Beginner's Guide: Getting Started With Solana

Learn how to participate in one of crypto's fastest-growing ecosystems.

Key Takeaways

- While Solana is still early in its development, it already has a lot to offer users.

- Wallets like Phantom and Solflare make it easy to interact with the network.

- Solana's central limit order book Serum provides one of the best decentralized trading experiences.

Share this article

Launched in March 2020, Solana aims to address the scalability issues other smart contract blockchains like Ethereum face. While still in the early stages of development, users can already take advantage of a whole host of features on Solana.

Why Use the Solana Ecosystem?

From the average user’s perspective, the biggest advantage to using Solana is the network’s high speed and low cost. With transactions priced in fractions of pennies, the fees for interacting with dApps are barely noticeable. Additionally, other complex transactions are also much cheaper. The cost of minting NFTs, which can set users back an exorbitant amount of gas on Ethereum, is vastly reduced on Solana, even during times of high network congestion.

Solana’s consensus mechanism also helps alleviate one of the biggest problems other competing blockchains face—transaction frontrunning. With Solana’s Proof-of-History consensus, transactions are time-stamped and processed in the order they are submitted for validation, making it nearly impossible for other users to profit from stacking transactions. The protection against frontrunning improves the end user’s experience and makes Solana a more attractive platform for future developments such as tokenized stock trading.

Choosing a Wallet

Getting started with Solana requires setting up a compatible wallet.

For those looking for an in-browser Web3 wallet similar to MetaMask, the two best choices on the market today are Phantom and Solflare. Both wallets are non-custodial and offer features such as SOL staking, in-wallet token swaps, and NFT support with full video and audio capability. Solflare’s browser extension is only available for Firefox, while Phantom boasts compatibility with Google Chrome, Brave, Firefox, and Microsoft Edge.

Mobile wallet options are more limited. The Exodus wallet might be the best option available today, partly because it allows for SOL staking. However, as Solana grows, more wallets should start offering mobile versions; Solflare has already announced that it will develop a mobile app.

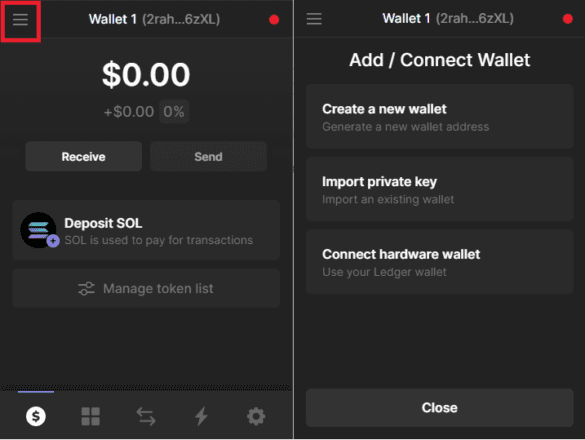

Once you have decided on your wallet of choice, download the extension or app from the wallet’s website and follow the steps to create a new wallet. Make sure to write down your seed phrase and store it safely. If you already have a seed phrase from an existing Solana wallet, you can import it to Phantom or Solflare after downloading the browser extension.

After your wallet has been set up, the next step is to add some funds so that you can start using the network. Solana’s native token is SOL; you need it to pay transaction fees. The easiest option is to use a centralized exchange such as Coinbase or Kraken to buy SOL with fiat. Once you’ve purchased some SOL, follow the steps to withdraw the coins to your Solana wallet. On Phantom and Solflare, you can find your wallet’s address at the top of the browser extension; click it to copy the address to your clipboard and paste it directly into your withdrawal transaction.

Trading on Solana

Once you have a wallet set up and have transferred over some SOL, you will be able to start exploring Solana’s growing DeFi ecosystem.

All DeFi apps in Solana’s ecosystem can operate through a central limit order book (CLOB) exchange called Serum. Made possible by Solana’s incredibly fast block times, Serum allows any app on the network to share its liquidity. Unlike dApps such as Uniswap, Serum does not use liquidity pools to facilitate trades; it matches sellers and buyers like a traditional exchange instead. To the end user, this means lower slippage and fewer price fluctuations when using Serum.

Trading on Serum is simple. After navigating to the website, enter the app by clicking the “Trade on Serum DEX” button. Next, connect your wallet using the button in the top right corner of the page. Whether you’re using Serum or any other app, you’ll usually find the connect button in the same place on every site.

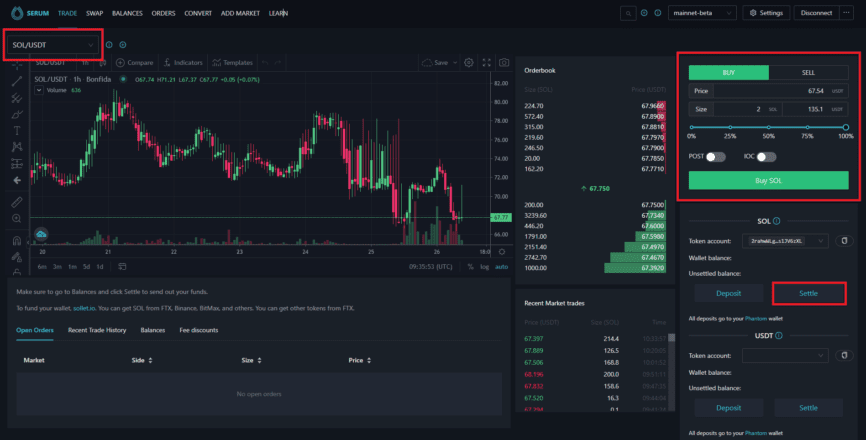

Once your wallet is connected, you can start making transactions. First, select your trading pair from the dropdown box on the left of the site. Next, create an order by using the fields on the right-hand side. In the below example, Crypto Briefing buys SOL on the SOL/USDT market. Select your trading pair of choice, enter the price that you want to buy or sell the asset for in the top box, then enter the quantity you want to buy or sell in the box below. A final box located to the right should automatically fill and show the cost of your order.

After double-checking that everything is correct, send the order by clicking the buy or sell button. In this case, the button says “Buy SOL.” Depending on which wallet you’re using, you may need to click through permissions before your trade goes live. Make sure you only give trustworthy sites permission to interact with your wallet; otherwise, you could lose your funds. Once your order has been filled, you need to navigate down to the page and click the “Settle” button for your newly purchased asset. Funds will not appear in your wallet until you settle them, so make sure to remember to do it after every transaction.

Trading on Serum is just the tip of the iceberg when it comes to Solana. If you’re looking for more advanced trading options, be sure to check out Mango Markets. The user interface is similar to Serum, and it also allows users to take advantage of on-chain margin trading and perpetual contracts for select assets.

Another of Solana’s most popular apps is Raydium. While Serum solely uses an order book to facilitate trades, Raydium takes a dual approach. Using Serum’s order book combined with its own liquidity pools, Raydium can route through both to find the best trades with the lowest slippage. Additionally, as Raydium uses liquidity pools, users can provide liquidity and earn interest from the fees generated by the protocol. Currently, users can make 15.93% APY through the SOL/USDC pool on Raydium.

Solana’s NFT ecosystem has also seen growth following crypto’s first “NFT summer.” Arguably the best marketplace for Solana-based non-fungibles today is Solanart. Over the past few weeks, NFTs have boomed on Solana, with floor prices for popular projects such as Degenerate Ape Academy rising at a rapid rate. Last week, a Solana Monkey Business NFT sold for $2.1 million; it was minted for 2 SOL only a few weeks prior. While Solanart is not as streamlined as the leading NFT marketplace OpenSea, it has all the basic functionality to buy, sell, and discover NFTs on Solana.

Getting acquainted with Solana early can give users a serious edge over other market participants. The network is growing at a rapid rate and is likely to become more popular as the crypto space grows in the future.

Disclaimer: At the time of writing this feature, the author owned BTC, ETH, and several other cryptocurrencies.

Share this article