Shutterstock cover by kakabe

Aave CEO Says Yield Farming “Craze” Is Coming to an End

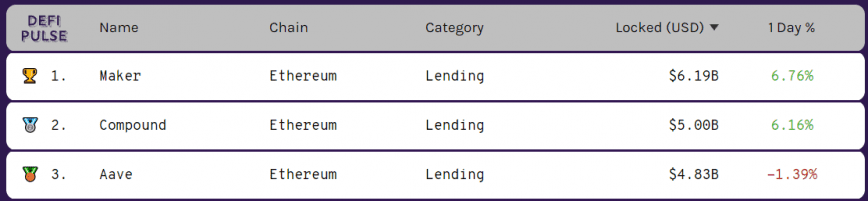

A lack of innovation is stifling DeFi, according to the CEO of one of the industry's biggest lending platforms.

Stani Kulechov, the CEO of Aave, highlighted some of the problems with the copy-and-paste nature of today’s DeFi space, adding that the overall fundamentals are still strong.

Aave CEO Defines Decentralization

The DeFi economy can be imbalanced, often favoring wealthy whales over average users. This is especially true when high Ethereum fees shut out retail investors.

Aave founder and CEO Stani Kulechov spoke to Crypto Briefing about DeFi’s problems and potential solutions.

While distribution models favor larger accounts, “this can be solved by simply creating more democratic incentives instead of copy/pasting the same model all over again,” said Kulechov.

"DeFi" becomes a lot less interesting if it's replacing a centralized, opaque system with another centralized, opaque system.

There's potential here to build an actually better financial system.

Not a cheaper way to yield farm and trade shitcoins.

— Camila Russo (@CamiRusso) February 25, 2021

Decentralization is, of course, the answer. As Kulechov pointed out, decentralization in DeFi can be something of a misnomer, and he offered his own method for evaluating projects in the space.

“I personally believe that a protocol is decentralized when the founding team’s proposal can be voted successfully against,” said Kulechov, “and the team, including its early investors, do not hold over 50% of the tokens.”

Yield Farming “Craze” Is on Its Way Out

Speaking to Crypto Briefing, Kulechov said that DeFi has always been about incentives, adding that “yield farming is indeed an interesting way to reward user behavior such as providing liquidity. The sad part is that many yield farming protocols are offering yields that are absolutely unsustainable.”

He went on to say that the yield farming practices we see today are “pretty much money printing.”

“I believe that the craze will end at some point and we will see more sustainable incentives.”

Kulechov commented on the “fatigue” suffered by the yield farming industry in recent months, adding that “the fatigue is related to innovation.”

“Most of the liquidity mining incentives are copy-pasted from other notable projects and do not provide creative ways for communities to distribute token governance and let communities get more involved into the project.”

While liquidity mining may endure for a while longer, said Kulechov, projects must involve their entire communities in decentralized token distributions.

Kulechov added that innovation continues on his own project, Aave, which recently released v2 of its governance model, allowing the community to delegate voting power. Aave is exploring Layer 2 solutions, he added, saying, “we will see some progress there soon.”

The DeFi founder’s comments on the nature of the space highlight ongoing problems that have been the subject of criticism since the onset of the industry.

DeFi projects market themselves as decentralized while project teams retain disproportionate control over the token supply. A recent report by the St. Louis Fed listed this as a serious and common risk in DeFi.

It’s all too easy to copy and launch an existing project in a somewhat unregulated atmosphere, adding little value in the process. However, as both Kulechov and the St. Louis Fed report pointed out, the space is full of potential, and projects that truly innovate and offer value could be hugely disruptive.

When asked about what other projects he was following in the space, Kulechov mentioned Pods Finance, a project working on reducing the cost of options using Aave’s aTokens as collateral. He also expressed an interest in Aavegotchi, a DeFi and NFT hybrid project which launched on Mar. 2.

Disclosure: The author held Bitcoin at the time of writing.

Earn with Nexo

Earn with Nexo