254 Million Shades of Grayscale: Bitcoin Inflows Up Dramatically

Grayscale interest continues to surge despite a depressed crypto market.

Share this article

Grayscale is often seen as a bellwether for institutional interest in cryptocurrency as an asset class. The world’s largest crypto-focused fund’s quarterly reports are eagerly awaited signals of whether or not big money is entering the sector… or leaving it.

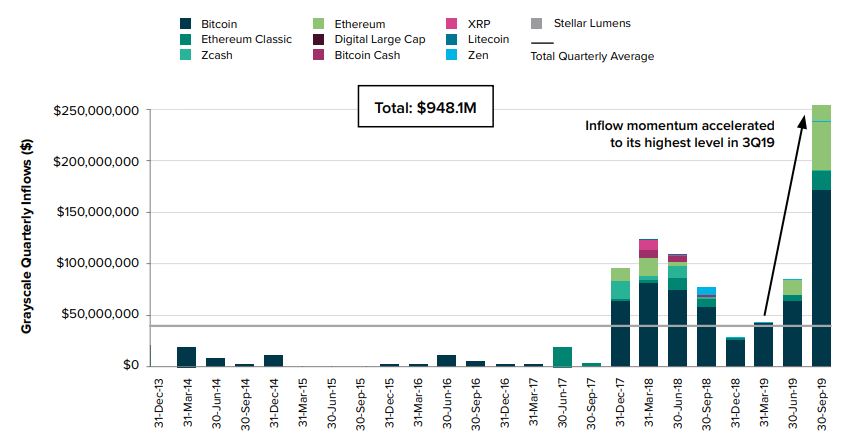

The fund has released its third quarter results from 2019, revealing quarter billion-dollar inflows into the fund. It marks the fund’s most successful quarter since its inception, and represents triple the inflows of Q2, up from $84.8 to $254.9 million.

Its third quarter inflows represent over a quarter of total inflows since the fund’s inception in September 2013.

That quarter-over-quarter tripling of inflows has come despite flattening asset prices. It brings inflows up to $382.3 million year-to-date, and twelve-month inflows of $412.3 million.

Grayscale enjoyed a 42 percent increase in inflows in Q1 2019 from Q4 2018, a doubling of inflows from Q1 2019 to Q2 2019. Quarter three marks a tripling since last quarter. All this comes after a very strong 2018.

Given subdued prices over the past quarter, Grayscale’s assets under management have fallen from $2.7 billion to $2.1 billion. Quarterly inflows have grown dramatically over the course of 2019, with their inflows in quarter one of $42.7 million bloating to $254.9 million in the third quarter.

Gray’s Anatomy: Bitcoin Retakes Mantle

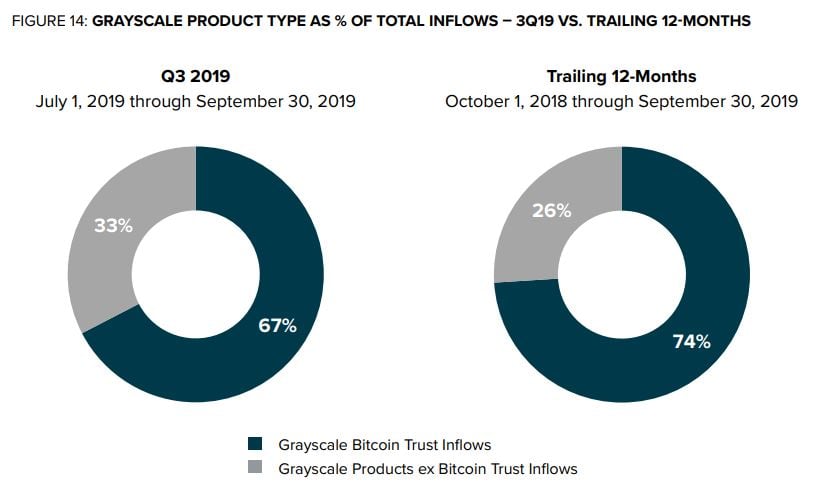

In the second quarter, the fund saw increased interest in its alt funds, with ex Bitcoin Trust inflows having accounted for 24 percent, up from a mere one percent in Q1. Its quarter three results saw bitcoin interest surge again, with 67 percent of inflows into the Grayscale Bitcoin Trust.

Almost all of those inflows came in July, as the fund was closed to new investments in August and September. Bitcoin demand was evinced by a single day $75 million inflow. July 2019 easily trumped the second-most successful month for the Bitcoin Trust, which saw $64.7 million worth of inflows into the fund in December 2017.

The shutting down of new funds into its bitcoin fund partly helped balance their inflows into the Bitcoin Trust and their other nine funds. With Bitcoin Trust inflows reaching $171.7 million in July, 33 percent of inflows went into its other products. That 67-33 split was slightly more balanced than its trailing twelve-month inflows, which were 74-26 percent in bitcoin’s favor.

Where’s The Money, Lebowski?

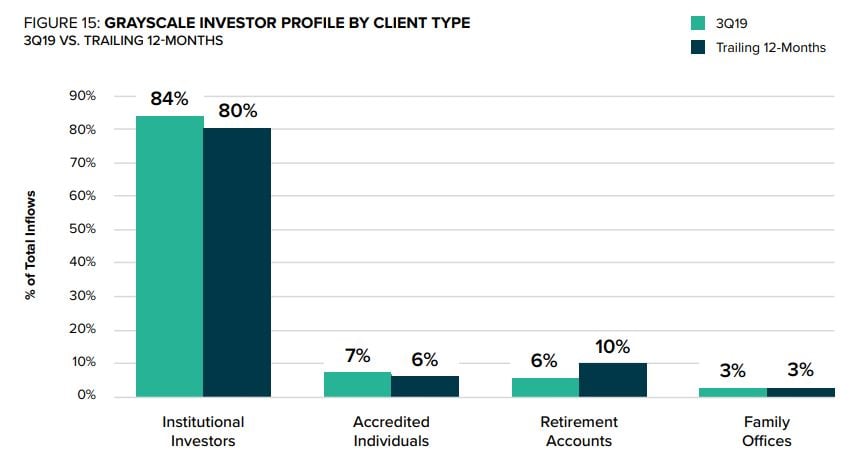

Institutional investors dominated their Q3 inflows, accounting for 84 percent of total Q3 inflows. That theme has been consistent throughout the year. Institutional investors, primarily hedge funds, represented 84 percent of inflows in both Q2 and Q3, slightly up from 77 percent in Q1 of 2019.

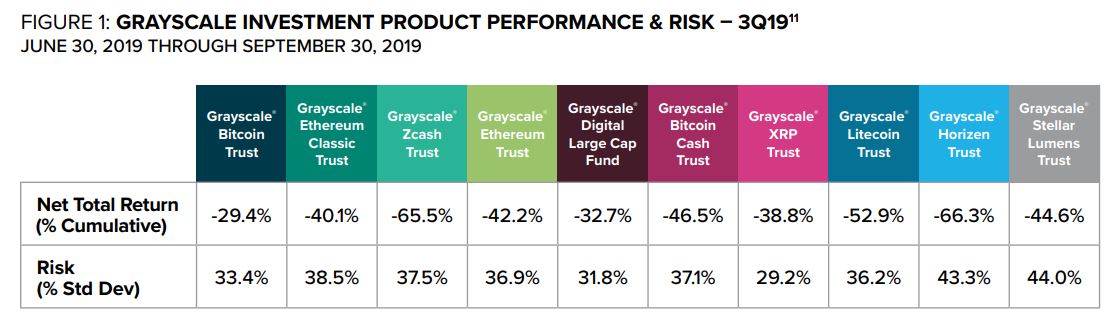

Notwithstanding the strong growth in Grayscale’s products, all of the company’s funds made significant losses in the quarter. As Grayscale reported:

“Grayscale Bitcoin Trust and Grayscale Digital Large Cap Fund were performance leaders in 3Q19, with declines limited to 29.4% and 32.7%, while privacy-focused products Grayscale Zcash Trust and Grayscale Horizen Trust were laggards, each down more than 65%.”

– Grayscale Investments LLC, Digital Asset Investment Report Q3 2019

The single caveat to an otherwise successful quarter – inflow wise – for Grayscale, is that most of the inflows were not new fiat cash entering the market. 80% of the inflows were in-kind, meaning digital assets already owned moving across to Grayscale from elsewhere.

Crypto Briefing reported last month that investors in Grayscale’s Bitcoin Trust products were paying a 22 percent premium to participate in the fund. The in-kind component, which has been reasonably steady over Grayscale’s life cycle, perhaps represents risk-aversion among institutional investors, who are seeking the safety of Grayscale’s custodial arrangements, rather than a growing appetite for digital assets themselves.

Only twenty percent of the inflows were not in-kind digital assets. While Grayscale’s growth does suggest growing interest in the asset class, that optimism must be tempered by the reality that much of the interest in Grayscale’s products could be explained by their appeal as respected custodians of digital assets, notwithstanding the growing security of the digital asset class.

We may not be talking as much about hacks and security risks surrounding cryptocurrencies anymore, but institutional interest may lag that of the rest of the industry given the heady days of exit scams and exchange hacks.

Share this article