Why Bitcoin? Banks Versus the World

Part 4: Banks, do we really need them in a world of Bitcoin?

Share this article

In this series on Bitcoin and money, Crypto Briefing takes a deep dive into the complexities of the modern monetary system and how Bitcoin, as the ultimate hard money, can serve as a solution to many of its problems.

In Part Four of the series we examine the banking system: how banks make money, and how Bitcoin and other cryptocurrencies empower ordinary citizens. The full nine-part series is available here.

Bitcoin and Money—Recap

So far we’ve taken a look at the history of money; the notion of Bitcoin as ‘digital gold’ and some of the macro-economic forces that shape the global economy.

In our last exploration, we posited that the current global monetary system is rife with problems that have enormous consequences, which we see coming to fruition in today’s global economy.

It should be no surprise then, that today’s conglomeration of banks and financial institutions has taken full advantage of these flaws to enrich themselves and their closest allies and friends, at the expense of the rest of the world’s population.

This begs the question: How might a sound monetary foundation instead be used for the benefit of many?

Fees And Inescapable Debt

Many people wonder, how exactly do banks make so much money? The answer is more complicated than first imagined. There was a time that the bulk of a bank’s revenues would have been gathered via fees and loan interest. Over recent decades, however, we have seen banks expanding their reach, extending a broader umbrella over much more economic activity.

While fees and loans do make up a pretty hefty sum of a commercial bank’s revenues, it’s really just scratching the surface of the money that banks can access and thus control.

The key concept that carries through all of the tools that a bank uses to make itself wealthy is that money gets continuously concentrated into greater density, funneling into an ever-tinier proportion of the population.

Fees are certainly one of the major ways banks do generate substantial revenues, often at the greatest expense of those with the least money. One can observe, just by examining fee structures alone, that an inversely proportional relationship exists between banks’ revenues from clients and the economic status of those clients.

To sum up the relationship; the lower the income of the bank client, the higher the proportional cost of accessing bank services tends to be.

The lowest income-earners might even forego using a bank account entirely due to the basic monthly fees that can be unaffordable to those on the socio-economic fringe. Many major banks charge monthly fees to clients who don’t keep a balance of at least $1,500, for example.

Such a potential client might resort to instead using cash or perhaps buying prepaid debit cards with high fees. Any borrowing activity would be of the payday loan nature, where users are often charged predatory interest rates. Such loans, of course, are not of the forward-thinking investment variety, but are instead usually borrowed to cover emergency expenses or basic living costs.

While payday and other unsecured loans have traditionally been under the purview of businesses outside the banking system, the market for these sorts of loans is changing. Not wishing to leave such profitable potential returns languishing on the sidelines, more banks are beginning to offer such lending options to their most financially-vulnerable clientele.

Moving up a step from the lowest rung of the economic ladder, a bank account holder with limited to moderate means may get access to basic credit cards.

Charging upwards of 15% on any borrowed funds, payment schemes on credit cards are often designed to encourage low-income borrowers to make minimum payments that will squeeze out the maximum amount of interest charges over the longest period of time.

Penalty interest rates charged to these clients for late payments often approach the maximum legal amount of 29.99%. These same clients are often encouraged to increase their credit limit and are enticed with “You’re richer than you think” ads that conflate access to credit and its subsequent debt with actual wealth.

Add to this the cost for overdrafts, penalties for moving accounts or mortgages, commissions on investments, and application fees for any of a wide variety of services, and it’s easy to see how banks can maximize their profits by leveraging the needs of the most vulnerable and, sadly, the most financially inept.

Without meaningful regulation, banks have proven time and time again to be willing to lend well beyond the means of borrowers. These businesses have often been shown to lure clients into unmanageable debts, especially for cars and homes, that they have no business having in the first place.

It rings consistent with the adage of “buy now, pay later” that is so predominant in modern culture. This has resulted in an economy that accepts extreme levels of national and personal debt, teetering on the edge of collapse as it attempts to endure through decades with little hope of escape.

Sadly, however, this is just the tip of the iceberg when it comes to how banks really pull in massive revenues.

Banks Betting Against Clients And Workers

To be fair, banks are businesses; not charities. And they should indeed make money for their shareholders. One could make a fair argument for the justification of fees and the imposition of higher interest rates on higher-risk borrowers. Yet, no such argument can be made to support the reckless “investments” banks have been known to dabble in since being given the freedom to do so.

When Goldman Sachs hedged against an imminent housing collapse in 2007, it did so at the expense of its own clientele. Essentially, the firm pawned off bad debt to trusting investors who then were left with the losses.

Goldman went so far as to “sell short”, or bet against these bad debts after shilling them to clients, and then made off with huge profits when their bets paid off. Deutsche Bank and Morgan Stanley, among others, also participated in this nefarious activity, costing American investors billions.

Sylvain R. Raynes, an expert in structured finance, assessed the clear conflict of interest in this all-too-common scenario:

“When you buy protection against an event that you have a hand in causing, you are buying fire insurance on someone else’s house and then committing arson.”

Banks and other financial institutions were in on the action, working together to their own benefit, at the expense of the larger population. Unfortunately, when left to their own devices in their constant quest for further deregulation, such entities often do not compete for the betterment of the market at large.

Adam Smith, the father of modern economics and writer of “The Wealth of Nations”, warned of this problem when he explained that businesses will collude, not compete, if left unfettered:

“People of the same trade seldom meet together, even for merriment and diversion, but the conversation ends in a conspiracy against the public, or in some contrivance to raise prices.“

Similar predatory behavior is exhibited by private equity firms, which remain free to feast upon the assets of what have been long-standing retail companies, at the expense of their workers.

These financial predators take advantage of near-zero interest rates to borrow funds and purchase companies, not as an investment, but merely to consume them. After hollowing out the subsequently bankrupted companies by selling off their assets and seizing their pension funds, these parasitic institutions have brought an end to many a household name from Sears to KMart to Toys R Us, leaving workers bereft of jobs and deprived of what would have otherwise been secure retirements.

Banks and Criminal Behavior

Again, while banks should indeed be free to profit from legitimate activities, such freedom does not excuse banks from acts of fraud, collusion, and money laundering. Without going into a comprehensive list, here’s just a few recent samples of occasions where banks were caught in criminal behaviour:

- Wells Fargo was fined for multiple account abuses, stealing funds from their own clients in a series of scams ranging from insurance and mortgage fraud to creating fake accounts and then charging customers fees for the created accounts.

- HSBC was caught money laundering for Mexican and Colombian drug cartels, essentially acting as a willing accomplice in large-scale crime, drug addiction, and murder. Netflix has a documentary about it.

- JPMorgan Chase has been fined for corruption and fraudulent behavior numerous times, most infamously for their involvement in Bernie Madoff’s Ponzi scheme. They even managed to pay some of their fines with money that was raised fraudulently.

- The Bank of America has been bailed out by taxpayers after committing fraud against investors, homeowners, and other clients.

- Citigroup, Goldman Sachs and other banks are also in on the criminal action.

And these are just examples of the times these criminals have been caught!

Banks have paid billions and billions of dollars in fines… yet the cost of committing these crimes is massively outweighed by the profit in continuing to accept fines as a cost of doing business.

Money as a Weapon

Since the innovation of fiat as a monetary system, easy money has gained the capacity to be weaponized, particularly when hostile economies choose alternative currencies that do not fall under the sovereignty of certain military powers.

Libya, Venezuela, and Iran again serve as reminders of this system, whereby the United States uses the dollar as a weapon, via sanctions. Excluding countries from the global monetary system commences a stranglehold that often leads to violent resolution. Thus, weapons, vehicles, and military forces can be produced and deployed, funded by infinitely printed fiat currency.

Global authority and acceptance of the dollar is thereby enforced, first through sanctions, but eventually in many cases, through war.

Because the fiat currencies of the world have no genuine market value, sanctions and violence are the necessary means of coercion for maintaining a market “value” for such currencies. Thus, central banks and their allies continuously push for war in an effort to maintain the status quo.

This is performed in an effort to stave off economic slowdown and, importantly, to maintain the authority of fiat.

The enforced acceptance of easy money in the place of genuinely valuable hard money, which can instead be freely accepted by willing market participants, contributes to the corruption of monetary priorities in government policy.

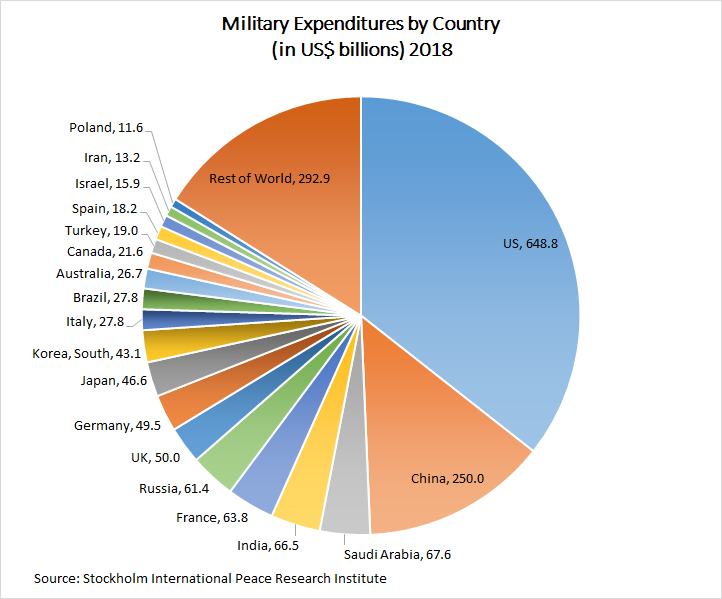

This monetary perversion is most evident when one observes the astronomical government spending, nearing a trillion dollars annually when all components of military spending are counted, on America’s military industrial complex.

Through taxation and highly effective inflationary tools like quantitative easing, American citizens are forced to fund a military that consumes more than half of all annual discretionary federal spending.

This totals an amount greater than the next ten countries spend on their military programs together.

To put this further into perspective, consider that the second highest spending priority in America’s discretionary federal budget is Health and Human Services, which includes Medicare, Medicaid, and the Affordable Care act. At a budget under $90 billion, less than 10% of what is spent on the military is spent on these programs.

Federal discretionary spending on education stands at $70 billion.

Yet, the same spending policies continue from year to year, from term to term, and from government to government. With a constant stream of military contractors voraciously lobbying the government and convincing citizens of the ongoing need for more war, defense is no longer a priority.

Instead, perpetual war is the order of the day and, frankly, is necessary to keep the dollar on top against all competitors. Orwell had a point.

The Cantillon Effect

The undue influence of central bank fiat production and manipulation emerges most damagingly in what is referred to as the Cantillon Effect. In summation, central banks create buying power at the top amongst those who first have access to funds at no cost, with newly printed currency being filtered down through the economy as it gradually diminishes in value against assets.

This phenomenon results in inflation as the currency eventually trickles down to those at the bottom. Those who first receive the newly created money see a rise in income while those who receive it last experience a decline in purchasing power.

Because central and commercial banks, along with other financial institutions, hold a monopoly on the production and initial acquisition of previously non-existent money, they can purchase goods, services, and assets prior to the devaluation of the currency. This results in the lion’s share of the economic benefit concentrating further towards these institutions at the expense of the rest of the market.

The Cantillon Effect causes a sort of modern feudalism whereby an oligarchy of financial institutions has become the new “landowner” class, gathering up ownership of the vast majority of real-world assets, with the working citizenry taking on the role of the serfdom:

“In the same manner as the landed aristocracy of times past extracted rent by virtue of monopolistic ownership of land, so today the financial oligarchy extracts interest and other financial charges by virtue of having concentrated the major bulk of national resources in their hands in the form of finance capital.” —Ismael Hossein-Zadeh and Anthony A. Gabb.

These modern-day feudal lords are able to acquire virtually interest-free money, enabling them to hoard real-world assets at the lowest possible cost. They can then profit from lending out the wealth at higher interest, returning even greater wealth back to themselves in an oppressive feedback loop that is predicated on the creation of fiat currency from thin air.

How the Monetary System Could Work for Individuals

It’s clear that the global monetary system needs a complete reboot. But such an enormous shift can’t be of the top-down nature. Clearly, it is against the interests of a tiny minority of extremely wealthy and powerful financial authorities to see such a monetary transformation take place.

This is a change that must happen organically. It can only be accomplished through the principle of decentralization.

With the creation of decentralized money, namely Bitcoin, no central authority can directly produce and enjoy the benefits of money creation and its initial distribution at the expense of all others. Competition and the freedom for anyone to participate in its production, distribution, and acquisition is baked into the protocol.

With hard money as the base layer, quantitative easing becomes impossible, allowing citizens to retain value in their money.

Decentralization of money production also negates the Cantillon Effect. With hard money as the base currency, easy money can not simply be fabricated out of thin air and doled out to those with the privilege of having first access to the funds. Decentralized, free-market money thus ends modern monetary feudalism by enabling “serfs” to become “landowners” themselves.

The benefits do not end with the abolition of quantitative easing and the Cantillon Effect. With wealth no longer being controlled strictly “at the top”, commercial banks can no longer gamble away client investments on bad debt, nor can they bet against the economy with the same degree of knowledge and influence previously available to them.

Even problems as simple as exorbitant fees can be minimized, as there would be no need for funds to be held in traditional bank accounts. Fees would be of the free-market nature, required for confirmation of transactions and to cover the costs of other financial services.

Borrowers could complete applications for loans via smart contracts, with decentralized lending made available on a broader scale. Clients could choose a lender with far greater market competition and freedom, rather than depending on a select few central authorities to approve loans.

Decentralized money also succeeds in removing the capacity for central and commercial banks to collude against clients. Without direct control of the currency, the technology significantly reduces the capacity of banks to commit acts of fraud or money-laundering. Banks can no longer so easily act as the laundry machine of cartels, with the distributed open ledger of Bitcoin being visible for all to examine and scrutinize.

The implications even reach into the corrupt lobbying of political systems and the current militarized condition of the world. No longer would a military industrial complex have the same undue influence on the government as it currently does with its access to easy money.

A political campaign funded by Bitcoin, for example, would be transparent and accountable, with donations being tracked and known. This eliminates the “you scratch my back, I scratch yours” mentality of the current political campaign lobbying relationship.

Money can no longer be weaponized as it is with the current fiat system, since a decentralized monetary system holds no sway on a nation’s ability to trade with another nation. Thus, the capacity for military aggression and war diminishes.

In a decentralized monetary system, citizens enjoy financial sovereignty. Hard money, by nature, incentivizes saving, wiser spending, and investment.

As funds for unwanted costs cannot simply be siphoned away by banks and financial institutions via the printing of easy money, citizens can choose instead to spend on societal benefits and their own free market choices, without the need for any form of coercion by central powers.

In Part Five of this series, we move into more political territory, considering the thesis that political extremism inevitably results in greater centralization: in a highly-controlled markets such as under a Communist government, that may be a nepotistic oligarchy; while under unfettered free-market capitalism, it might manifest as a corpocracy.

Share this article