When Do Crypto Hedge Funds Invest in Bitcoin?

Although markets are held up mostly by retail investors, crypto hedge funds have been watching Bitcoin closely.

Key Takeaways

- Crypto hedge fund assets under management sit at around $2 billion.

- AUM witnessed 4x growth in 2019.

- Hedge fund inflows into crypto assets appear to correlate with crypto price behavior.

Share this article

A recent report from PWC found that investments in Bitcoin and other digital currencies by crypto hedge funds correlate with crypto price behavior, and have grown over time.

Crypto Hedge Funds Are All About Timing

According to PWC’s 2020 Crypto Hedge Fund Report, hedge fund money is increasingly interested in digital currencies, with investments growing at a 4x pace last year.

A survey of the largest global crypto funds found that assets under management (AUM) doubled from 2018 to 2019.

The findings show that there are currently around 150 active funds in the world. 63% of them were launched in 2018 and 2019, indicating both opportunistic launches at attractive entry points and a strong correlation between Bitcoin price and hedge fund interest.

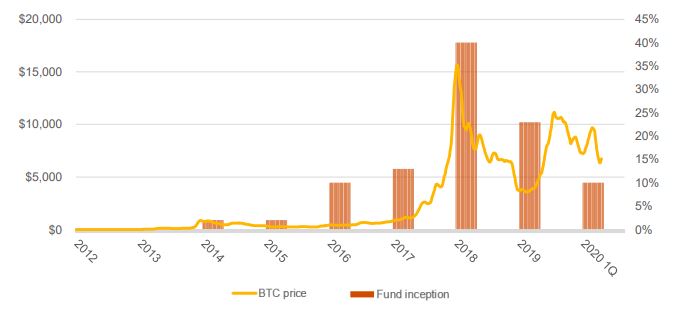

As illustrated in the graph below, hedge funds appear to launch when Bitcoin prices rise.

The chart demonstrates that, at different times, crypto hedge funds launch in response to, and in anticipation of, a rise in the price of Bitcoin.

After hitting all-time highs in 2017-18, Bitcoin attracted around 40% of the funds operating.

The timing of those fund launches suggests managers were following the money and that big money did not cause BTC’s price action at that time.

BTC Dominance Is High Among Hedge Funds

Bitcoin dominates crypto funds, with 97% of them trading the premier cryptocurrency. Ethereum follows with interest among 67% of the funds.

XRP, Litecoin, and Bitcoin Cash have attracted the interest of around a third of all funds. EOS follows with investments among a quarter of the funds.

Average AUM among the firms surveyed stands at around $44 million. That figure has doubled since 2018, reflecting both positive price movements and higher investor inflows. Around 50 funds have more than $20 million in AUM.

The survey results suggest that while these kinds of investments have grown significantly, they remain a small portion of the market.

As Crypto Briefing reported yesterday, on-chain data from Glassnode suggests, the primary growth engine of crypto adoption is still retail traders and investors.

Share this article