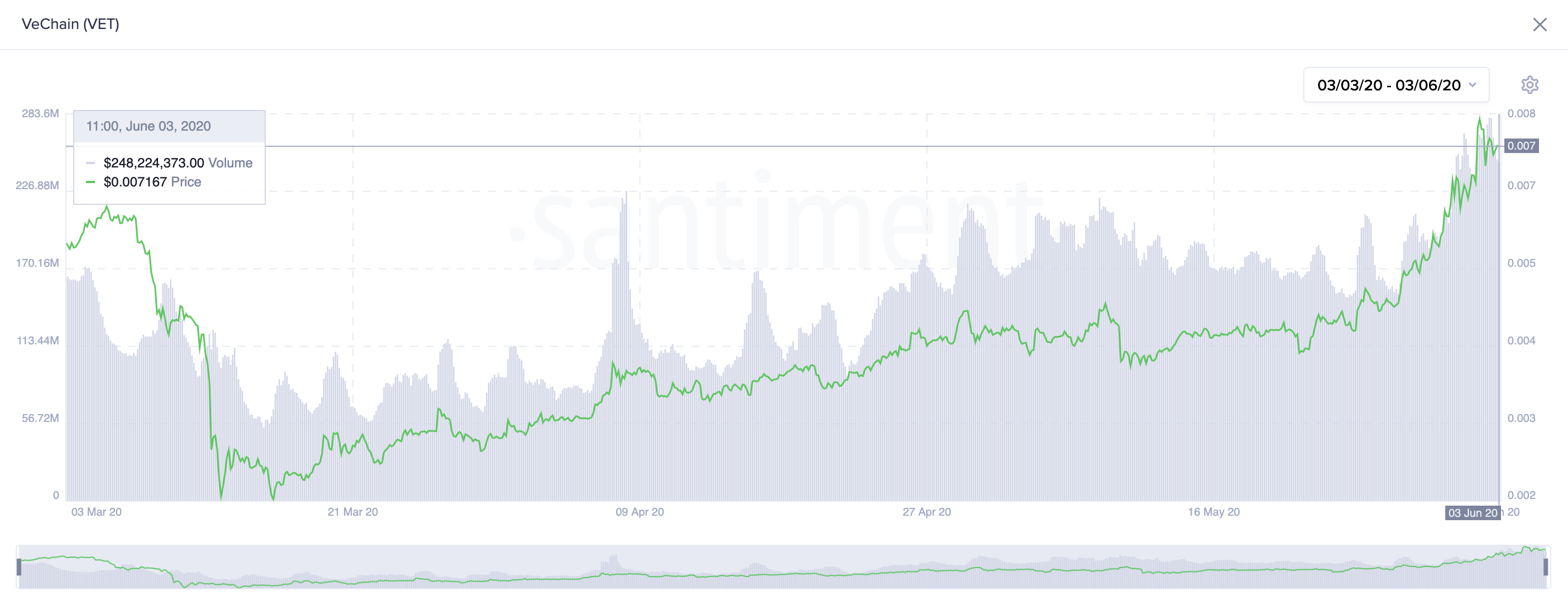

Santiment’s on-chain volume index adds credence to this optimistic outlook. This gauge has been increasing alongside VET’s price, supporting the rally seen in the past few weeks.

If on-chain volume continues to rise, VeChain could be poised for a further upward advance.

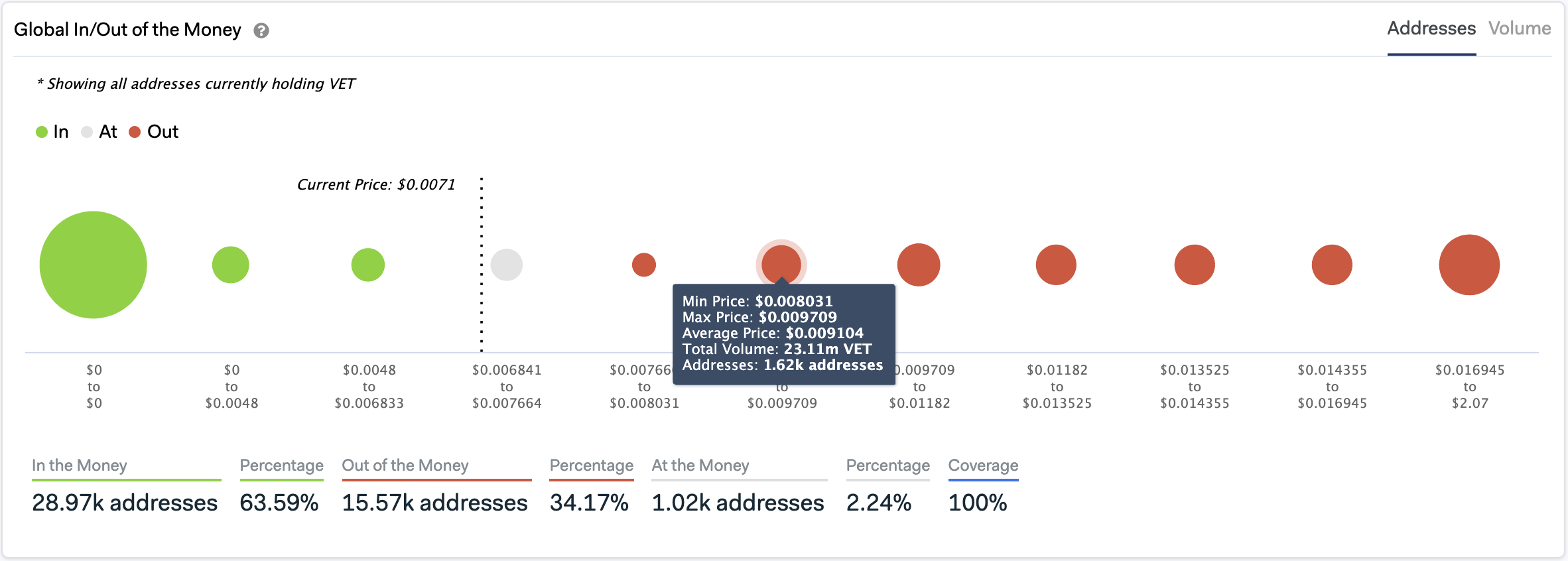

IntoTheBlock’s “Global In/Out of the Money” model shows that for VeChain to reach new yearly highs it must first break above the overhead resistance around $0.0077.

Moving past this price hurdle increases the odds for an upward impulse towards the next significant resistance wall at $0.009 since there isn’t any barrier in-between.

As such, the $0.008-$0.0097 zone is a massive area of supply since more than 1,600 addresses bought over 23 million VET around this price level. And, it may provide strong resistance if VeChain were to climb higher.

On the flip side, the Fibonacci retracement indicator puts a lot of weight on the 78.6% Fib level at $0.0066. A daily candlestick close below this support barrier could jeopardize the bullish outlook triggering a retracement to the next areas of support around the 61.8% or 50% Fib levels.

These support zones sit at $0.0055 and $0.0048.

With so much hype around VET and the VeChain Foundation’s determination to meet China’s demand for blockchain technology, the future of this project seems bright from both a fundamental and technical perspective.

Now, it is just a matter of time before support or resistance breaks to help determine where its price is headed next.

Share this article