BOOM! Saudi Oil Attacks Pose Crucial Test for Bitcoin

Attacks on Saudi oil production facilities could offer crypto a pivot point.

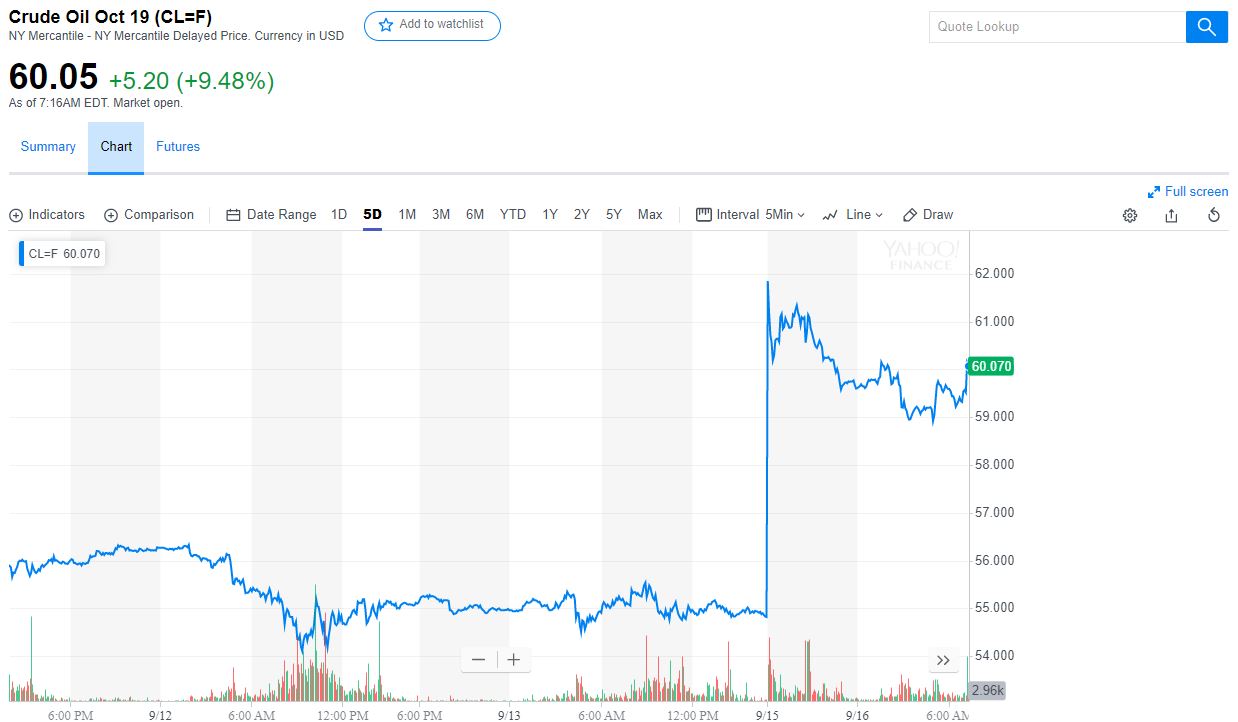

The weekend drone attack on Saudi Arabia’s oil production facilities has slashed global oil supplies by five percent, temporarily sending the price of Brent crude up twenty percent. The attack also prompted a one percent rise in the price of gold. For Bitcoin, which is often touted as a virtual form of gold, the Saudi oil attacks will prove a crucial test of the asset’s safe-haven bona fides.

Iran has denied any involvement, with the Iranian-aligned Houthi rebels in Yemen claiming responsibility. The sophisticated nature of the attacks, and the direction from which they appear to have been launched, have cast some doubt on those claims.

The U.S. administration has stopped short of blaming Iran, but there is no denying the Islamic Republic has both the means and the motive to have taken the brazen move.

Cryptocurrency has faced recessionary fears and worries over unforeseen complications from a no-deal Brexit, but it has yet to face a real geopolitical crisis. How will bitcoin react?

Bitcoin Has Been Stable… How Will a Saudi Arabia Oil Attack Affect It?

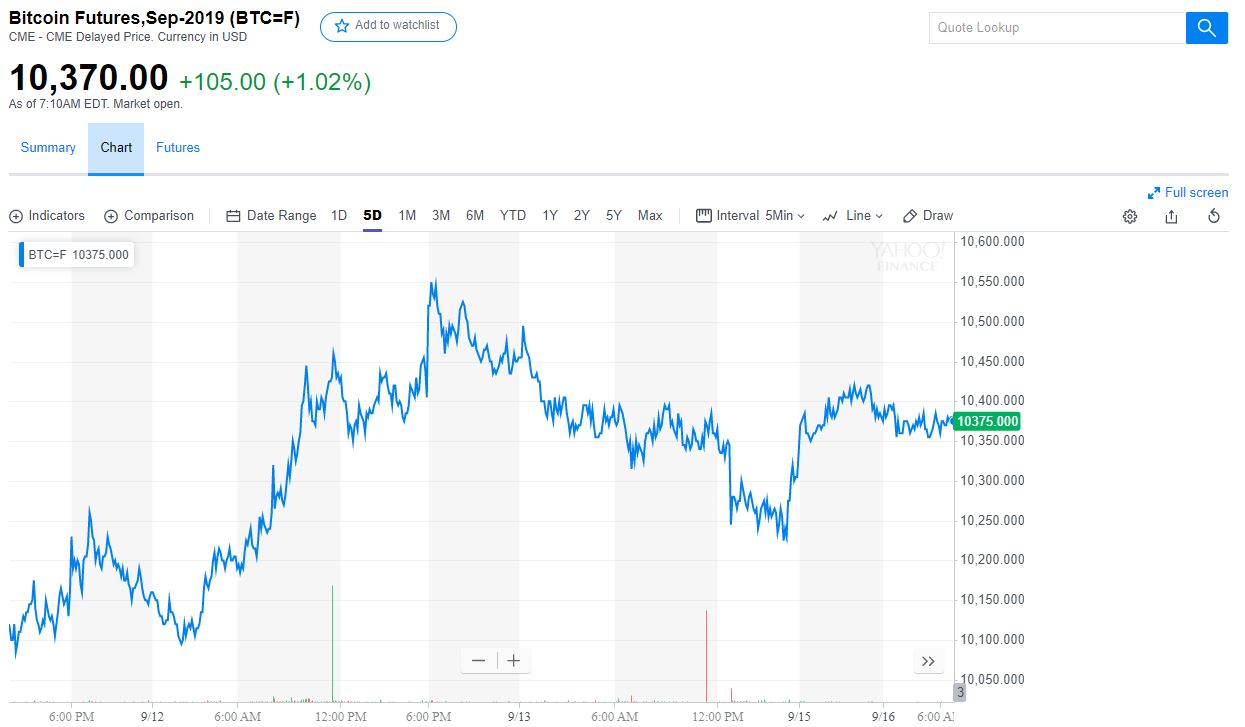

Notwithstanding spikes in late June and mid-July, bitcoin has remained remarkably stable over the past three months, meandering around the $10,000 mark.

Coinmetrics wrote of bitcoin’s “inconsistent sensitivity to geopolitical and macroeconomic events,” suggesting that the OG crypto has developed a sense of institutionalized resilience to economic or geopolitical shocks.

An oil shock and the potential for follow-up military action could challenge that resilience. The proximity of derivative and leveraged products has failed to excite bitcoin’s price action, and that same level of indifference may well dampen any response to the sudden attacks on the world’s oil supply.

But what if digital gold followed a similar trajectory to gold?

Gold… The Barometer of Fear and Uncertainty

Gold futures spiked on news of the drone attacks, although the response was muted. This is somewhat surprising, given the likelihood of a brutal war should Iran be blamed for the attacks.

Oil futures rose more dramatically, which is not surprising given Saudi Arabia’s significance to the global oil supply. Despite oil reserves being released by the U.S. and the Gulf state, it would likely take some time for the Kingdom to return to full production capacity.

Bitcoin CME futures also rose, but only tepidly. The rise was very much in line with the rise in gold futures, and certainly not in violation of longer-term trading trends.

One explanation for these three metrics is that there is a distinct lack of panic over the Saudi Arabia attacks. The bitcoin-as–gold narrative is strengthened here, as the muted responses of both assets indicate no significant rise in the perception of geopolitical risk among investors.

Another theory may be that bitcoin investors are watching Binance futures and the launch of Bakkt, and they regard it not so much as a gold-like hedge against uncertainty, but as a speculative commodity. It could also be that with talk of recession and a slowdown in global economic growth, the price of fear has already been baked into the price of bitcoin.

When the Trump administration decides on a course of action in response to the attacks on Saudi Arabia, bitcoin will face yet another point at which we can gauge how investors think of the leading digital asset.

Earn with Nexo

Earn with Nexo