0x Digital Asset Report And Evaluation – Initiation Review

0x (ZRX) is examined in Crypto Briefing's deep new analysis tool - the Digital Asset Report and Evaluation (DARE).

As an open protocol for asset exchange, 0x ultimately aims to support an ecosystem of interconnected exchanges and dApps that benefit from the network effect of a shared asset exchange infrastructure. In our 0x Digital Asset Report and Evaluation, we examine the ZRX token and its long-term fundamental strengths and weaknesses.

Introduction to 0x

0x is an open protocol designed to facilitate digital asset trades in a decentralized manner utilizing the Ethereum blockchain.

Within the current paradigm, both centralized and decentralized exchanges present means by which to trade digital assets, each with their own pros and cons. 0x offers a solution to the drawbacks of both approaches through an “off-chain order relay with on-chain settlement”.

Via this hybridized model, off-chain state channels are employed for conducting orders and transactions to increase speeds; only orders that have been settled are recorded on the blockchain.

As an open protocol for asset exchange, 0x ultimately aims to support an ecosystem of interconnected exchanges and dApps that benefit from the network effect of a shared asset exchange infrastructure.

0x Market Opportunity

The utility of 0x protocol as a means for exchanging tokens gives it a wide range of use case scenarios within both DEX and dApp settings.

As a means for exchanging tokens in a decentralized way, 0x targets many of the issues associated with decentralized exchanges, including the high costs, slow transaction rates and lack of liquidity. If a DEX operates its order book onchain, execution of each new order is limited by the transaction speed of the chain. This scenario also leads to network transaction fees at every interaction, contributing to the cost factor.

0x addresses both of those issues by developing a standard protocol to relay orders in an offchain environment. Orders go back on the blockchain when they are settled instead of recording every transaction, enabling trades to occur at speeds more comparable to centralized exchanges while eliminating a share of the transaction fees.

Another core value propositions of 0x addresses the lack of liquidity faced by DEXs. 0x incorporates an API framework for creating shared liquidity pools among disparate dApps built on the protocol, which in theory allows new entrants to bootstrap liquidity by accessing broadcasted orders from all order books across the network.

While 0x is designed to be different from both centralized and decentralized exchanges, the protocol must contend with both existing DEXs (IDEX and EtherDelta), the entrance of well-branded platforms like StellarX and Binance DEX, and Kyber Network, another decentralized exchange protocol that conducts all actions onchain.

0x Underlying Technology

The use of state channels has been proposed as a pathway to scaling the Ethereum network in a cost-reductive manner by moving transactions offchain. State channel users send cryptographically signed messages back and forth, accumulating intermediate state changes without publishing them to the canonical chain until the channel is closed.

The hybrid implementation of 0x, referred to as the “off-chain order relay with on-chain settlement,” combines the efficiency of state channels with the near instant settlement of on-chain order books.

0x employs use of state channels as a solution to support dApp scenarios where numerous intermediate state changes are accumulated offchain before settlement by a single transaction onchain (i.e. day trading, turn-based games).

Through this approach, cryptographically signed orders are broadcast off of the blockchain, at which point an interested counterparty executes an order through a smart contract directly on the blockchain. Costs are minimized for market makers by broadcasting intent offchain, while actual onchain transactions only occur when value is transferred between parties.

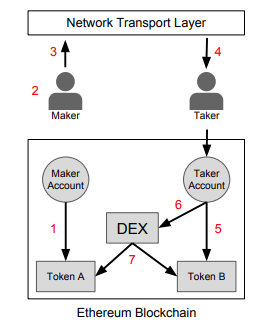

A diagram of this process from the 0x whitepaper is outlined on the next page.

Within the diagram, gray rectangles and circles represent Ethereum smart contracts and accounts. Arrows pointing to Ethereum smart contracts represent function calls.

- The maker approves the DEX contract to access the balance of Token A

- The maker creates an order to exchange Token A for Token B and specifies a desired exchange rate, expiration time, and signs the order with a private key

- The maker broadcasts the order

- The taker views the order and decides to fill it

- The taker approves the DEX contract to access their Token B balance

- The taker submits the maker’s signed order to the DEX contract

- The DEX contract authenticates the maker signature, verifying the order has not expired or already been filled, then transfers tokens between the two parties at the specified exchange rate.

The infrastructure for cross-platform compatibility on the 0x network is provided by the Standard Relayer API. Any relayer that interfaces with the API has access to a defined set of methods for communication between programs using the 0x protocol.

The Standard Relayer API allows programs to access and trade across multiple sources of liquidity at the same time, allowing relayers to pull orders from the order books of other relayers to bootstrap liquidity. Further, programs that incorporate the API are also compatible with all new relayers entering the 0x ecosystem.

While the Standard Relayer API provides an important component for reinforcing the interdependence the network and in turn, incentive to participate in its governance, relayers are not required to adopt the API to build on the protocol.

It is possible to imagine a scenario unfolding where a handful of 0x exchanges grow large enough that participating in the shared liquidity pool becomes detrimental rather than beneficial, as sharing order books would help prop up competitors.

How 0x plans to address this caveat remains unclear at this stage.

Update #1

In preparation for the v.2 mainnet release, 0x released a full set of updated developer tools including the 0x.js Javascript library and Standard Relayer API update, the latter letting relayers plug into the shared liquidity pool.

On September 25th, 0x launched the v2 mainnet of the protocol, originally scheduled for release in Q1 2018. The v.2 mainnet included a number of new features including updates to the smart contract architecture, support for ERC-721 non-fungible tokens, and the incorporation of new asset proxies, which makes onboarding new token standards possible without the need to modify current smart contracts.

Toward the end of tokenizing a wider array of assets in the future, the inclusion of support for ERC-721 tokens and asset proxies is a step in the right direction for 0x.

Of the 493 cryptocurrencies tracked by CryptoMiso, 0x is number 1 in terms of Github commits. In the lead up to the v.2 launch, the activity reached a peak, but has since dropped off significantly, especially in comparison to the preceding period of May through August. The reduction in activity likely reflects a lull in development as the team works to figure out how governance of the network will be implemented.

0x Ecosystem Structure

With each trade that utilizes 0x, there are two parties- the maker and the taker. The maker broadcasts an order message containing information on a specified amount of one token in exchange for another token.

The maker then submits these amounts to a “relayer”. While a relayer can theoretically take different forms, the most common example is a web application that allows traders to place and fill orders i.e. an exchange.

The relayer collects cryptographically signed versions of these orders into an off-chain database, referred to as an order book. Relayers, as the name suggests, relay orders to takers, who then fill them directly through 0x smart contracts. Instead of executing trades and handling user funds, relayers merely facilitate matching orders between market participants by hosting an order book.

The 0x protocol smart contract performs an atomic swap, exchanging the maker and taker tokens. The relayer then collects fees from the orders they host in the form of ZRX tokens. The use of an off-chain order book reduces friction costs for market makers and also ensures that the blockchain is only used for trade settlement. For hosting and maintaining off-chain order books, relayers can freely set their transaction fees at will.

The project has launched the 0x Portal as an aggregate access point to active relayers. The Portal functions as a decentralized application that facilitates trustless trading of Ethereum-based tokens through a web interface aggregation of relayers.

In addition to the 0x Portal, the team also created 0x OTC, a consumer facing product that uses the 0x protocol to bypass the need for Relayers altogether when buying or selling ERC-20 tokens, in what is essentially a p2p transaction. In August of 2017, this OTC feature was taken down, reportedly to make updates according to one Reddit source.

Since then, OTC trading continues to remain unavailable. With the OTC service down, 0x is missing a core feature that sets it apart from traditional DEXs and allows the protocol to compete with Kyber Network, which offers a similar means for users to conduct token swaps via KyberSwap.

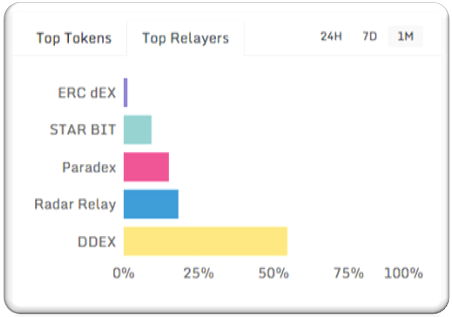

There are purportedly 19 dApp projects and 19 DEXs that incorporate use of the 0x protocol. Out of the relayer DEXs launched so far, only two, DDEX and Radar Relay, have managed to garner any substantial level of use.

Nonetheless, the projects built on 0x have served to collectively demonstrate the viability of the network for its intended use.

0x token (ZRX) is utilized in two ways:

Makers and takers (i.e. market participants that generate and consume orders, respectively) pay transaction fees to relayers (entities that host and maintain public order books).

For decentralized governance over the protocol update mechanism, which allows 0x smart contracts and network functionality to be improved over time. With the continually changing status of the Ethereum network, an update mechanism is essential for the protocol.

Currently, decentralized governance is still in the research phase as the team seeks a solution that maximizes both security and adaptability to network changes. Until the governance structure is formalized, multi-sig is used as a placeholder. As the theoretical governance structure currently stands, the voting power of ZRX holders is proportional to the amount held.

While 0x protocol provides an infrastructure framework for exchanging tokens, the real value of ZRX as outlined by the team is derived from its role as a governance token, and not simply as a medium of exchange. The value of ZRX therefore primarily derives from the network effects resulting from the shared liquidity made possible through the open design of the protocol and future goal of establishing a decentralized governance structure for maintaining the network.

0x conducted an ICO on August 15th, 2017, raising $24 million. A fixed supply of 1 billion ZRX tokens were created, 500 million of which were sold during the ICO. 15% were retained by the 0x core developer team, another 15% were allocated to a developer fund, 10% went to the founding team and 10% to advisors and early backers.

The tokens allocated to the founding team are purportedly locked-up according to a 4-year vesting schedule with a 1 year cliff.

Update #1

0x maintains a list of both dApps and DEXs that plan to or have already built on the protocol. The largest projects so far to launch on 0x include Radar Relay, a wallet-to-wallet DEX that raised $10 million in investment in August, which is currently open for trading.

0x is also at the core of DDEX, one of the top DEXs by both total number of transactions and trading volume.

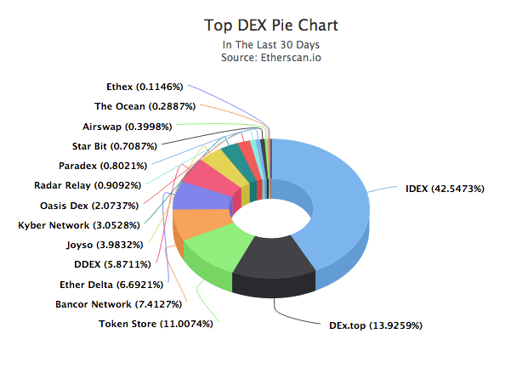

According to Etherscan Dextracker, of the total volume traded on DEXs in the last 30 days , those utilizing 0x protocol account for approximately 8.5% percent of total transactions.

The 0x tracker also reveals the top relayers by volume. Of the trade volume on the 0x network, half of the total market share has passed through DDEX in the past month, followed by Radar Relay at 18%.

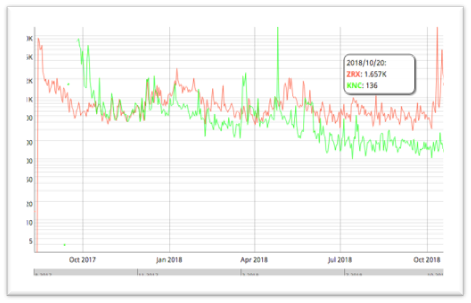

The 0x network itself has shown signs of growth recently in the month of October. The latest figures on 0x show around 1657 active network addresses, which reached a staggering 14k on October 12th.

The number of active addresses is well above Kyber Network at 136 as of October 20th. This spike in active addresses occurred in the lead up to rumors of a Coinbase listing, which proved true when Coinbase did in fact list ZRX on October 17th.

While the network itself has grown, there are little indication of any upcoming catalysts that would help support sustained momentum. That said, the addition of ZRX on Coinbase could lead the way to other fiat-to-crypto exchanges listing the token, with the approval of such a large player serving as a tacit go-ahead for others.

The 0x network tracker includes information on volume, transactions and relayers. Network volume has proven volatile over the last 3 months, at one point reaching above $7 million on September 6th before declining.

On October 21st, network volume measured below $500,000. As an protocol aimed at improving the way in which token trades are carried out, the highly inconsistent volume and recent downward trend are not a positive signs.

0x Token Economy

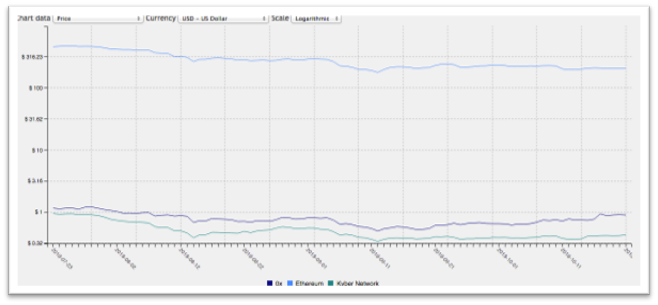

Measured against the price movements of Ethereum and competitor Kyber Network, 0x largely stayed in line with market trends until around the October 6th mark, when the price rose from $0.68 to a peak at $0.93 on the day of the Coinbase listing.

In the following week, the price maintained support at this new level hovering between $0.87-$0.90. Whether or not the price retains support at this level over time remains in question, however.

0x / Ethereum / Kyber Network price

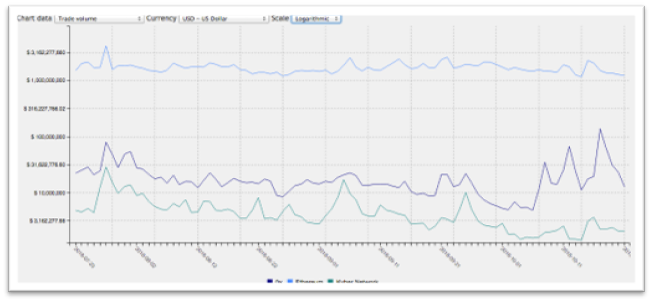

0x experienced several significant surges in trade volume as well starting on October 6th in the lead up to the Coinbase listing.

From the 6th to the 8th, trade volume jumped from $4.8 million to $34.7 million as rumors circulated of the possible impending listing.

From the 14th to the 17th, trade volume increased a staggering $127 million dollars, reaching nearly $138M at the peak.

While trading volume has since dropped back down to around the $11 million mark, the price has remained stable since the Coinbase announcement.

0x / Ethereum / Kyber Network trade volume

Looking ahead to the future, it is important to note that 0x faces heavy competition from DEXs as the project attempts to grow the ecosystem.

One potential scenario could see high profile projects like StellarX and Binance DEX garner enough liquidity to attract traders en masse away from the other decentralized exchanges.

The low level of trade volume and liquidity as observed on the 0x Portal and network tracker highlights this challenge for the project. The resources at the disposal of competitors poised to enter the market are formidable and could well represent the toughest challenge for 0x yet.

With no foreseeable catalysts on the horizon, the risk associated with the project increases further.

0x Core Team

The co-founders of 0x are CEO Will Warren and CTO Amir Bandeali. Will Warren is a PhD dropout from UC San Diego, where he pursued his doctoral studies in Structural Engineering for two years while simultaneously working as a Graduate Research Assistant at the Los Alamos National Laboratory on laser diagnostics and signal processing. After departing Los Alamos, Will went on to co-found 0x Protocol.

Amir Bandeali holds a BSc in General Finance from University of Illinois, Urbana-Champaign. Amir spent two and a half years as a Trader at Chopper Trading, before spending another year and a half with DRW in the same capacity. He left DRW in 2016 to co-found 0x and serve as CTO.

0x Roadmap

2017

Q1 Release whitepaper

Q2 Deploy alpha contracts (upgradeable) to Kovan testnet

Launch 0x OTC on Kovan

Release 0x.js v0.8.0

Q3 Contracts moved from alpha to beta via governance on Kovan

0x v1.0.0 deployment on mainnet

ZRX token sale

Radar Relay beta launch

0x.js updates

0x Portal announcement

Standard relayer API draft

Q4 0x hackathon

0x external development grant program

Relayer legal framework

0x Portal feature updates

Standard relayer API v1

0x.js v1.0.0 release

Protocol features and optimizations R&D

0x v1.x.x deployed on Kovan and Ropsten testnets

2018

Q1 Governance R&D

Reusable relayer UI components

0x v2.0.0 deployed on mainnet

Q2 Trade explorer v1 release

Governance whitepaper

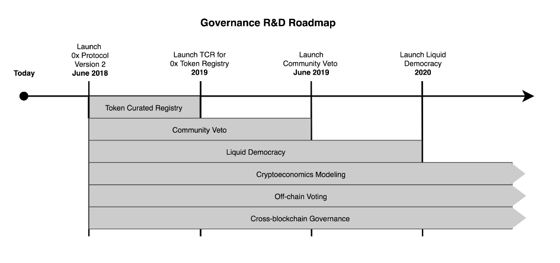

0x released a separate roadmap for Governance R&D in March, 2018. Full implementation of the governance plan extends into 2020.

On the technical perspective front, the project has experienced significant delays in 2018 toward reaching project milestones critical for sustained ecosystem development.

The v.2 mainnet, which brought with it a number of core functions, was not released until the end of Q3. Moreover, the team has still yet to release the governance whitepaper, with explicit details outlining this vital aspect of the project will in practice function.

With the value ZRX token based on its role as a governance token, this delay and subsequent announcement of a two year plan toward reaching the final phase of decentralization does not play toward the project’s favor, especially given the increasing competition in the space.

Final Thoughts and Verdict

0x is initiated with a C+ grade.

With the delayed release of the v.2 mainnet and lack of a clear path forward on how governance of the network will function, the team has missed the mark on two crucial milestones for 2018.

While the commercial proposition of 0x has competitive potential in theory, both the nascent state of the DEX market as a whole and as of yet unresolved governance issues pose significant risk factors for the project going forward.

Update #1

0x maintains a C+ grade.

Since the inception of the 0x protocol, the project has achieved some traction with the launch of a functional mainnet, adoption by small-scale DEX players, and recent listing on Coinbase.

However, issues persist surrounding network governance, questions surrounding further growth of the ecosystem and significant threats from competitor projects that all bring a high level of risk to the 0x project.

The lack of an articulated strategy on how the team plans to face these challenges, coupled with the drawn out milestones for implementing network governance over a two year period add a tangible element of uncertainty to the future prospects of the project.

Earn with Nexo

Earn with Nexo