Why Bitcoin? Necessity and Desirability of Wealth Transfer

Part 8: Is the redistribution of wealth necessary or desirable?

Share this article

In this series on Bitcoin and money, Crypto Briefing takes a deep dive into the complexities of the modern monetary system and how Bitcoin, as the ultimate hard money, can serve as a solution to many of its problems.

In Part Eight of the series we consider not only whether Bitcoin could facilitate a remarkable redistribution of global wealth, but also whether this is a necessary and beneficial thing to which society should aspire. Once again, our premise is not that ‘socialism’ or ‘capitalism’ are inherently good or bad; more that a healthy economic system is unlikely to see extreme economic power wielded by a tiny minority. The full nine-part series is available here.

Redistributing Global Wealth

In earlier chapters, we examined the history and nature of money and the ways it has changed and been manipulated over the course of time. Today, we examine the movement of wealth in an economy and how Bitcoin may eventually become a tool for the greatest transfer of wealth in history.

Importantly, one must recognize that money is, in its essence, an expression of wealth. It flows through an economy, moving from one participant in the system, such as an investor, to a business, which then carries the wealth through to the production of goods and the creation of labor, disseminating the wealth among workers who may then consume goods produced by the larger ecosystem of businesses.

The wealth is redistributed through spending, taxation, and inflation as well as through the printing of money, which tilts the weight of money, in terms of its value, back toward the top, where it is lent out for the purposes of investment, continuing the cycle.

The Circular System of Wealth

Ultimately, wealth is not created nor is it destroyed. Instead, it is merely circulated throughout the organs and tissue that make up an economic body. When it flows freely between all parts without interference, it can maintain the health of the entire body.

Unfortunately, in an unhealthy economic situation, it can be accumulated at certain choke points, like an embolism, as it struggles to make its way through the inefficient system.

Wealth can also be imagined to be like energy; it only moves from one entity to another, perhaps changing in form, but not ever being created or destroyed. Over extended periods of time, money can be observed to move in a cyclical pattern through the economy. This cycle of wealth can be witnessed on a macro scale in the rise and fall of economies throughout history.

Wealth is transferred between various classes, through the implementation of policies, economic innovations, and management failures, at times concentrating into fewer wealthy and powerful hands, and at other times spreading more widely among the population.

Examining the movement of wealth from 1800 to the 1920s in America, the wealth gap widened, but then reversed from 1920 until the 1970s, in a period called “the great compression”, during which time the “wealth of a typical family increased by a multiple of 40.”

Since the late 1970s, however, the wealth gap has rapidly widened again, during a time now referred to as “the great divergence.” The cycle appears to continue, indicating the potential for future patterns in the cycle that are worth watching.

In recent decades, the wealthiest minority has enjoyed a positive shift in the concentration of money, as mentioned previously. Those holding the greatest wealth tend to seek shelter in assets that are intended to store value. Real estate in particular is bought up, especially in “stable economies,” where, as we mentioned earlier, wealthy individuals may snap up properties—not for the purpose of living—but simply for parking money safely.

At the same time, many of the ultra-wealthy seem to be running out of ‘stuff’ to spend their money on, buying extremely extravagant “assets” in a competition for who can live the most lavishly.

This phenomenon is eerily reminiscent of the economic conditions shortly before the fall of the Roman Empire.

Before the Fall

Looking at the similarities between today’s ultra-wealthy and those of the Roman Empire before its collapse, we see both could be identified as an age of excess for the few elite. A stark contrast exists between the extremely wealthy and those who are “just” wealthy:

“… the differences within the wealthiest one per cent are almost as stark as the difference between the top one per cent and the remaining 99. The millionaires want to reach the level of decamillionaires, who strive to match the centimillionaires, who are trying to keep up with billionaires. The result is very intense status rivalry, expressed through conspicuous consumption.” (Source: Peter Turchin, Professor of Ecology and Evolution at the University of Connecticut and Vice-President of the Evolution Institute, author of ‘War and Peace and War: the Rise and Fall of Empires’)

This conspicuous consumption—a competition to live even more lavishly than the billionaire neighbor—is symptomatic of a corrupted and unsustainable economy:

“Towards the end of the Republic, Roman aristocrats competed by exhibiting works of art and massive silver decorations in their homes. They threw extravagant banquets with peacocks from Samos, oysters from Lake Lucrino and snails from Africa, all imported at great expense. Archaeology confirms a genuine and dramatic shift towards luxury.”

Today, modern extravagances in the wealthiest economies are remarkably similar, with the ultra-wealthy competing to one-up each other in luxurious excess. Billionaires spend millions and even billions on works of art, yachts, private jets, custom-designed and vintage cars, as well as collections of extravagant homes scattered around the world.

It seems the wealthy just don’t know what to do with all of their money. All this while nearly ten percent of America’s population lives on food stamps.

This phenomenon of extreme economic disparity also happens to coincide with a broad policy of monetary recklessness that may well contribute to economic collapse, as it certainly did in the case of the Roman Empire.

This Time, It’s Different—Really

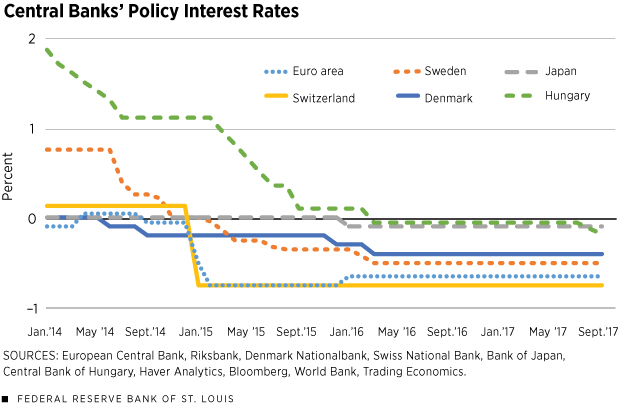

We are once again approaching the end of one of many cycles of wealth that ebb and flow throughout history. This time, however, there is a very important difference; central banks have never before in the history of humankind used negative interest rates to unnaturally sustain a stage in the cycle beyond its natural resolution on such a large global scale — a scale that is growing.

We are delving into uncharted territory.

To continue the movement of wealth in currently unhealthy economies and to sustain the “central banks’ firepower”, economists have generated a range of “ingenious proposals,” from taxing cash held in deposit, to lottery schemes that declare random banknotes void, making them risky to hold.

Some economists have proposed phasing out cash altogether, and this particular approach to forcing payments on negative interest rates is already taking place in some countries, as mentioned earlier.

This is causing a shift in the understanding of money and interest:

“When central banks started dropping interest rates to below zero without adopting any measures to make cash costly to hold, it changed the prevailing worldview. Zero was no longer the lower bound on interest rates. It turned out that many were actually willing to pay for the convenience of not having to hold their savings in cash.” —Kenneth Rogoff, Harvard University

Economists aren’t really sure just what the lower bound on interest rates might be, with Switzerland dabbling with -0.75% rates.

“Views have been voiced on where the effective lower bound might be and what it depends on. But in the end, we still do not know; no country has reached this point, and it remains unknown just how much further interest rates can be cut before we see a broad shift into cash,” said the IMF

This is where things can get very dangerous for everyone involved. We simply do not know where the breaking point is, at which the whole arrangement falls apart. At some point, however, the zombie economy jig will be up. We just don’t know exactly when:

“The most important concern when it comes to negative interest rates is that we do not know at which point people, corporations or financial institutions will want to sell all their bonds and bank deposits and demand cash instead. We don’t know where the lower bound is, and inadvertently reaching this point could be bad for the trust and smooth functioning of the financial system,” said the World Economic Forum.

From Old Money to New

As mentioned earlier, wealth can not be created or destroyed; it simply moves, like energy, from one place and form to another. Wealth will not disappear when the economy reaches this theoretical “lower bound,” but it will move elsewhere.

Most commonly, those who seek to hedge against financial downturns rely on gold, silver, and real estate.

Bitcoin, as the hardest money in the history of humankind, may serve well as fiat wealth tends to move toward hard assets during times of uncertainty and instability.

Bitcoin was cleverly designed to behave in virtually the opposite direction from fiat currency, which tends to centralize and become concentrated over time. Through the process of mining, which creates bitcoins, the currency is dissipated and decentralized over time as new parties can accumulate their wealth in the hard asset, either by purchasing the bitcoins or by mining it themselves.

Wealth is then disseminated in such a manner that is essentially the opposite of fiat, distributed to any party who wishes to be involved in its production and circulation rather than being reserved for a few elite cronies. This negates the possibility of a Cantillon Effect where the already rich can borrow easy money for free and gain wealth through the accumulation of assets from the rest of the population.

Bitcoin is therefore fairly distributed, unlike the current monetary system which is not all that different from a Ponzi scheme, whereby the wealthiest escape from the collapse of currencies by holding assets instead of fiat, leaving the less wealthy holding the bag when their modest fiat savings becoming worthless.

Bitcoin Mining Risks

In the early years of Bitcoin mining, miners were risking their own capital, “with no guarantee that the Bitcoins they received would ever have value.” “Faucets” were created that freely distributed bitcoins to anyone interested, in order to spur on adoption.

Early adopter, Laszlo Hanyecz, agreed to pay 10,000 bitcoins for two pizzas on what has now become known as “Bitcoin Pizza Day.” He made this trade two more times in an effort to disperse bitcoins. Many of these early adopters made a concerted effort to “spread the wealth” distributing bitcoins to a widening population. This trend continues, with 15% of all BTC moving out of old addresses to new buyers in 2017.

It’s worth noting that as of today, Bitcoin’s market capitalization is extremely tiny compared to traditional markets, so wealth is highly concentrated in relatively few addresses. The vast majority of people around the world own no Bitcoin whatsoever and many Bitcoin wallets only hold small amounts while a few hold quantities worth millions in USD value.

This relationship, sometimes called the Gini Coefficient, should gradually diminish due to the free market buying and selling of the asset that takes place over the course of time. Again, this moves in the opposite direction from fiat, which causes wealth to gradually become more concentrated.

Revisiting De-Dollarization

Earlier in Part Three, we examined the current global trend toward de-dollarization. Certain nations that are interested in moving away from dependence on the United States Dollar are finding ways to escape its influence, much to the chagrin of America’s Central Bank, the Federal Reserve.

As nations choose to forego settling international trades in USD, demand for the dollar may diminish. This is terribly problematic for certain powerful and wealthy parties, especially those with a vested interest in maintaining the status quo.

If a few nations were to begin a trend toward settling in decentralized cryptocurrencies like Bitcoin, the implications are enormous. This is not as far-fetched as it might seem to be. With citizens in heavily sanctioned regions like Iran turning to Bitcoin, the notion of using the currency to reject the dollar is not inconceivable.

When central bank governors like Mark Carney suggest a digital reserve currency “could dampen the domineering influence of the US dollar on global trade,” it’s probably time to think seriously about this possibility. If a single nation were to, for example, declare a percentage of its reserves to be held in Bitcoin, others would promptly follow in a rush to avoid being left behind.

This is, of course, hypothetical, but it does beg the question: Are we on the verge of an impending battle between old and new money?

The Status Quo Versus Bitcoin

One could make the argument that a war has already begun against Bitcoin. A constant stream of negative press focuses on the currency’s utility in terrorism, crime, and the drug trade.

As we observed in Part Four, the American dollar is by far the most used currency for such activity and banks have happily cooperated in its usage for such nefarious activities on numerous occasions. Still, the false narrative may be effective at discouraging adoption that would move money and control away from banks into the hands of Bitcoin holders.

These same parties will downplay the advantages of a decentralized currency whilst promoting centralized digital currencies as the next big thing. Facebook’s Libra and government-created digital currencies have recently been presented as the new way to give “the unbanked” access to wealth where cryptocurrencies have so far failed to take off for the most part.

In reality, these new centralized currencies merely offer more corporate control of personal wealth. These currencies can continue to be manipulated with easy production, fractional reserves, and quantitative easing, with the added corporate benefit of total surveillance of transactional behavior of all participants.

An Ideological Battle

Unlike fiat currency wars, this particular currency battle cannot be physically enforced. It is instead fought in the minds of consumers who are told repeatedly by the powers-that-be to steer clear of the dangerous alternative.

It may take the newer generations, brought up as digital natives, for currencies like Bitcoin to gain wider acceptance. Teenagers are accustomed to digital currency whether it’s used for buying video games, music, or paying for virtual items to show off to friends.

Still, many may not understand the difference between a centralized digital currency and a decentralized cryptocurrency. This new population could easily be misled to accept a cashless approach to the economy, with all of its problems, as we noted way back in Part Three.

Unfortunately, it is often crisis that allows for genuine and significant change. As the economic status of young people continues to diminish, more people may begin to question the current paradigm. The current system is making it more difficult for young adults to buy houses, or in many places, just to buy affordable food, with everyday living becoming unaffordable while a tiny minority sits atop vast troves of wealth.

This economic scenario is not unlike the conditions leading to the French Revolution and many other uprisings of a similar nature. An interest in shifting to monetary independence and a rejection of the marriage of money and state may be an inevitability.

While revolutionary paradigm shifts have required violent means in the past, Bitcoin may offer a peaceful monetary transition, changing who holds the reins of power in society. The key difference with this revolution is that Bitcoin requires no military coercion, instead quietly infiltrating and usurping power every time an individual makes a choice to store or transact it instead of relying on enforced stores of value and mediums of exchange, such as the dollar.

In the American Revolution, a major point of conflict was “taxation without representation.” Similar conditions of resentment now exist, with indirect taxation via inflation and quantitative easing that is causing greater poverty and animosity toward malevolent powers.

Whereas the French and American revolutions were infamously bloody and violent, the Bitcoin revolution is a gradual peaceful movement of wealth that slowly seeps its way into society through the democratic act of free market consensus.

In the final essay in our series, we will examine the changes that will need to be made to facilitate global adoption of Bitcoin… and the likelihood of them occurring. Having made the argument for a decentralized digital currency that can create a more inclusive economic model, we finally advocate for those changes and urge the reader to participate in the Bitcoin economy.

Share this article