Wirecard is Missing $2 Billion on Audit Deception, According to EY

The issuing company behind notable crypto-powered payment cards has failed an audit from Ernst & Young.

Key Takeaways

- Wirecard is missing $2 billion from its balance sheet.

- The company is responsible for issuing notable crypto payment cards from Crypto.com, TenX, and Wirex.

- Customers of those cards will not be directly affected.

Share this article

Wirecard, a popular payment processor and debit card issuer for crypto cards, is unable to locate 1.9 billion EUR. The missing funds make up one-quarter of the firm’s balance sheet.

Spurious Balances

The absent funds were detected by the company’s auditor, Ernst & Young (EY), which revealed that there was “no sufficient audit evidence” for cash balances on Wirecard’s trust accounts. Supposedly, Wirecard’s third-party trustee provided “spurious balance confirmations” to deceive the auditor and create false perceptions of cash balances and holdings.

Though Wirecard is working to resolve the problem, the firm’s annual financial statements will be delayed. This is the fourth time the company’s annual audit has been postponed. Because of these issues, banks will also be able to terminate loans—up to a value of $2 billion—that they have issued to the Munich-based company. The news has caused Wirecard’s share value to crash, with prices dropping from 104.50 EUR to 39.90 EUR in just hours.

Crypto Customers Unaffected

Wirecard is relevant to the crypto world because it is the issuing company behind popular cards like Crypto.com, TenX, and Wirex. However, the news does not directly impact customers and investors who own those crypto payment cards.

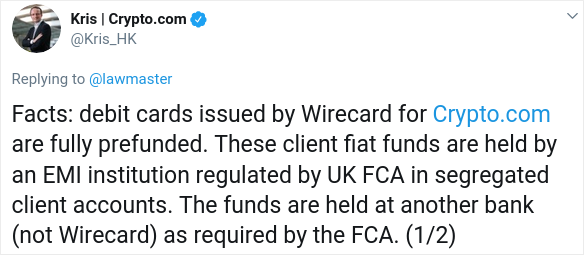

Though Wirecard serves as a card issuer, it does not actually hold any customer funds, according to Crypto.com CEO Kris Marszalek:

Marszalek added in a later tweet that “Wirecard does not have custody of any crypto held by Crypto.com.” Presumably, Crypto.com and other companies could move to a different card issuer if the company experiences further problems.

Nevertheless, Wirecard’s shortcomings are a reminder that centralized cryptocurrency services introduce points of failure that are not present in most blockchain transactions.

Share this article