yEarn Token to Correct, Bounce, and Reach for New Highs

yEarn.Finance looks poised to pull back despite the on-going bullish price action in the cryptocurrency market.

Key Takeaways

- yEarn.Finance is trading at a critical price level that may have the strength to trigger a steep decline.

- The TD sequential indicator adds credence to the bearish outlook after it presented a sell signal on the 2-hour chart.

- If sell orders begin to pile up, YFI's price could drop to $21,500 before resuming its uptrend.

Share this article

Extreme levels of “greed” in the cryptocurrency market continue to pose a threat to top coins, including DeFi’s so-called “blue chip” tokens. Coincidentally, yEarn.Finance is forming multiple bearish patterns, suggesting that a correction is in the works.

yEarn.Finance to Dip Before Further Gains

Though Bitcoin has stolen the crypto spotlight given its impressive run to new all-time highs, several altcoins are poised for a correction before higher highs.

DeFi token YFI is exemplary of this. The TD sequential indicator is now presenting a sell signal on yEarn.Finance’s 2-hour chart.

The bearish formation developed as a green nine candlestick. A spike in downward pressure may help validate this technical pattern leading to a one to four 2-hour candlesticks correction.

But if the number of sell orders is significant enough, a new downward countdown to a red nine candlestick could begin.

Such a pessimistic outlook will allow sidelined investors to re-enter the market and propel YFI to new horizons. Indeed, a downswing towards $21,450 would create the right shoulder of a head-and-shoulders pattern forming within the same time frame.

If this support level can keep falling prices at bay, then yEarn.Finance will likely surge to the neckline of this technical formation at $26,650. Slicing through this resistance barrier will signal a 31% breakout towards $35,000.

The bullish target is determined by measuring the distance between the head and the neckline and adding it to the breakout point.

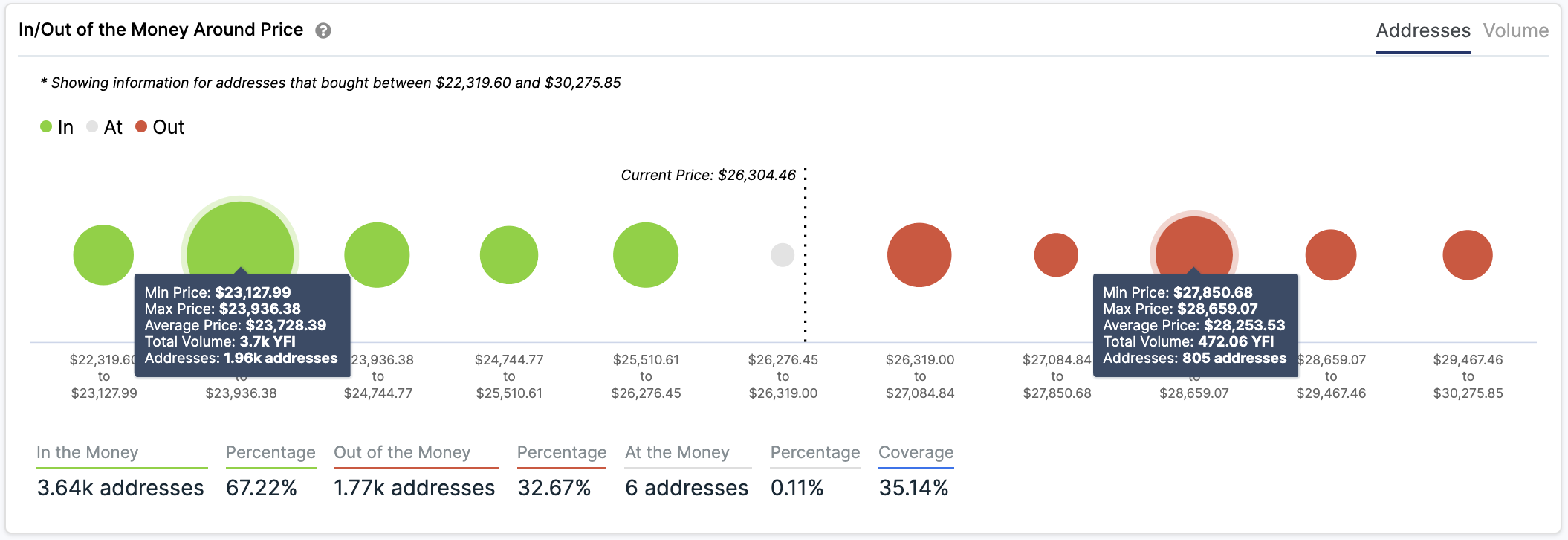

Despite the high probability of a retracement before higher highs, IntoTheBlock’s “In/Out of the Money Around Price” (IOMAP) model reveals that yEarn.Finance faces little to no resistance.

Based on this on-chain metric, the only significant supply barrier ahead lies around $28,000. Here, roughly 800 addresses had previously purchased more than 470 YFI.

A spike in buy orders that pushes the DeFi token above its overhead resistance may invalidate the near-term bearish outlook.

Under such circumstances, YFI could surge to November’s high of $30,000 or even $31,300.

Disclosure: Andre Cronje, the creator of yEarn Finance, is an equity-holder in Crypto Briefing.

Share this article