Zilliqa Digital Asset Report And Evaluation (DARE) by Crypto Briefing

Zilliqa (ZIL) is examined in Crypto Briefing's deep new analysis tool - the Digital Asset Report and Evaluation (DARE).

Our Zilliqa Digital Asset Report and Evaluation takes a close look at the sharding protocol in light of its increasingly competitive operational space, and its significant delays in deployment. The scaling project may have lost some of its first-mover advantage, but there is still considerable hope that it may be one of the business models that succeeds with panache in the cryptocurrency arena.

Introduction to Zilliqa

Zilliqa is a high-throughput blockchain protocol that has pioneered the use of sharding technology to boost network transaction speed.

The system architecture is designed to host a network that is powerful, stable, and fast enough to process thousands of transactions per second.

As a frontrunner in the scalability race, Zilliqa has garnered a significant amount of attention in the space and made solid headway toward delivering a viable product.

Zilliqa Market Opportunity

The high transaction rate targeted by Zilliqa offers a potential gateway for diversifying the use case of DLT, most of which at present remain outside the performance capability of networks like Bitcoin and Ethereum.

To leverage blockchain technology in industries like gaming, digital advertising, financial markets and electronic payments, throughput is one of the most critical roadblocks currently standing in the way.

With a potential breakthrough to this roadblock, Zilliqa has managed to establish partnerships with Mindshare and Infoteria to begin exploring application scenarios in the digital advertising and fintech sectors.

These sectors are projected to have a combined market value of $272 billion by 2020 in the Asia-Pacific region alone.

While Zilliqa was one of the first serious projects in the scalability race, the project has been joined by many others. When it comes to comparable sharding-based protocols, QuarkChain (QKC) has since entered the game, with other projects like MultiVAC (MTV) aiming to enter the market in the near future.

Then there is the elephant in the room- sharding on Ethereum.

Aside from sharding, a number of other methods to reach equal or higher transaction speeds exist that are employed by other blockchain projects.

With this in mind, Zilliqa has taken aim at niche application scenarios through their partnerships to gain a hold on the market. While these partnerships are tantalizing for the future of the project, research on the application of blockchain technology in both the digital advertising and fintech sectors is also quickly gaining momentum.

Zilliqa Underlying Technology

The core technology pioneered by Zilliqa in the blockchain space is sharding. The use of sharding divides the mining network into smaller consensus groups, or shards, which are capable of processing transactions in parallel.

The Zilliqa whitepaper provides an example to illustrate the value add of this design based on a theoretical network consisting of 8000 miners.

The miners are divided into 10 shards, each comprised of 800 miners, without the use of a trusted coordinator. Divided into shards, the network is now capable of processing transactions in parallel with each other. If each shard reaches agreement on 100 transactions, 10 shards together can process 1000 transactions in aggregate.

To reach global consensus across the network, a leader is first elected randomly in each shard to aggregate signatures from other nodes in the group through a PBFT-based scheme.

Each shard submits a microblock to the DS Committee once this process is executed. A leader is elected within the DS Committee itself to verify the microblocks through another PBFT-based consensus process.

Once the microblocks are aggregated, a full block is committed to the blockchain.

Update #1

The Q2 2018 of the v2.0 Zilliqa testnet, D24, launched according to schedule on June 30th. With the timely release, the project appeared to be on track for the scheduled mainnet launch in Q3.

However, on August 6th, an announcement on the Zilliqa Telegram channel stated the mainnet release would be delayed until January 2019 at the latest.

The launch of the Zilliqa mainnet will prove a pivotal moment for showcasing the core value proposition of the network to the cryptospace in what has quickly become a market saturated with protocol after protocol promising higher throughput speeds than the rest.

Moreover, release of the mainnet and accompanying dev tools will complete the foundation on which an ecosystem of dApps could possibly grow. Co-founder Amrit Kumar released the following statement, edited for brevity, about the delay of the mainnet launch:

“Since the release of our technical whitepaper back in August 2017, we have come a long way and have modified part of the initial design and implemented new techniques to make the protocol more performant and more secure (…)

Oftentimes, such modifications to the protocol design required a complete re-design of certain parts of the system. In the past few weeks, we have had extensive discussions to review the timeline in light of these enhancements. Unfortunately, we will need more time to ensure that the code gets properly tested by the core development team, the community and last but not the least, established auditing firms.”

The delayed release of the mainnet and developer tools forestalls the possibility of 3rd party developers building and launching dApps with Zilliqa.

Until a complete developer toolkit and viable mainnet are available, Zilliqa will continue to lose crucial time and, consequently, will take on more risk as competitors push ahead.

Zilliqa Ecosystem

There are two main participants in the Zilliqa network: users and miners. A user is simply an external entity who accesses the network infrastructure to transfer funds or execute a smart contract. Each user has a public/private key pair which functions as a digital signature.

Miners comprise the nodes in the network, who run a PBFT consensus protocol in return for a reward. Each miner has an associated IP address and public key that functions as an identifier for the network.

Through sharding, the mining network is divided into smaller networks. To divide the nodes into shards, a group of miners called directory service nodes (DS Nodes) are selected through a PoW puzzle and placed on the Directory Service Committee (DC Committee). Members of the DC Committee change over an unspecified period of blocks, referred to as an epoch.

To spur growth among dApp developers within the blockchain space, Zilliqa has launched the BuildOnZil “ecosystem fund”. However, the outcome so far has largely served to further build out a range of technical components, rather than entice other projects to build on the protocol.

Whether or not future rounds of the program succeed in onboarding actual dApp projects will provide an important barometer for measuring developer sentiment toward Zilliqa.

Update #1

Efforts to set the initial groundwork for an ecosystem have mainly focused on the launch of a fund for developers and several enterprise partnerships. When measured against the progress Zilliqa has made toward a fully-functional mainnet, interest from potential users of the protocol has been lacking.

The ecosystem development program BuildOnZIL was launched on June 19th to solicit support from the wider developer community toward creation of both dApps and network components that would spur further growth.

On August 14th, program participants and their respective projects were shared with the public. Participating developers have delivered a number of network components like a browser wallet extension, smart contract library for dApps, and an API for Javascript. While many important network components arose from the initiative that will help lay the foundation for development, the current array of tools available to developers interested in building on Zilliqa is still in the early stages.

In the realm of partnerships, the announcement of cooperation between Zilliqa and leading media/marketing company Mindshare initially represented a promising signal that enterprise interest in the project would help drive forward adoption. References about the partnership have died down since the announcement, with only sporadic mentions like a Tweet from the official Zilliqa Twitter account on May 23rd, in reference to a “full value chain solution” pilot-project that would include NASDAQ and NYSE-listed firms.

A question in the Zilliqa Telegram channel on August 21st from a community member regarding enterprise partnerships received a confirmation from their admin that the Mindshare partnership is indeed still on, yet no official updates have been released in several months. In the pre-mainnet stage of any network, partnerships play a crucial role for bolstering confidence in the future of a given project. As time goes by without any updates, that confidence inevitably declines as well.

On August 2nd, 2018, Zilliqa released news of a new partnership with Japanese software company Infoteria. According to the announcement, both companies will promote the Zilliqa platform on Asteria, a middleware product developed by Infoteria that serves more than 6,500 enterprise customers. As an enterprise blockchain integration, the exact relationship with the Zilliqa public blockchain remains unclear.

With the project’s value proposition tied heavily to enterprise deployment, the results of these partnerships hold significant weight; the ambiguity that has shrouded both avenues for adoption calls into question whether the Q4 milestone of key, “anchor” dApps will be met.

These anchor dApps will serve as the flagship fleet for the protocol, instrumental for increasing adoption by demonstrating the true potential of the network to deliver on the promise of high speed transactions.

Missing this milestone would pose another significant setback during what is an absolutely decisive moment in ensuring the long-term success of the project.

The lack of updates on the progress of these anchor apps reduces the surety Zilliqa will reach this milestone by Q4.

Competition In Blockchain Space

Just as the rise of Ethereum catalyzed an emergence of competing protocols built to address the limitations of the network, the implementation of sharding could foreseeably result in the redundancy of these very same projects.

For Zilliqa to compete in any real manner with an Ethereum network using sharding, a robust ecosystem must be established and given time to develop well before a sharding solution is released. The foremost risk factor posed by Ethereum is that adoption levels of the network are simply so high, with 1000+ dApps already deployed on the network.

On May 1st, Vitalik Buterin posted a proof-of-concept on Reddit for sharding on the Ethereum network. As it stands, the current roadmap has set a vague target for implementation of sharding between 2019-2020.

The delayed Zilliqa mainnet release means efforts to attract developers must invariably contend with even the slightest concrete signal that sharding is around the corner for Ethereum. While the risk to Zilliqa posed by Ethereum is high, timing could play toward Zilliqa’s favor when it comes to building a niche ecosystem of dApps.

Zilliqa’s technological advantage over Ethereum opens up a brief window to cross the moat. If Zilliqa fails to achieve a contendeble level of adoption by dApp developers during that time period, the project prospects look dismal.

When it comes to squaring up with the competition, Zilliqa faces another potential hurdle to onboarding the number of developers needed for mass adoption

If Solidity maintains its status as the blockchain industry standard, in our view a likely scenario, Zilliqa’s use of Scilla could prove a barrier to entry. Underlying the prevalence of Solidity among dApp developers is the fact Ethereum has reached an unparalleled level of mass adoption within the cryptospace as a whole.

While the current market dominance of Ethereum does not preclude coexistence with other protocols in the future, the long-term viability of Zilliqa rests heavily on carving out a niche user base while the window of opportunity remains open.

Zilliqa Token Economy

The Zilliqa economic model is based on a single native network token- ZIL. The token gives users access to the platform, where it is used to pay for transactions and run smart contracts. ZIL is in turn used to reward network nodes.

On the network, blocks are validated by multiple miners simultaneously, so that miner income remains more stable in comparison to other chains.

The network has a finite supply of 21 billion tokens, with each block generating new tokens to reward miners.

In the whitepaper, it is stated that the team aims for all tokens to enter into circulation over a ten year period; approximately 80% in the first four years and the remaining 20% in the following six.

Update #1

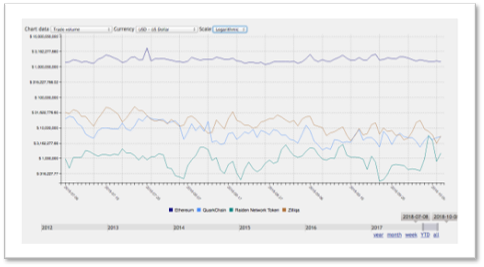

Since reaching peak trading volume on May 5th, 2018, at approximately $600M, ZIL has followed a steady downtrend to a current level around $5.5M.

The daily trading volume of QuarkChain (QKC) – another sharding-based protocol aimed at addressing the throughput issues facing Ethereum – has surpassed ZIL on 13 of the last 90 days, with ZIL maintaining a slight edge overall.

Between the two protocols, the actual liquidity level of ZIL is only nominally higher than QKC. With daily trading volume having fallen so much between May and October, market interest has certainly died down.

ETH / QKC / RDN / ZIL price

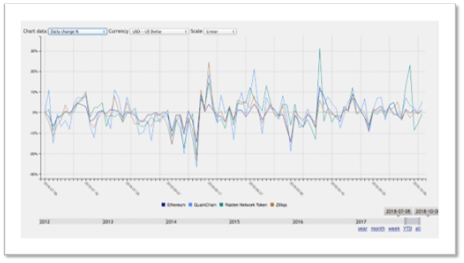

ZIL volatility has remained comparatively below that of both QKC and offchain Ethereum scaling solution, Raiden (RDN). This is likely attributable to the comparatively lower daily trading volume of QKC and RDN.

Eth /QKC / RDN / ZIL volatility

With the Zilliqa mainnet launch scheduled for the end of January 2019, any significant price increase will likely occur early into next year, though the uncertainty of the launch and possible continuation of bear market conditions would require substantive news of progress in the lead-up for the release to result in a significant uptrend.

The reluctance of developers to move over to ZIL and consequent absence of a growing ecosystem will likely result in any uptrend being short-lived.

Furthermore, the last major release that could have catalyzed a price increase, the v.2 testnet, did not lead to any meaningful price movement preceding the launch or thereafter. ZIL currently hovers around 34th place on CoinMarketCap.

Zilliqa Core Team

Xinshu Dong (Founder and CEO) began his commercial foray into the blockchain world after establishing Anquan, providing proprietary blockchain and trusted computing solutions for financial markets. Xinshu holds a PhD in Computer Science from the National University of Singapore (NUS)

Yaoqi Jia (Co-founder and CTO) has 5 years of experience at NUS as a Research Fellow where he gained his PhD in Computer Science. His introduction to blockchain in the commercial sector began as an R&D intern with Anquan, before moving up the ranks and continuing on with Zilliqa.

Juzar Motiwalla (Co-founder and Chief Strategist) is a venture capitalist in the global technology sector, with a regional focus across Asia and in Silicon Valley. He also has over a decade of experience as Director of smartBridge, a telecom company.

Amrit Kumar (Co-founder and Head of Research) holds a PhD from Université Grenoble-Alpes in Data Analysis. Prior to co-founding Zilliqa, Amrit spent two years at NUS as a Research Fellow.

Prateek Saxena (Co-founder and CSA) is a Research Professor of Computer Science at NUS with an academic focus on blockchain and computer security. Prateek holds a PhD in Computer Science from UC Berkeley and is also a Co-founder of Anquan.

The Zilliqa team includes 27 members in total, including eight Core Developers, two Compiler Developers, one Full Stack Developer and one dApp Developer on the engineering team. Complete information on the team is available here.

Zilliqa Roadmap

June 2017: Project Launch

August 2017: Whitepaper released

September 2017: Release results of v0.1 internal testnet

October 2017: Release results of v0.5 internal testnet

December 2017: Release Scillia design document

January 2018: Release source code

March 2018: Release testnet v1.0

Q2 2018: Release testnet v2.0

Q3 2018: Mainnet launch (postponed until January 2019)

Q4 2018: Release of anchor dApps (with partnership companies)

Final Thoughts and Verdict

Zilliqa token is initiated with a B- grade.

The ZIL token receives a B- rating. Looking at the project from a technical perspective, Zilliqa is a competitive frontrunner in the high-throughput race.

The team has largely stuck to deadlines on the tech side and made significant progress toward demonstrating the performance capability of the network.

Zilliqa has also made inroads with two large enterprise partners, but these collaborations have largely fallen into the background. To this end, the scheduled Q4 release of anchor dApps looks doubtful.

The risks facing the project at this stage rest heavily on the uncertainty of adoption and threats posed by competing protocols, yet the advanced stage of network development serves to help mitigate this issue for now.

Update #1

ZIL token maintains a B- grade.

Zilliqa has by and large maintained solid momentum toward developing the network, with the mainnet delay representing the first real setback toward launch.

Still, the minimal progress made by the project toward onboarding developers and establishing partnerships represents a significant risk factor, especially given the threat posed by sharding on the Ethereum network, which has the potential to undermine the core value proposition of Zilliqa.

A timely, successful launch of the mainnet will prove extremely important in boosting momentum of the project, but remains only half of the equation for establishing a firm grasp on the market.