Bitcoin Breaks New All-Time Highs Targeting $23,000

The bellwether cryptocurrency looks unstoppable after making a new all-time high.

Key Takeaways

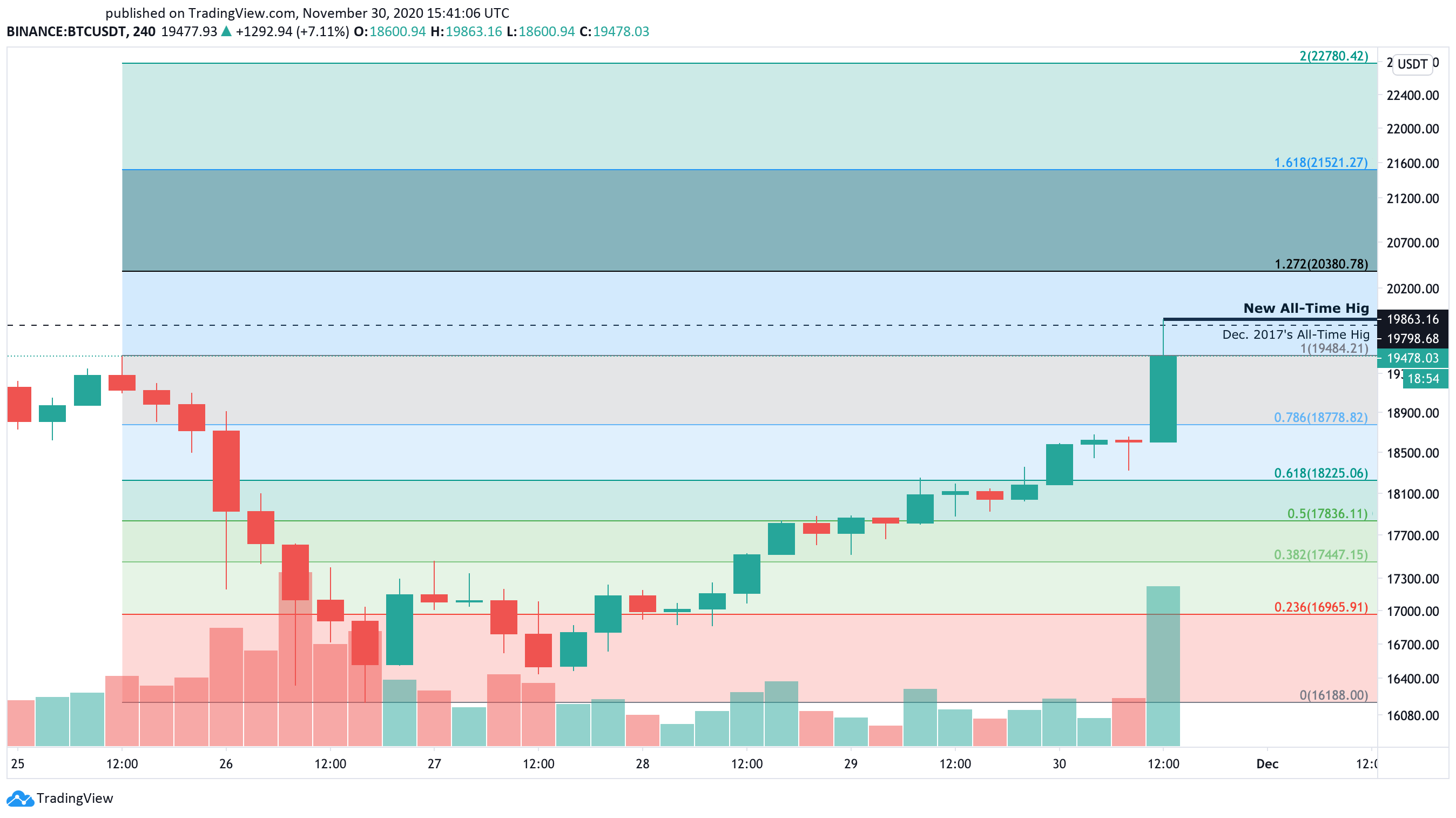

- Bitcoin surged to $19,860, smashing previous all-time highs by a few dollars.

- The recent upswing seems to be fuelled by increasing demand among institutional investors.

- A 4-hour candlestick close above or below $19,500 will determine where BTC is headed next.

Share this article

Bitcoin rose to a new all-time high for the first time since mid-December 2017. While speculation mounts about further gains on the horizon, multiple on-chain metrics point to a steep decline.

Breaking New All-Time Highs

Bitcoin managed to recover all the losses incurred after the 17% retracement of Nov. 25.

Even though more than 200,000 traders were liquidated during the most recent correction in the cryptocurrency market, investors did not wait long to re-enter their long positions.

The spike in buying pressure saw BTC rise by more than 22%. It went from trading at a low of $16,200 on Nov. 26 to hit a new all-time high of $19,860.

Paolo Ardoino, CTO at Bitfinex, maintains that the recent price action can be attributed to the increasing demand among institutional investors.

“Bitcoin’s ascent today to a new all-time high of $19,844 will captivate. Still, of far greater consequence are the fundamentals giving fuel to this rally, notably the increasing presence of institutional investors. Bitcoin is still nascent, and even relatively small allocations into the asset class from investment funds can have a seismic impact.”

If the buying pressure continues mounting, Bitcoin might be able to rise towards $23,000.

A 4-hour candlestick close above $19,500 will add credence to the optimistic outlook as it increases the chances for this potential upswing.

Retail investors do not seem willing to enter the market at the current price levels. Such behavior can be seen in the declining number of new daily addresses joining the Bitcoin network.

This sort of divergence between prices and network growth can be considered a bearish signal.

Usually, when the network shrinks for a prolonged period, prices tend to tumble.

Failing to close above the $19,500 resistance level could trigger a sell-off among investors. If this were to happen, Bitcoin may pull back to the 78.6% or 50% Fibonacci retracement level before the uptrend resumes.

These support levels sit at $18,800 and $17,800, respectively.

Share this article